Bob Gauvain, head trader at Pioneer Investments, has been around the securities industry a long time.

At 16, Gauvain was a messenger for the Boston Stock Exchange Clearing Corp., delivering stock certificates to the exchange’s member firms. He worked part time on the exchange floor throughout college on the recording desk. There, he made sure that, as trades were executed, each went on the tape. He also kept track of the total volume of shares traded solely on the Beantown exchange.

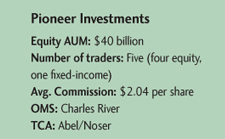

Those tasks turned into a lifelong career for the former part-timer. Gauvain has now been head trader for the past 21 years at Pioneer Investments, which was a mutual fund firm with four funds and $4.6 billion under management when he started and now has more than 100 funds and global assets under management of $204 billion.

“The business was fascinating to me. I fell in love with it,” he said.

Of course, the business has changed a bit since Gauvain joined Pioneer in 1984 to trade small-cap and Nasdaq-listed stocks.

“The quote monitors at the time were static. If you punched in a quote, the quote would stay the same unless you punched in another quote,” he said. “And when you did an execution, you handwrote the execution onto the trade ticket. Then you manually had to figure out what funds got what execution. So it was paper and calculator. The order management system was your traders.”

Technology has wrought dramatic change, Gauvain said. Among other things, trading technology enables Pioneer to do more with fewer people. “My group of five traders is doing what six or seven people used to do, and now they are also handling fixed income trading,” he said.

Both buyside and sellside traders’ roles have changed, as well. “What used to be done by brokers can be done by buy-side traders themselves off their desktops with algos and execution management systems,” Gauvain said. Indeed, close to 50 percent of the firm’s equity business is now done away from the traditional broker’s cash desk, he said.

“Algos are taking on a lot of the role of what a sell-side trader used to do,” said Gauvain. Traditional brokers’ desks “are still very important but the buy-side traders do a lot more than they used to do.”

Cross-Training

Pioneer’s trading team includes Eddie Doyle, who focuses on value stocks; Sofia Sermos, whose specialty is core stocks; Dan Sim, growth; Nick Lambros, international, and Mark Phillips, fixed income. Phil Colburn is the trading assistant.

The traders are cross-trained-all of the equity traders can trade anything on the equity side, and each one is also picking up a different piece of the fixed-income business as well, he said.

“Once we brought fixed income into the trading room two years ago, rather than having silos, we took a hybrid approach,” Gauvain said. As a result, the traders “are more conversant in the market as a whole as opposed to their subset of it. It helps their trading.”

Gauvain calls the group’s trading style “liquidity-based,” at this point.

“We’ll trade anywhere on any platform to buy the most amount of shares at the best possible price for the least amount of commission,” he said.

The team uses algos provided by bulge bracket firms across the whole spectrum of trades, he said. By using brokers’ algo platforms, Pioneer gets a credit that the firm uses to pay smaller research boutiques that might not have a trading desk or a good trading capability.

About 40 percent of Pioneer’s equity transactions are done via algos, Gauvain said. Algos enable traders to maintain anonymity, he said. “With a cash desk, you have the risk of having a phone call made by the cash desk to mess up the picture.”

(c) 2013 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/