ICE, the exchange operator and data, technology and market infrastructure provider, reported the best second quarter in the company’s history, following on from its record first quarter this year.

Warren Gardiner, chief financial officer at ICE, said on the results call that ICE had the best second quarter in the company’s history, on top of 12% growth in the second quarter of 2021. Net revenues in the second quarter of this year were $1.8bn, an increase of 8% versus last year.

“Through the first half of the year, we have grown revenues, operating income and cash flow,” added Gardiner. “Recurring revenues, which account for roughly 50% of our total revenue, continue to compound alongside growth in our diverse transaction-based businesses.

Jeffrey Sprecher, chair & chief executive of ICE, said on the call: “Amidst a backdrop of continued volatility and uncertainty, our strong second quarter performance reflects the value of our markets, technology and data services. Our strategic diversification across asset classes and geographies enables us to better innovate for customers and drive growth across an array of macro environments.”

Exchange performance

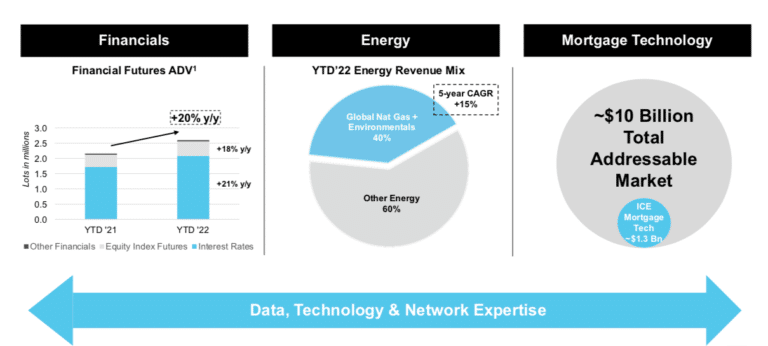

Exchange net revenues were $1bn in the second quarter, an increase of 13% year-over-year. ICE said strong performance was driven by an 80% increase in interest rate futures and 36% increase in equity derivatives revenues.

Gardiner said: “Importantly, total open interest, which we believe to be the best indicator of long-term growth, ended July 11% up versus the end of last year, including 6% growth in energy and 21% growth across a financial futures and options complex.”

Cash equities and equity options revenue increased by 17% from a year ago in the second quarter. In July ICE also migrated the NYSE Arca options platform to NYSE Pillar technology which Gardiner said was in the midst of processing record message volume.

Fixed income and data services had record revenue of $512m in the second quarter, a 13% increase versus a year ago. Fixed income transaction revenues increased by 78% including 85% growth in ICE bonds and a 76% growth credit default swap clearing.

“Strong growth was driven in part by customers allocating more capital to CDs trading, as well as our continued efforts to build institutional connectivity to our bond platforms where we’re seeing market share gains in our municipal bond business,” said Gardiner.

Lynn Martin, president of the NYSE and chair of fixed income & data services, said on the call that the growth of fixed income trading during the second quarter was a result of the firm’s efforts to build out the infrastructure to connect the institutional market to ICE’s municipal bind execution platforms.

“Over the last two years we have really focused on leveraging our market-leading assets in the muni ecosystem, including our data assets,” she added. “Our index business now serves as the benchmark for more than 60% of the assets under management in this area.”

She continued that institutional share of ICE’s muni execution platforms has doubled since 2020, and grew 50% year-over-year in the second quarter.

Ben Jackson, president of ICE and chair of ICE Mortgage Technology, said on the call that rising inflation has created an interest rate environment that many customers have not navigated in over a decade while the continued war in Ukraine has triggered a reshaping of the global energy supply chain, creating new risks and uncertainties for market participants.

“In our interest rate markets we’ve seen record year-to-date volumes in our Euribor contracts as customers increasingly seek to manage risks associated with rising rates in central bank activity across Europe and the UK,” Jackson said. “This heightened risk has also contributed to strength in our equity derivatives complex, driving an 18% increase in volumes year-to-date.”

Environmental contracts

Jackson continued volumes increased in energy contracts, especially global gas contracts, but governments, corporates and market participants remain committed to reducing carbon emissions and ICE has one of the largest networks of environmental products including renewable fuel contracts, carbon allowances, nature based solutions, and renewable energy certificates.

“The breadth of our complex, coupled with the growing importance of carbon price transparency, has contributed to the 19% average annual volume growth in our environmental complex over the past five years.,” added Jackson. “As the clean energy transition continues to introduce new complexities, uncertainty, and volatility to energy markets, our global environmental suite alongside our gas and oil complexes will provide the price transparency across the energy spectrum needed to manage these evolving risks.”

Martin continued that ICE’s strength in fixed income data and its ability to tie alternate datasets into data that is useful to the market means that the firm is uniquely positioned to add transparency around ESG, especially on climate risk.

In December 2021 ICE announced the acquisitions of risQ and Level 11 Analytics, which deploy data-driven technologies for managing climate change risk. Since the two companies were founded in 2016 and 2019 respectively, risQ and Level 11 Analytics have tied data from geospatial mapping systems to financial securities to provide climate risk analytics and investment decision-making tools for U.S. municipal bond, mortgage-backed securities and real estate markets.

In July this year ICE announced the purchase of Urgentem, which provides Scope 1, 2 and 3 greenhouse gas emissions data, analytics and tools for over 30,000 publicly-listed and privately-held securities. ICE said this data data will be used to enhance its global sustainable finance offering, which includes a corporate ESG database of over 10,000 companies, U.S. municipal bond and mortgage-backed securities climate risk services, a suite of global corporate climate indices in addition to its environmental contracts.

ICE also launched an ESG Geo-Analyzer, an on-demand platform that takes user-provided location data including street address, latitude / longitude, or zip code to analyze the climate risk and social impact characteristics surrounding any location or portfolio of properties, within the contiguous U.S. It can be used to analyze commercial and residential properties, whole loan portfolios and real estate holdings, and the asset-backed securities or business and corporate operations tied to those locations.

Martin said: “We have the ability to offer ESG information measured by geographic coordinates in the US and we have plans to expand that globally.

Black Knight acquisition

In May ICE announced it was acquiring Black Knight in a transaction which valued the mortgage software, data and analytics company at $13.1bn in order to build on ICE’s position as a provider of end-to-end electronic workflow solutions for the U.S. residential mortgage industry. ICE management said on the call that they would not be commenting on the acquisition apart from continuing to believe the transaction will close during the first half of 2023.

Eoin Mullany, analyst at German financial services group Berenberg, said in a report in July that ICE’s 25% P/E discount to peers was at an all-time high due to market concerns about the acquisition and the increased leverage. The report highlighted that ICE has grown its mortgage business through acquisitions including Simplifile, Mortgage Electronic Registrations Systems (MERS) and Ellie Mae.

“Although some investors question the timing of the Black Knight acquisition as originations fall and mortgage rates rise, strategically, we think it makes sense,” said Mullany. “The acquisition fills gaps in ICE’s mortgage offering and it provides the mortgage business with more recurring revenues which will rise to 70% from 50%.”