By James Chu, Stefanos Bazinas, and Choey Li, NYSE

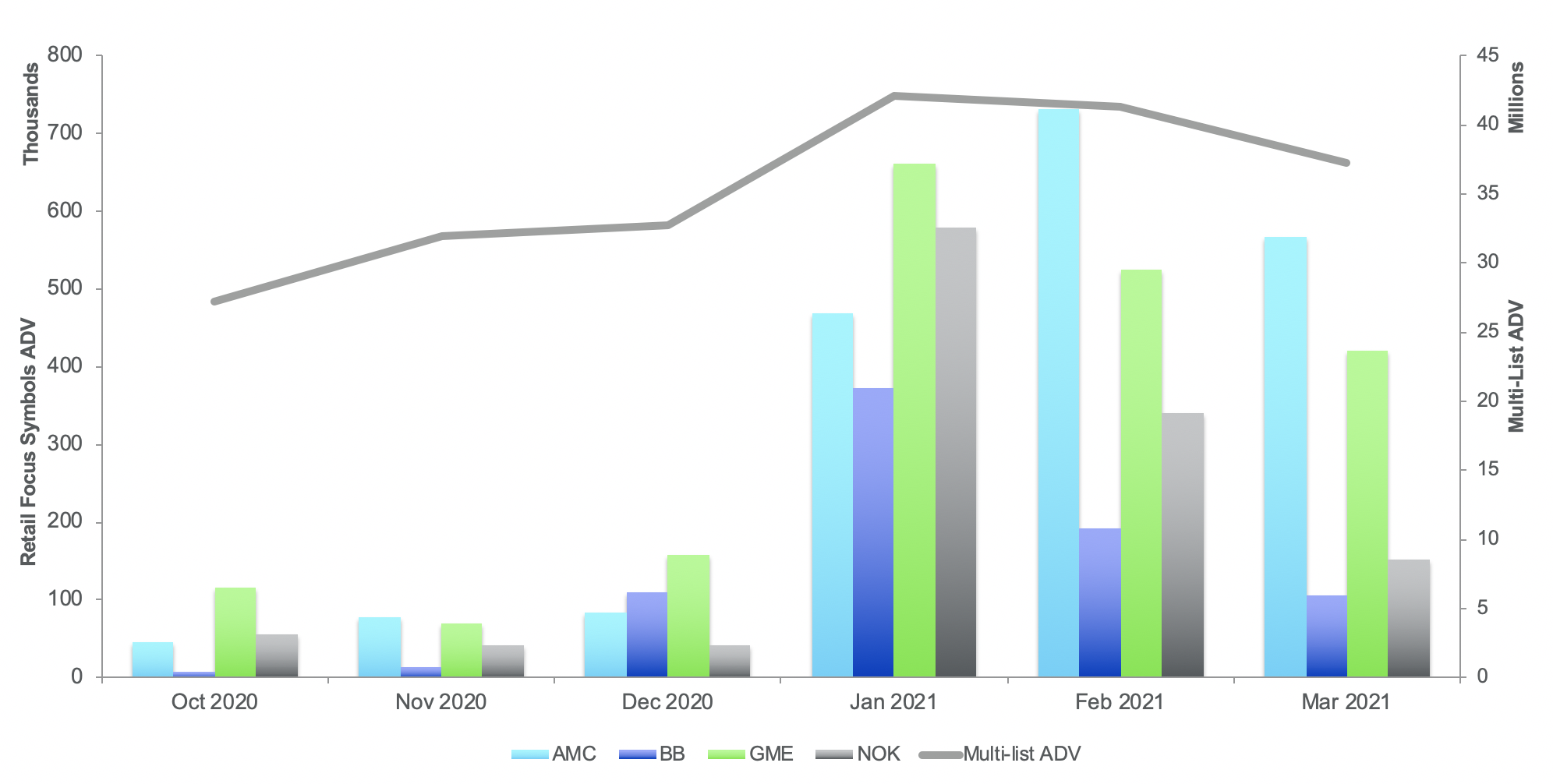

At the end of January, stock market news was everywhere from mainstream outlets to Saturday Night Live, as social media seemed to drive unprecedented trading interest in a few stocks. AMC Entertainment (AMC), BlackBerry (BB), GameStop (GME), and Nokia (NOK) received the most attention and saw their combined options ADV increase from 68K contracts in Q4 2020 to over 426K contracts in Q1 2021 − a 523% increase. Overall multi-list options ADV increased 31.3% in that same time frame.

