PRINCETON, N.J., May 8, 2024 /PRNewswire/ — Miami International Holdings, Inc. (MIH), a technology-driven leader in building and operating regulated financial markets across multiple asset classes and geographies, today reported April 2024 trading results for its U.S. exchange subsidiaries – MIAX®, MIAX Pearl® and MIAX Emerald® (together, the MIAX Exchange Group), and Minneapolis Grain Exchange (MGEX™).

April 2024 and Year-to-Date Trading Volume and Market Share Highlights

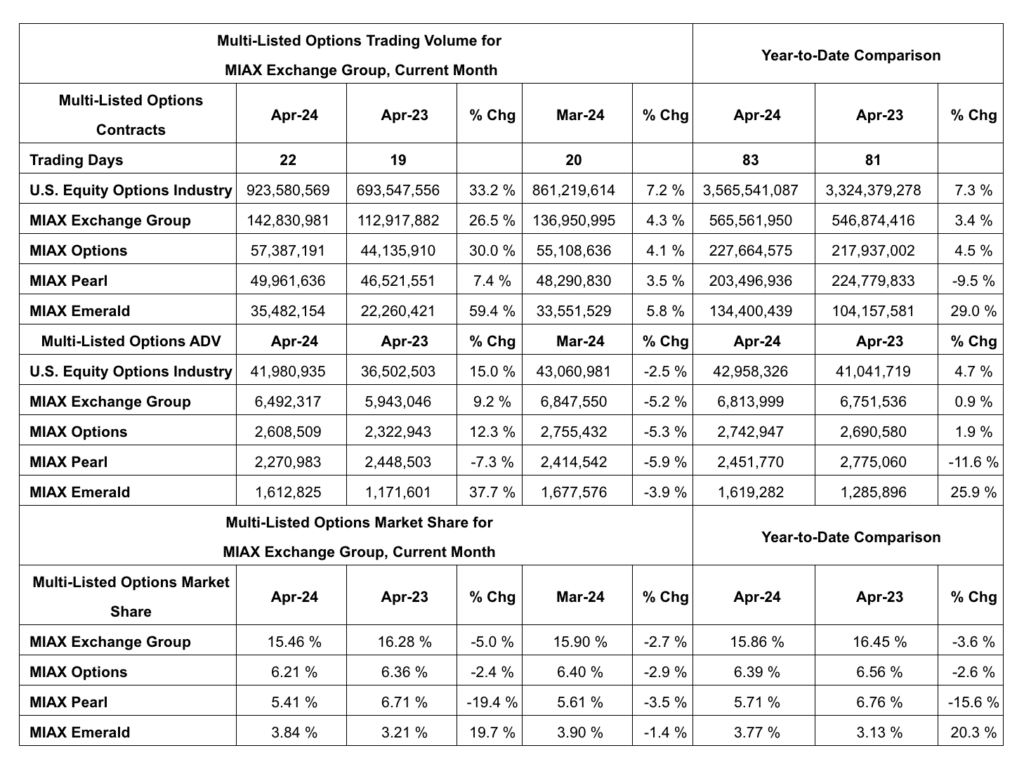

- Total multi-listed options volume for the MIAX Exchange Group reached a monthly total of 142.8 million contracts, a 26.5% increase year-over-year (YoY) and representing an increase of 4.3% from March 2024. Average daily volume (ADV) reached 6.5 million contracts, a 9.2% increase YoY. April 2024 market share reached 15.5%, a 5.0% decrease YoY. Total year-to-date (YTD) volume reached a record 565.6 million contracts, a 3.4% increase from the same period in 2023.

- MIAX Options reached a monthly volume of 57.4 million contracts, a 30.0% increase YoY and representing a monthly ADV of 2.6 million contracts, a 12.3% increase YoY. Total YTD volume reached a record 227.7 million contracts, a 4.5% increase from the same period in 2023.

- MIAX Pearl Options reached a monthly volume of 50.0 million contracts, a 7.4% increase YoY and representing a monthly ADV of 2.3 million contracts, a 7.3% decrease YoY. April 2024 market share reached 5.4%, a 19.4% decrease YoY. Total YTD volume reached 203.5 million contracts, a 9.5% decrease from the same period in 2023.

- MIAX Emerald Options reached a monthly volume of 35.5 million contracts, a 59.4% increase YoY and representing a monthly ADV of 1.6 million contracts, a 37.7% increase YoY. April 2024 market share reached 3.8%, a 19.7% increase YoY. Total YTD volume reached a record 134.4 million contracts, a 29.0% increase from the same period in 2023.

