Jeffrey Sprecher, chairman and chief executive of ICE, stressed that the strategy of diversification has made the data, technology and market infrastructure operator an “all weather” name as it reported the sixteenth consecutive year of record revenues.

ICE reported that 2021 full-year net revenues were $7.1bn, an 18% year-on-year increase, and record operating income of $3.4bn, a rise of 14% from 2020.

Warren Gardiner, chief financial officer of ICE, said in a statement: “In 2021 we generated record revenues, record operating income and record operating cash flows. We grew revenues across the asset classes in which we operate, generating double-digit growth in our recurring revenues.”

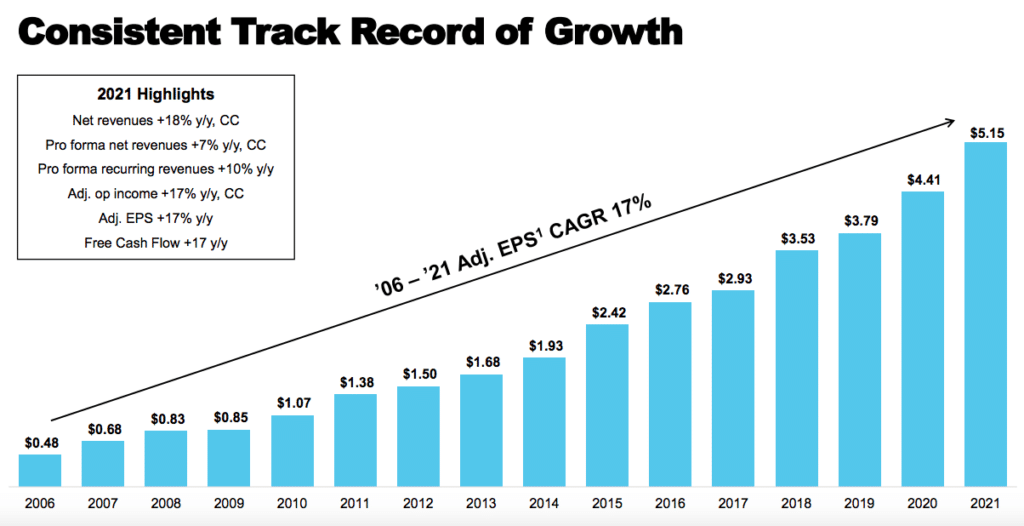

Sprecher said on the results call that 2021 marked ICE’s sixteenth consecutive year of record revenues and record adjusted earnings per share. He explained this track record reflects ICE’s strategy of diversifying the business and positioning the company at the centre of some of the largest markets undergoing an analogue to digital conversion strategy.

“That has made ICE an all weather name – a business model that provides upside to volatility with less downside risk, and importantly, a positioning that drives growth on top of growth,” he added. “We have intentionally diversified across asset classes so that we are not tied to any one cyclical trend or one macroeconomic environment.”

For example, in 2021 ICE had record volumes across its energy complex driven by inflationary concerns and market speculation of central bank activity. The European and UK interest rate business also benefited from interest rate volatility which drove a 15% increase in revenues in 2021 and a 34% increase in January.

“Against this backdrop of rising interest rates our mortgage technology business outperformed the broader market, again a reflection of the all weather nature of our business model,” said Sprecher.

Fixed income and data services

In December 2021 ICE announced a series of senior leadership changes.

Sprecher said: “I’m surrounded by a generation that is younger than me, is incredibly talented and that delivered the best year in our history. Those changes are an opportunity to start to put leaders in that generation and because the company is so geographically diverse we are trying to give people opportunities to try their skills in different businesses and give them exposure to the markets.”

Amongst the changes Lynn Martin, formerly president, ICE fixed income and data services, was named president of the NYSE, succeeding Stacey Cunningham, who has joined the board of directors of the NYSE. Martin has continued her role as chair of ICE fixed income and data services to help guide that business as Amanda Hindlian, previously global head of capital markets at the NYSE, becomes president of the business.

Martin said on the results call: “With data and technology at our core, our goal is to provide solutions which add transparency to both commonly understood risks as well as emerging risks such as environmental, social and governance (ESG).”

She added that the data technology business and marketplaces positioned ICE to benefit from the secular trend toward sustainability and net zero carbon commitments. In December 2021 ICE expanded its climate change and alternative data capabilities with the acquisitions of risQ and Level 11 Analytics, which deploy data-driven technologies for managing climate change risk.

“Combining geospatial data technology with our financial data will bring greater transparency to ESG risks across the financial markets, including our existing municipal bond and mortgage-backed security offering,” she said.

Fixed income and data services includes the evaluated pricing business, which prices nearly 3 million securities daily, and the rapidly growing index business. Martin said increased automation, flexibility of delivery and passive investing will continue to drive demand for ICE’s proprietary data and rapidly growing index business.

The business has historically served the back and middle office but Martin said ICE has created tools and analytics for the front office.

“These tools are critical to the pre-trade transparency needed in the opaque, less liquid fixed income markets, as evidenced by our front office tools continuing to grow at double digits,” she added.

The growth in passive investment is continuing to boost the index business. In 2021 five asset managers with funds of over $66bn transitioned to ICE indices according to Martin, and an additional group of funds with $6.7bn in assets under management plan to transition during the first quarter of 2022.

Listings

Martin continued that 2021 was a record for NYSE listings with nearly $120bn raised in capital from 297 initial public offerings, including the three largest technology IPOs.

“Importantly we continue to lead the market in exchange-traded fund listings with more than 65% of new ETFs selecting NYSE as their home,” she said.

She added that ICE continues to prioritise technology and this was important last week when it processed nearly half a trillion equities messages in a single day with median response times of less than 30 microseconds.

NYSE has a healthy pipeline of IPOs said Martin, although the timing of some companies coming to market is shifting given the macroeconomic environment.

“We really see the environment changing and while the drivers of capital raising last year may have favoured our competitors, we see that shifting,” she added. “The issuers that I have been talking to more recently are valuing stability and trading, lower cost of capital and strong governance, and that really favours the NYSE market model.”

Carbon markets

Ben Jackson, president of ICE, said on the results call that ICE was early to diversify into environmental markets when it acquired the Climate Exchange in 2010.

“In 2021 we reached record volumes across the complex including in our EU, UK, renewable greenhouse gas initiatives and California carbon allowances,” he added.

Jackson continued that record volumes contributed to a 56% increase in environmental revenues from 2020 as customers navigated the uncertainty and volatility related to the clean energy transition.

ICE traded a total of 18 billion tons of carbon allowances in 2021, equivalent to an estimated $1 trillion in notional value and equal to over half the world’s estimated total annual energy-related emissions footprint.

In October 2021 ICE invested in LevelTen Energy, which brings greater transparency and liquidity to the renewable energy industry and enables participants to transact on power purchase agreements and physical energy assets more efficiently.