Williams Financial Adds To Research

Dallas-based Williams Financial Group has added to its research effort with three hires. They join Patrick Fay, who was named director of sales and trading earlier this year. Fay is a 32-year veteran who joined from D.A. Davidson, where he was director of equity trading.

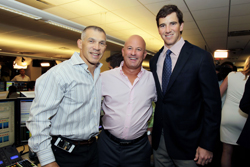

BTIG Brings in the Stars and Over $4 Million for Charities

Institutional broker BTIG celebrated its annual commissions for charities day last Wednesday by raising $4.5 million for various charities.

Redline Runs Risk Checks in Nanoseconds

Redline Trading Solutions, a provider of high-speed trading products for high-frequency traders, is offering brokers pre-trade risk check software that performs in less than one microsecond. The new service, dubbed Redline Pre-Trade Risk Solution, performs risk checks in the 400 to 900 nanosecond range, depending on the broker's risk check configuration.

Ladenburg Expands

Ladenburg Thalmann, the brokerage unit of 130-year old Ladenburg Thalmann Financial, has expanded its trading desk by moving into options and starting a soft-dollar business. This follows a recent expansion in its institutional equities desk, which now offers access to international equities.

ETF Volume Down, Fallback in Correlation Blamed

Volumes for exchange-traded funds are down, and many people believe that declines in correlations at the beginning of this year could be the cause. According to a recent Credit Suisse report, ETFs made up only 16 percent of overall volume in the first quarter of 2012, down from 19 percent for all of 2011.

SEC to Examine Tick Size for Small Caps

The Securities and Exchange Commission is preparing a review to see if raising the minimum trading increment for so-called "emerging growth companies" and other small-cap stocks could increase liquidity in these thinly traded names.

Parallel Parking by PDQ SOR

Chicago-based alternative trading system operator PDQ introduced parallel order posting capability into its smart order router. Equity traders can now send passive orders to multiple venues, both lit and dark, simultaneously and have these orders automatically rebalanced when a portion of the initial order is filled.

Veteran-Owned Firm Looks to Expand in Equities

Academy Securities, a veteran-owned brokerage, has a vision of how the three-year old company will expand its fledgling equities trading business. Academy's mandate is to give U.S. military veterans a shot at a Wall Street career.

Spanish B-D Auriga Expands Sales Trading Roster

Auriga USA, a broker-dealer affiliate of Spain's Auriga Global Investors, Sociedad de Valores, has been building out its sales trading effort over the last year.

Small-Cap Algo Usage Up, But Problems Remain

Trading algorithms have long been used for large-cap stocks, but historically, they have not been so adept at trading smaller, less liquid names. That, however, has been changing.