ADV Growth in Retail Focus Symbols

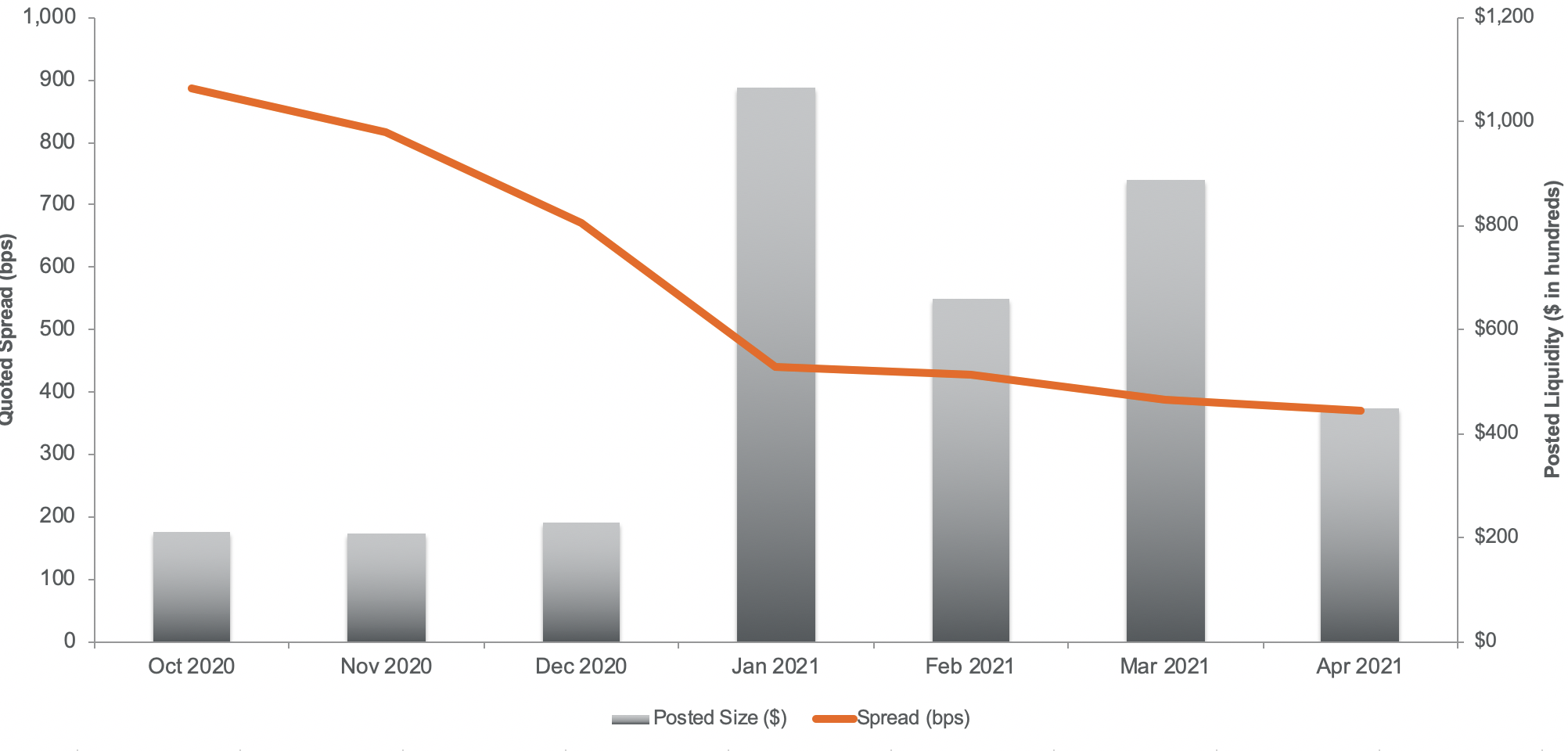

Market Quality

Increased volatility and uncertainty can adversely impact market quality, but in these 4 symbols, market quality metrics largely improved. Options bid-ask spreads in the combined 4 symbols tightened by 45% from 765 bps to 421 bps quarter-over-quarter (QoQ). The rise in participation and attention also led to a 303% QoQ increase in posted liquidity from $21.6K to $87.1K of market value displayed. Thus far in April, spread widths have further improved, while posted liquidity has declined, but remains double its Q4 levels.

