This first appeared on Medium.com from the Startup

There’s a lot of literature that describes the importance of securing a nest egg for your retirement, but what does this all really mean? The presence of the 4% rule has guided many financial planners and advisers with managing their client’s portfolios.

Financial literacy is not as easy as many people believe it to be. With the growing amount of baby boomers reaching retirement age, this is something people must think about as soon as possible.

What is a nest egg, and how much do you need to have in order to retire effortlessly? How much do you have to save per year to reach the amount of savings you need to retire? What are some things that you can do to make your retirement smoother?

We’ll be covering all of these details, and I will show you how to calculate how much you need to save, based on your own situation.

Without having a nest egg, you will never be able to retire in peace. Relying on your offspring to support you after retirement is not an investment.

4% Rule Explained

The 4% rule for retirement is a simple concept, you save a certain amount and invest in a specific conservative portfolio and every year you withdraw 4% to fund your living expenses. If your investment returns are higher than 4%, your portfolio will still be increasing in size, and upon your eventual death, you will still have the nest egg to pass on to your descendants. Even if your returns are not as high as the amount you’re withdrawing (4%), your nest egg will still only decrease slightly over the period of your retirement. Keep in mind the importance of factoring in inflation, as this will increase the amount you need to spend each year.

For example, with a $1 million retirement portfolio, 4% will provide you with $40,000 per year for living expenses. $2 million will net $80,000 per year and $3 million will net $120,000 per year. The importance of growing a nest egg becomes evident quickly through this quick calculation.

Everything is more expensive now, but wage growth has remained flat. The way you build your nest egg is through saving, and it should stress the importance of saving your wages.

A couple of issues for analysis require additional personal analysis.

(1) The 4% rule does not account for any additional income you may have upon retirement. Pension income and other forms of Social Security income can help relieve the pressure. The analysis, therefore, should be taken with a grain of salt and understand that you may still have income when you retire.

(2) The best scenario for your retirement occurs when you receive a positive return on investment every year. If there is a negative start and your portfolio takes a huge hit, the 4% rule no longer works as you will withdraw into a negative nest egg. You must pray that when you start your retirement, the markets do not tank.

Amount of Savings You Need

Find Your Spending Sweet Spot

Create a budget for what you need to spend once you retire. Be prudent with your assumptions, and don’t assume that you will be frugal. Assume that you will more or less maintain your current situation and spending.

Start with the mandatory payments, and the ones you cannot survive without. Food, shelter and basic transportation needs should be factored in. Your monthly budget should then be rolled up yearly to see exactly how much your family will need per year.

Once you know exactly how much you want to spend after retirement, you need to see how much of your income you should save in order to achieve this nest egg. The quicker way to do this calculation is through the rule of thumb of multiplying by 25.

Multiply by 25

Previously with the 4% rule, you would have to multiply the amount of money you want to spend each year by 25 to come up with your nest egg.

If you wanted to spend $70,000 per year (not crazy considering it will be for your partner as well), you would need to save $1,750,000.

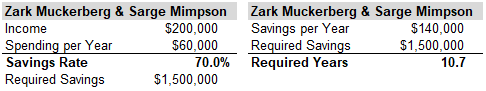

Everyone has different spending habits and incomes, but we’ll use a sample couple who are both quite successful in their respective fields.

When you use more thrifty spending per year in retirement, it becomes much more attainable.

The issue, however, is that many people do not currently think about saving as much as this. Many do not understand the importance of saving either. America has failed to teach its citizens about the importance of financial literacy.

Times Have Changed

Since the 1994 study by financial adviser Bill Bengen, the 4% rule has long been the standard for retirees. However, 25 years later, the world is now a much different place, and the underlying assumptions need to be adjusted. Inflation has been crazy, and things are much more expensive.

The 4% rule hinges on your investment return providing you with more than 4%, and even higher when you factor in the effects of inflation.

Conditions today are hugely different from back in 1994. In 1994, the average return from bonds and treasury bills alone was 5.1%. In 2019, the yields were 1.52%, much lower than the past. It would be crazy to think that yields would rise back to where they were two decades ago, and this is now the new norm.

Central banks in North America strive to hold inflation rates at 2%, so a gross 6% return is the equivalent of 4% returns net of inflation.

Think about your current investment portfolio, what is the likelihood that you will be able to sustain 6% returns for 25 years of retirement starting at 65? Keep in mind that markets fluctuate, and economic conditions are never certain. If you lose 10% in one year due to a recession, your nest egg is now 10% smaller, but you still need to withdraw a significant amount to survive.

Let’s go back to the example with a portfolio of $2 million. If your portfolio drops to $1,800,000, 4% of this is now $72,000 instead of the previous $80,000. Now you will be forced to either follow the previous rate of $72,000 to fund your living expenses or take out $80,000 (4.44%) of your portfolio. A couple of bad years will destroy your precious nest egg.

New Amount

4% is now too aggressive of a withdrawal rate. With much lower yields on both bonds and equity investments, 3% and even lower is the recommended withdrawal rate.

Since you can’t make 15%, or >5% on your bonds anymore, 4% of a withdrawal rate is too high. The only way you can make your nest egg last without additional income is decreasing the percentage withdrew. 3% is a safer bet, and further decreasing it makes sense. However, you must realize that if you are saving and building your nest egg, it must now be bigger, in order to factor in the decreased withdrawal rate. Instead, you may need to multiply your expected spending amount by 33 (3% withdrawal rate), or even higher to come up with the nest egg that you require.

Takeaway

Saving is not enough to sustain your retirement lifestyle. If you want to retire, you need to use the 3% withdrawal rate, or lower. The best way to ensure you have enough to keep your lifestyle is by earning additional income, on top of your investments.

You must find additional streams of income which will help alleviate the amount that you need from your nest egg, also helping in times when your portfolio underperforms. Additional streams of income even into retirement should be extra incentives to try and start a business.

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine, Markets Media Group or its staff. Traders Magazine welcomes reader feedback on this column and on all issues relevant to the institutional trading community.