In early March, my co-worker told me that he made thousands of dollars by shorting airline stocks. He bought right when news of the coronavirus spread, and the airline stocks were still at high prices. Their stock prices tanked, and he made out like a bandit.

I’ve never short sold in my life, but hearing his story made me feel like I should. Surely, anyone with an ounce of foresight could’ve predicted that airline stocks would drop like rocks. Why didn’t I jump onto the short selling bandwagon sooner? I was missing out on potentially huge gains. I had to try.

What Is Short Selling?

Before we go further, let’s pause for a second and discuss short selling.

For those who don’t know, short selling is a way to make money when stock prices fall. The investor borrows a stock, sells it, and then covers their short by buying the stock. If the stock price went down, the investor makes the difference. However, if the stock price rises, the investor’s short loses that much money.

For example, pretend that Joe wants to short Duff Beer’s stock, which is worth $50. Joe goes through his brokerage and shorts 20 Duff Beer stocks for a total of $1,000. Duff Beer’s stock drops from $50 to $40, so Joe decides to cover his short. He makes a profit of $10 for each share for a total of $200.

But what if Duff Beer went to $60 instead of $40? Since the price went up by $10, Joe would be down $200 as long as he held onto his shares. He could cover his shorts or hold onto them and hope that they go back down.

Shorting is an exciting way to make a quick buck in a volatile market, but it’s extremely risky. You have to pay the difference on however much the price changes. If the price skyrockets, you’ll lose that much money.

For example, if Duff Beer’s stock went from $50 to $90, Joe would’ve had to pay the $40 difference on all 20 of his stocks — a total of $800.

There’s no limit as to how high stock prices can soar, so there’s no limit to how much money you can lose.

Additionally, most brokerages require you to pay a fee for each day you hold a short. The costs are usually aren’t high (about $0.18 for me), but they can add up over time. The longer you borrow a stock, the more you’ll have to pay.

In other words, you don’t want to hold onto a short for a long time. That’s why they’re called shorts.

My Experience Short Selling

With stock prices dropping rapidly, I wanted to try out short selling. It seemed like the perfect opportunity to profit from other people’s panic selling. I started out slowly and cautiously by shorting 55 Marriott shares and 50 Delta Air shares. Surely enough, the stock prices dropped, and I covered the shares immediately.

I made $589.86 from Marriott and $370.15 from Delta Air. Not too bad, right?

I was ecstatic. I’d never shorted stocks ever, but here I was, making money almost instantly. I earned nearly $1,000 with virtually no effort. I could potentially earn hundreds or even thousands of more from shorting stocks. I figured that restaurants, airlines, retail, and hotels were all screwed from the coronavirus, so their prices could obviously fall lower.

Greed and excitement got the best of me, and I shorted:

- 10 shares of Boeing;

- 60 shares of Dunkin Donuts;

- 110 shares of Hilton;

- 55 shares of International Hotel Group;

- 15 shares of Lowe’s;

- 45 shares of Marriott;

- 12 shares of McDonald’s;

- 100 shares of Ryanair; and

- 70 shares of Yum! Brands.

The greed was real. Unfortunately, it didn’t work out for me.

I lost $5,292.91.

Here are the lessons I paid over $5,000 to learn:

1. It’s Almost Impossible to Time the Market

“Time in the market is better than timing the market,” is an adage I’ve told many fledgling investors. Nobody can predict the bottom despite many analysts telling you otherwise. But many people, including myself, expect the market to flow in one direction or another.

