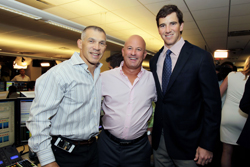

BTIG Brings in the Stars and Over $4 Million for Charities

Institutional broker BTIG celebrated its annual commissions for charities day last Wednesday by raising $4.5 million for various charities.

Wrap Powerhouse

With $66 billion in assets, Morgan Stanley's managed account desk ranks largest, making it an influential player on the Street and in the wrap trading business.

ITG Acquires Former Pipeline Patents

Independent execution and research broker ITG announced on Thursday it has acquired 21 patents from Aritas Group, formerly known as Pipeline Trading Systems.

A New Algo Option

With Autobahn Options, Deutsche Bank hopes to address the needs of options traders who are looking for new trading formulas.

BATS July Equities Market Share Jumps, Options Steady

BATS Global Markets reported its U.S. equities matched market share totaled 12.3 percent in July, jumping from 11.5 percent in June, and leaping from 11.1 one year ago. The exchange operator saw an average daily matched volume of 750 million shares during the month, off from 789.7 million shares in June.

Consolidation Expected Among Options Market Makers

A shake-out is looming in the options world. With penny quoting just around the corner, top trading officials are predicting a reduction in the number of options market makers.

STA Discusses Top Priorities Over the Next Year

Explaining the dangers of penny pricing and the benefits of minimum price variations (MPVs) are keys to better market structure, says the incoming Security Traders Association chairman. Tom Carter, longtime sales trader with JonesTrading, recently told Traders Magazine that penny pricing along with other reforms are hurting markets for a number of reasons.

Algos Get Serious

Trading in New York Stock Exchange-listed securities is going electronic. Liquidity in Nasdaq and Big Board names is splintering. Message rates for market data are accelerating. All this has created fertile ground for developers and promoters of algorithms. Now, as these products become smarter and better at grabbing liquidity, traders are customizing and adapting algos to trade more like themselves.

SEC ROUNDTABLE: Kill Switches and Best Practices Are Coming

The implementation of so-called "kill switches" and a uniform best practices guide to electronic trading stand as the two high points of Tuesday's Securities and Exchange Commission roundtable meeting.

FINRA Adjusts OTC Manning

One size does not fit all. That's what the Financial Industry Regulatory Authority (FINRA) discovered when it set out to adapt its Manning rules to over-the-counter trading. Dealers complained that rules designed for the listed markets would unfairly pinch their bottom lines when trading certain OTC names. So FINRA made some adjustments.