Quoted Spread (bps) and Posted Liquidity ($)

AMC, BB, GME, NOK

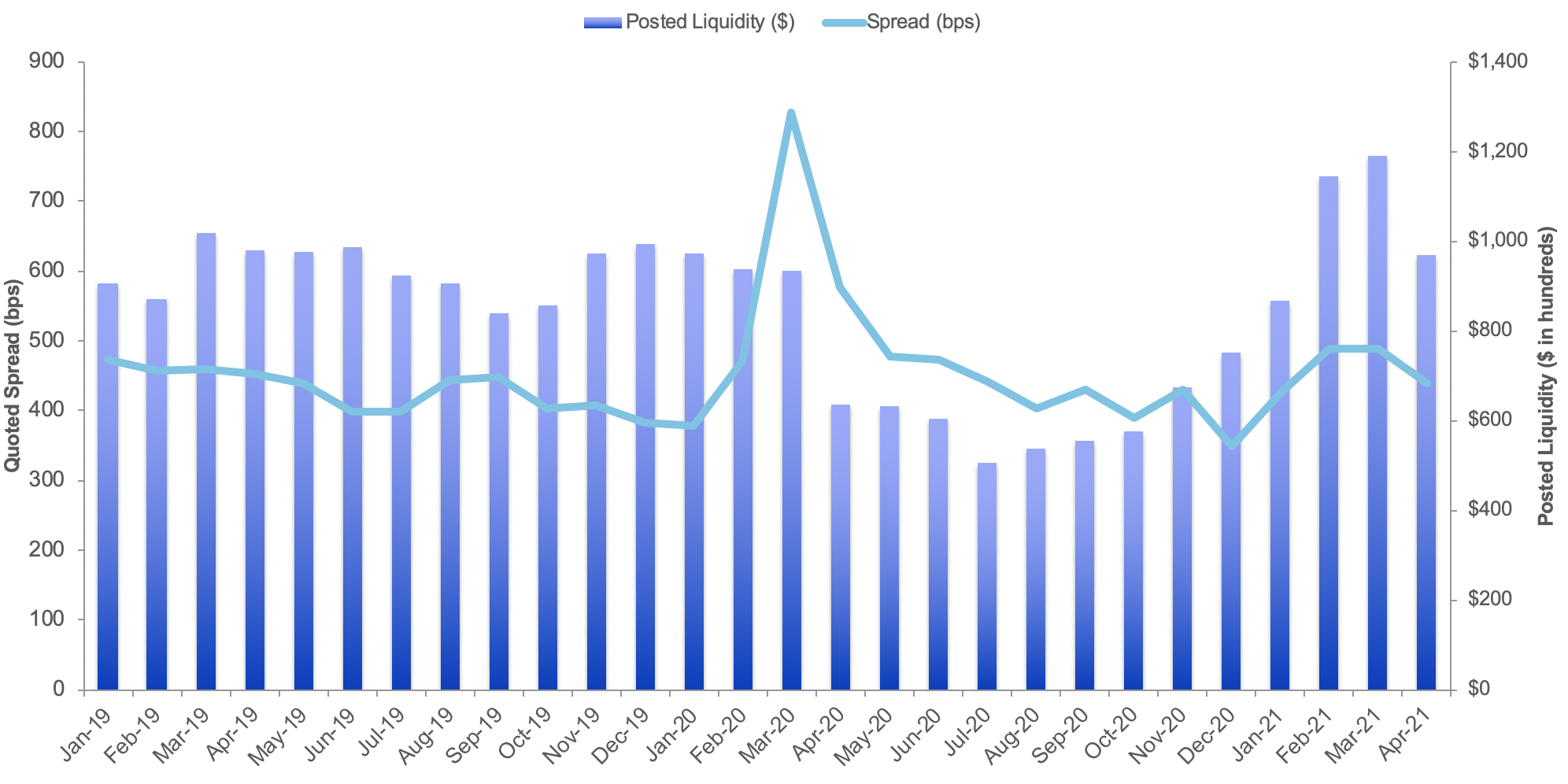

For comparison to the broader market (excluding SPY), we saw in our Q1 2021 Options Review that spreads widened by 21% and posted liquidity increased by 60% QoQ. Thus far in April for the broad market spread widths have tightened and posted liquidity has declined; both are at pre-pandemic levels.