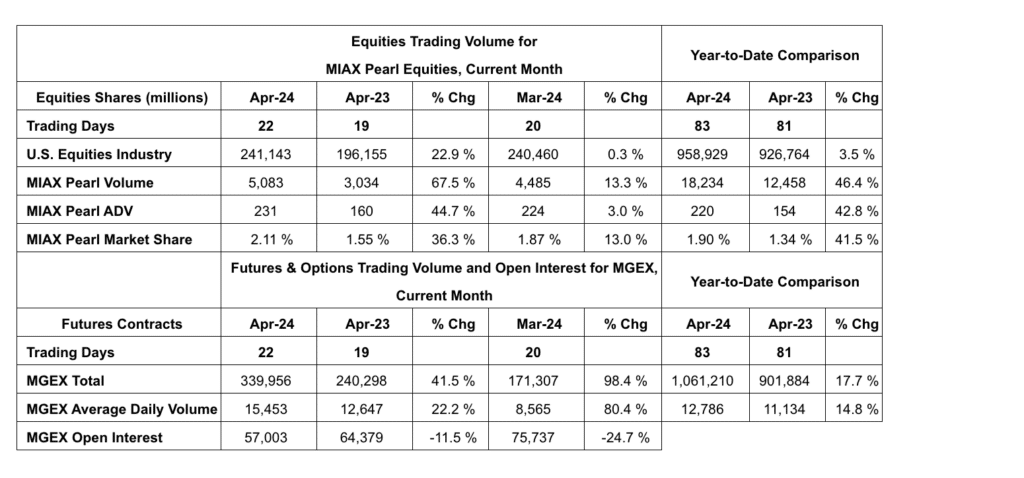

- In U.S. equities, MIAX Pearl Equities™ reached a monthly volume of 5.1 billion shares, a 67.5% increase YoY and representing a market share of 2.11%, a 36.3% increase YoY. Monthly ADV reached 231.0 million shares, a 44.7% increase YoY. Total YTD volume reached a record 18.2 billion shares, a 46.4% increase from the same period in 2023. YTD market share reached a record 1.9%, an increase of 41.5% from the same period in 2023.

- In U.S. futures, MGEX, a Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO), reached a monthly volume of 339,956 contracts, a 41.5% increase YoY and representing a 98.4% increase from March 2024. ADV reached 15,453 contracts in April 2024, representing a 22.2% increase YoY.

Additional MIAX Exchange Group and MGEX trading volume and market share information are included in the tables below.

About MIAX

MIAX’s parent holding company, Miami International Holdings, Inc., owns Miami International Securities Exchange, LLC (MIAX®), MIAX PEARL, LLC (MIAX Pearl®), MIAX Emerald, LLC (MIAX Emerald®), MIAX Sapphire LLC (MIAX SapphireTM), Minneapolis Grain Exchange, LLC (MGEX™), Ledger X LLC d/b/a MIAX Derivatives Exchange (MIAXdx), The Bermuda Stock Exchange (BSX) and Dorman Trading, LLC (Dorman Trading).

MIAX, MIAX Pearl and MIAX Emerald are national securities exchanges registered with the Securities and Exchange Commission that are enabled by MIAX’s in-house built, proprietary technology. MIAX offers trading of options on all three exchanges as well as cash equities through MIAX Pearl Equities™. The MIAX trading platform was built to meet the high-performance quoting demands of the U.S. options trading industry and is differentiated by throughput, latency, reliability and wire-order determinism. MIAX also serves as the exclusive exchange venue for cash-settled options on the SPIKES® Volatility Index (Ticker: SPIKE), a measure of the expected 30-day volatility in the SPDR® S&P 500® ETF (SPY).

MGEX is a registered exchange with the Commodity Futures Trading Commission (CFTC) and offers trading in a variety of products including Hard Red Spring Wheat Futures. MGEX is a Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO) under the CFTC, providing DCM and DCO services in an array of asset classes.

MIAXdx is a CFTC regulated exchange and clearinghouse and is registered as a Designated Contract Market (DCM), Derivatives Clearing Organization (DCO), and Swap Execution Facility (SEF) with the CFTC.

BSX is a fully electronic, vertically integrated international securities market headquartered in Bermuda and organized in 1971. BSX specializes in the listing and trading of capital market instruments such as equities, debt issues, funds, hedge funds, derivative warrants, and insurance linked securities.

Dorman Trading is a full-service Futures Commission Merchant registered with the CFTC.

MIAX’s executive offices and National Operations Center are located in Princeton, N.J., with additional U.S. offices located in Chicago, IL and Miami, FL. MGEX offices are located in Minneapolis, MN. MIAXdx offices are located in Princeton, N.J. BSX offices are located in Hamilton, Bermuda. Dorman Trading offices are located in Chicago, IL.

Source: MIAX