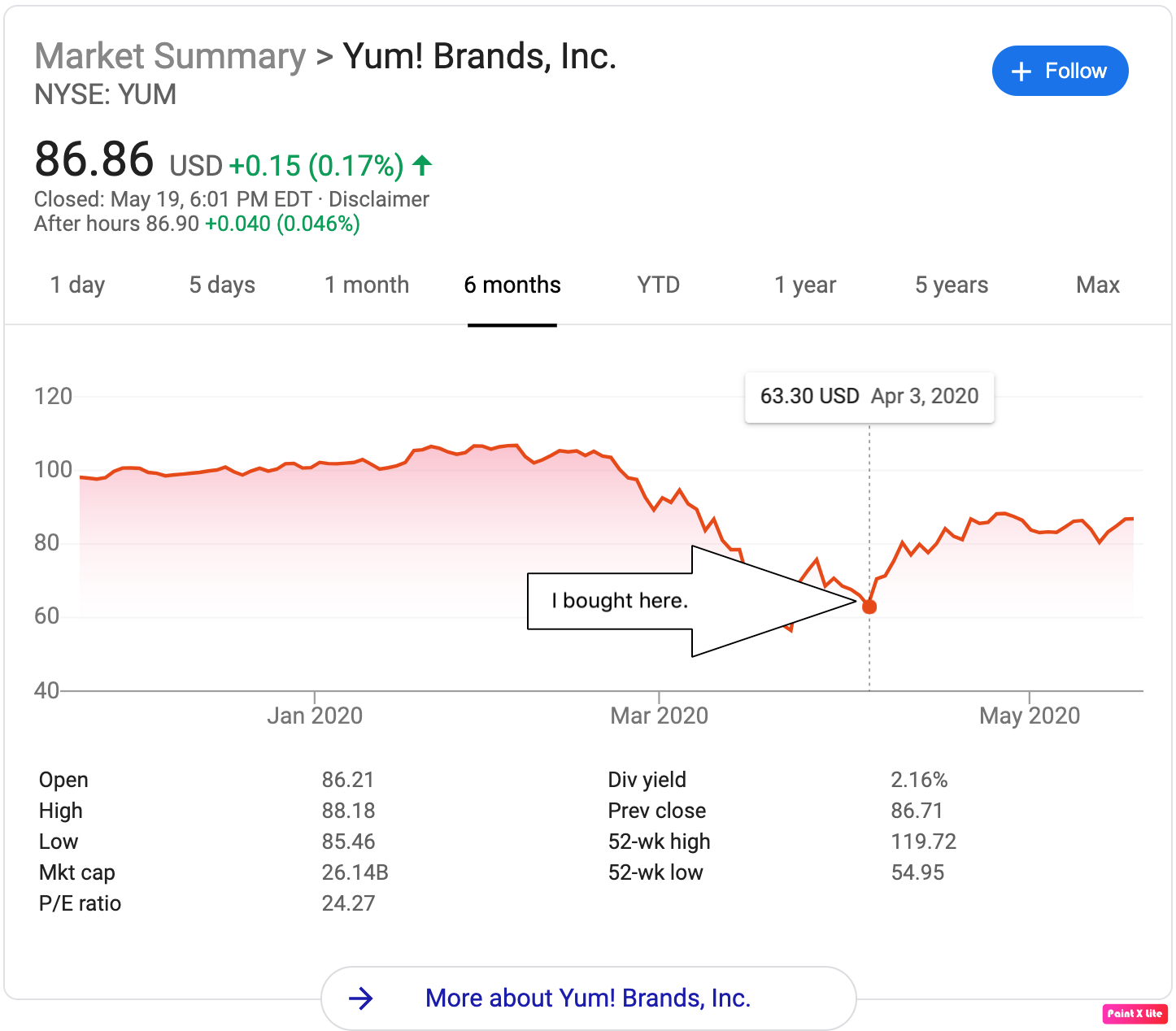

For example, I shorted the Yum! Brands on Friday, April 3rd, when it was worth $63.30. The stock was low, but still about $10 away from its 52-week low. I foolishly thought that it could always drop a bit more. Instead, the price skyrocketed upwards next week.

See the picture below for details.

Maybe someone more experienced can time the market, but I sure as hell can’t. The best strategy anyone can follow is to dollar cost average — consistently put money in the market whether it goes up or down. (Of course, buying during its lows isn’t a bad idea either.)

I’ve missed so many opportunities because I was too optimistic about a stock’s price. I thought they’d sink even lower, but they bounced up instead. I’m still pretty bitter about the missed opportunities, but I’ll learn to live with my mistakes.

2. Greed Gets the Best of Us

I’d like to think of myself as a frugal and financially savvy person. I’m very good at tracking my spending and refraining from impulse purchases. However, even I get swept up in emotions and excitement.

Shorting all those stocks was just was way my greed overtook my foresight. I got such a high adrenaline rush from my first shorts that I immediately wanted short again. Think of all the things I could buy! Maybe new camera lens or another Magic: the Gathering deck! I could potentially earn more doing this than I ever would working a full-time job.

It didn’t take long for my optimism to shatter. I held onto my shorts for over a month until I figured it was time to dump them for good. I didn’t want to hold onto them for too long due to the holding fees. It was painful to cover them, but holding on would’ve been much worse.

3. Shorting is Like Gambling

Many people believe that investing is like gambling. I disagree. Gambling puts the odds in the house’s favor while investing (generally) puts the odds in yours. Indices such as the S&P 500 and the Russell 2000 always go up over time. For example, $SPY was worth $43.94 in 1994 and is now worth almost $300. Individual stocks are risky, but index funds are almost always a safe bet.

However, shorting is like gambling. You have to expect a dramatic price change soon, or you’ll lose money. Not everybody has the same insight as Michael Burry.

Long-term investing is the most consistent way to make money in the stock market. Buy stocks that you’d be comfortable keeping for several years.

As Warren Buffett says, “If you are not willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

4. Don’t Hold Through a Dividend

Outside of fees and potential losses, shorting is also risky because you’ll have to pay the dividend for any stocks you borrow. Receiving dividends is one of my favorite things in the world. Paying them, on the other hand, is something I detest.

I held onto Lowe’s for so long that I ended up having to pay their dividend. Charles Schwab sent me a letter requesting $8.75 for the 15 Lowe’s shares I was borrowing. While $8.75 isn’t much, it added to my already devastating losses.

5. Writing Off Losses Helps Save Money on Taxes

There’s a small silver lining throughout all this horrible news. I learned that I can write off stock losses to help offset my gains. For example, if I earned $5,000 from stocks and wrote off $3,000 in losses, I’d only have to pay taxes for $2,000. The IRS only allows me to write off $3,000 in losses each year, but I can carry over the losses to each other year until they run out.

Writing off losses is a great way to save some money on taxes. But you know what would’ve made me happier? Not losing money in the first place.

Conclusion

Losing money sucks. Hell, psychologists Daniel Kahneman and Amos Tversky found out that the pain of losing money is twice as powerful as the happiness from gaining money. This behavior is called loss aversion and explains why many are so fearful about investing. When you lose money, you often think about how hard you worked to gain that amount and what you could’ve purchased.

My over $5,000 loss represents roughly 2.5 months of savings. Just like that, it’s all down the drain.

I’m upset, but I’ll live. The important thing is to keep my head up and start making smarter money moves. I’ve learned from my mistakes, and I hope that anyone reading this article will also learn. I’m not saying that you should never short stocks, but be careful. Do your research and invest with caution.

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine, Markets Media Group or its staff. Traders Magazine welcomes reader feedback on this column and on all issues relevant to the institutional trading community.