Quoted Spread (bps) and Posted Liquidity ($)

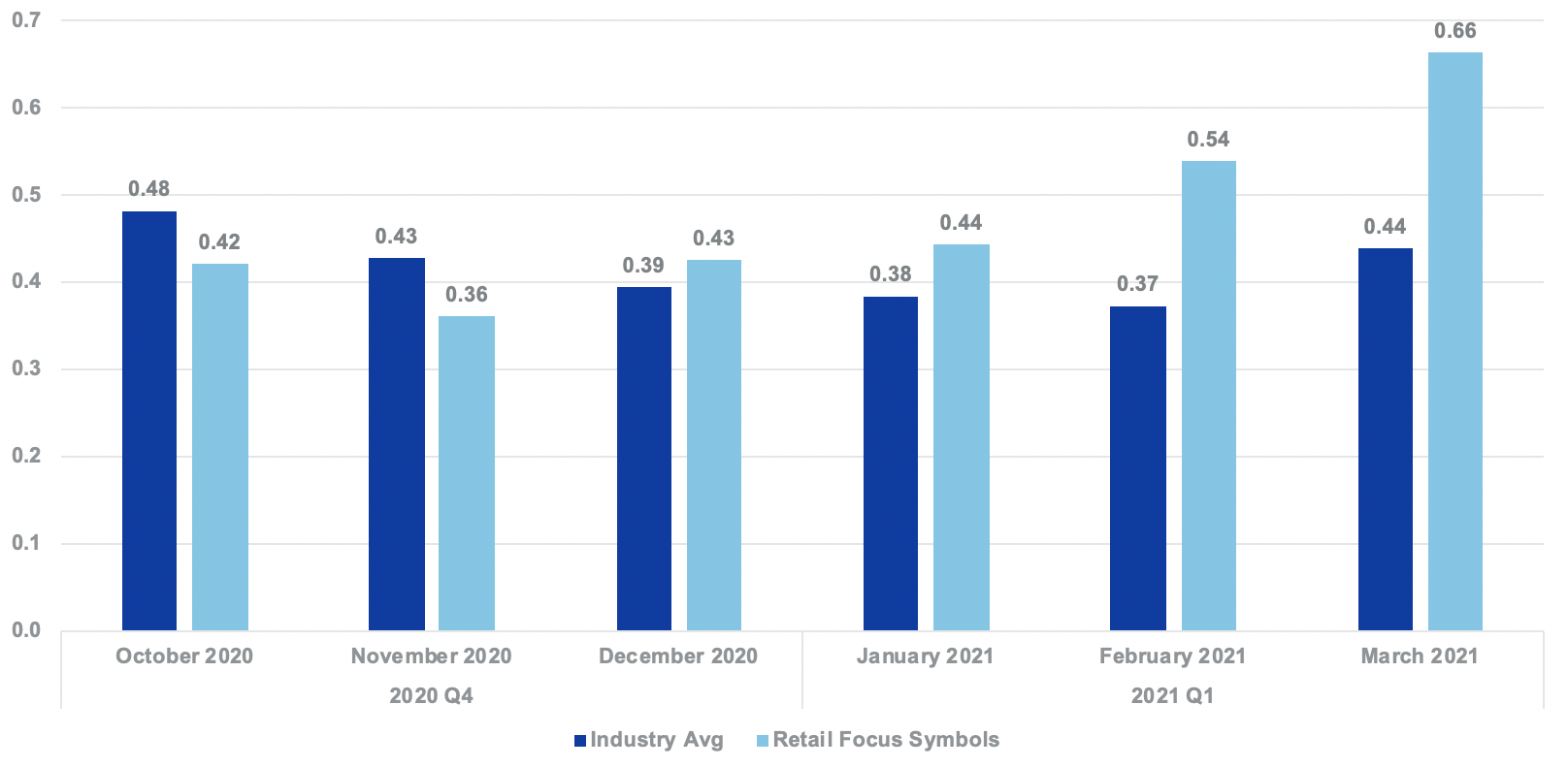

Complexion

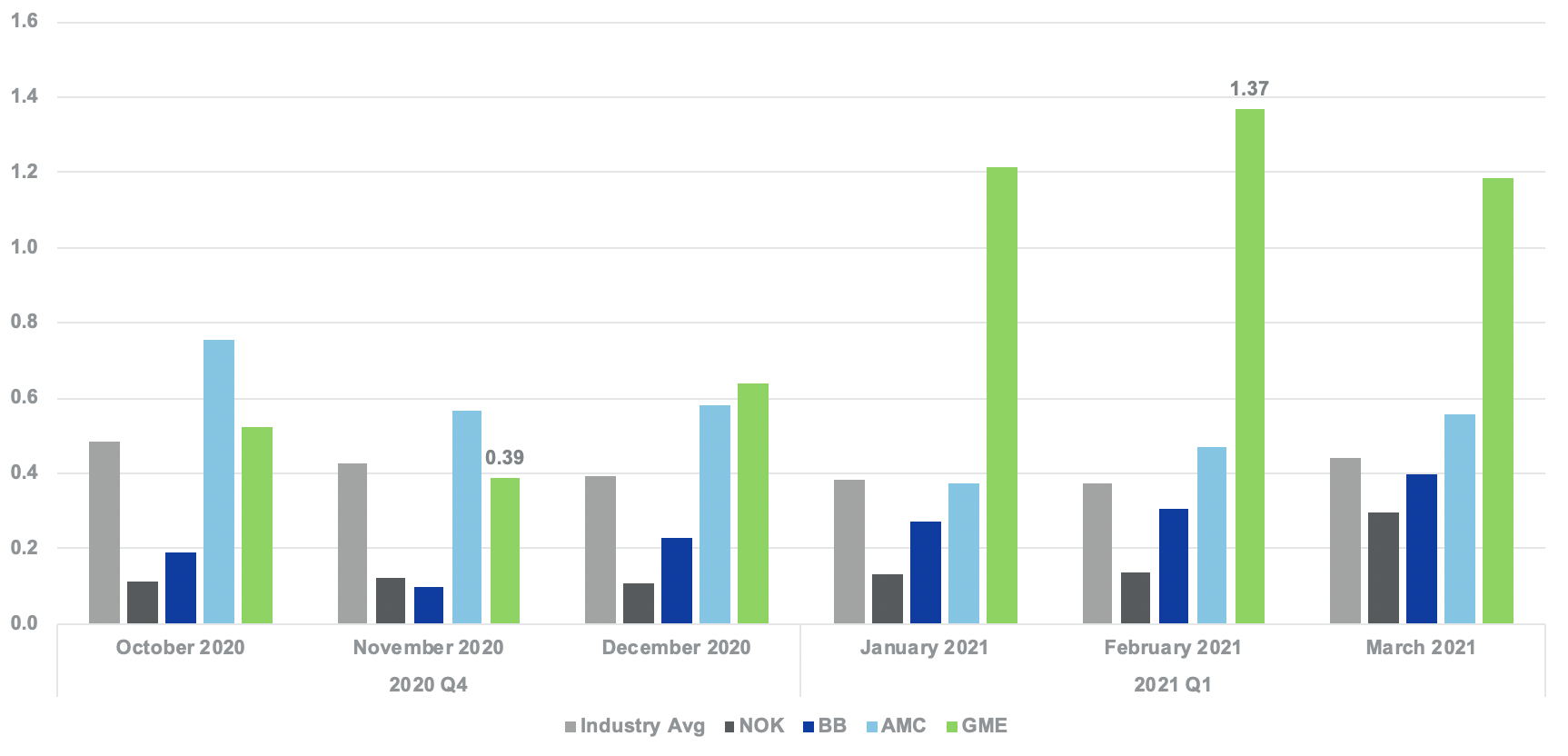

Put/Call Ratio in the 4 Retail Focus symbols increased significantly, especially when compared to single-stock symbols. This could be indicative of investors using options differently for names with particularly high levels of uncertainty and market volatility.

Put-Call Ratio

RETAIL FOCUS SYMBOLS VS INDUSTRY AVG

GME appeared to lead the trend of increasing P/C ratio with a reading of 0.39 in November 2020 that rose to 1.37 in February 2021.

Put-Call Ratio

AMC, BB, GME, NOK

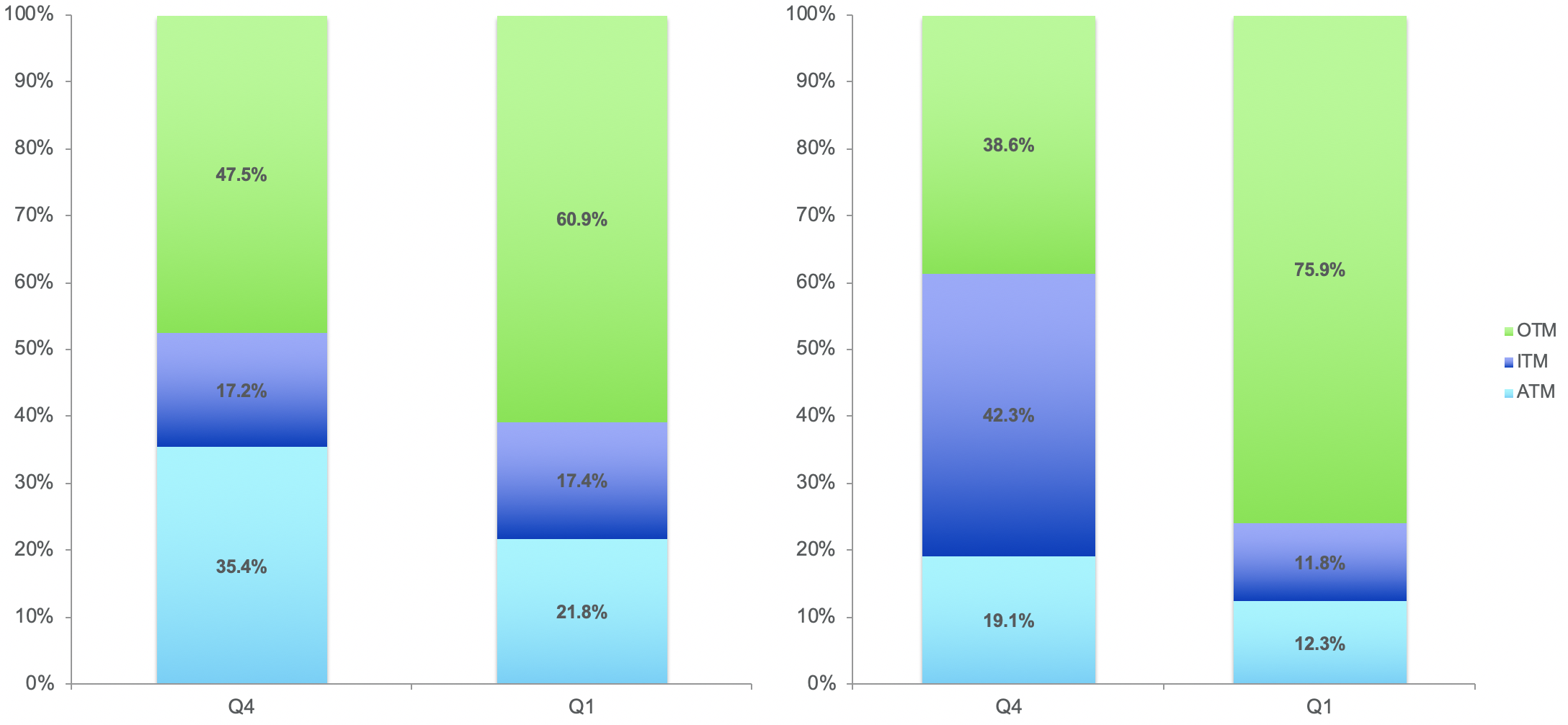

Instrument selection can help explain some of the previously mentioned changes in market quality. Out-of-the-money (OTM) puts in the Retail Focus symbols grew substantially from Q4 to Q1 and outpaced the growth in OTM calls. OTM calls increased from 47.5% of call volume to 60.9% QoQ, while OTM puts increased from 38.6% to 75.9% of put options. Along with the shift to OTM options, there was also a shift to short-term maturity options. Both OTM and shorter-term maturity options are lower priced relative to ATM (at-the-money), ITM (in-the-money) and longer-term maturity options and tend to have tighter spreads and larger posted liquidity. This may explain some of the improved market quality metrics.

Retail Focus Stocks

Call Moneyness

Retail Focus Stocks

Put Moneyness

In contrast, the overall market experienced wider, not tighter, spreads in Q1 2021. As with the Retail Focus symbols, volumes also shifted from longer dated options maturities to maturities dated 1 month or less and to OTM options and away from ATM and ITM options. These shifts would all typically lead to tighter spreads and more posted liquidity. However, ETF volume concentration decreased slightly, and single stock concentration increased, which would typically have a counter-effect.

Lessons Learned

The “meme stock” phenomenon of January 2021 drove a substantial uptick in options usage for a handful of Retail Focus symbols. The complexion of activity in these symbols showed that usage of the options market was highly concentrated, with short-term OTM options traded more frequently. Despite the sudden influx of focused liquidity demand and volatility, options market liquidity providers responded with improved market quality in the most active securities. These results demonstrate the resiliency of the options market and its ability to adapt to highly unusual conditions with little associated impact to the broader market. As we progress into the 2nd quarter of 2021, we look forward to observing the level of retail participation in the options market and overall options market quality.