The securities settlement cycle in the US, Canada and Mexico will be reduced in May but market participants are starting to think about shorter settlement cycles globally and the eventuality of real-time delivery versus payment, or atomic settlement.

Adam Watson, global head of commercial product for custody at BNY Mellon, told Markets Media: “We are starting to push clients to be ready for compressions in settlement cycles across global markets, and eventually, for real-time atomic settlement. We are innovating and disrupting the ecosystem to be ready for whatever gets thrown at us.”

Gary Gensler, chair of the US Securities and Exchange Commission, said in a speech to the European Commission in January that “time is money, time is risk” so market participants have been calling for shorter settlement cycles. The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on Tuesday 28 May 2024. Canada and Mexico moving on the previous day, the U.S. Memorial Day holiday.

Gensler highlighted that T+1 is not new in the U.S. or around the globe. For example, the U.S. Treasuries market has been T+1 since 1986, and T+1 also exists in securities options markets, much of the derivatives markets, mutual funds, commercial paper, certificates of deposit, and money market funds settle on the same day as the transaction (T0). India completed moving its equity markets to T+1 in January 2023 and China moved to same-day securities delivery (within four hours after market close) for its A-shares securities.

He encouraged Europe to consider shortening its settlement cycle from T+2 to T+1, despite the challenges of having dozens of regulated markets and 14 clearinghouses. Gensler noted that some markets have already moved to settlement on the day of the transaction.

“This includes parts of U.S. money markets, parts of the Chinese equity markets, and most recently India has proposed doing so in some equity markets,” added Gensler. “Thus, looking forward, it raises the question as to whether further shortening beyond T+1 may be appropriate.”

T+1 preparations

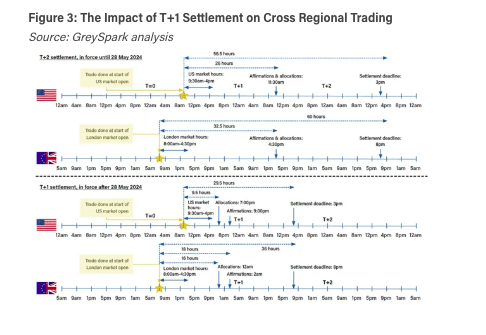

Watson said that if transactions are sent to a custodian on trade day before 6:30pm Eastern Standard Time, there is a high probability that it will settle the next day in a compressed settlement cycle for the US market. There is less probability for any transaction that is sent between 6:30pm EST and midnight, and a significantly diminished probability if sent the following day.

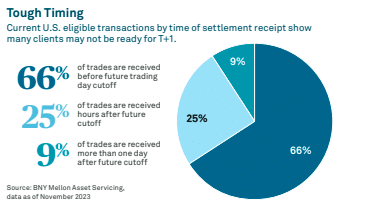

BNY Mellon said in a report in January that analysis of its U.S. custody base found that one third of trades settled by DTCC may face issues in preparation for the settlement cycle reduction to T+1 and about 25% of client transactions need to adjust their workflows to meet the new settlement cutoffs. Another 9% would need significant operating model changes by late May to meet the new deadlines.

Watson added that the firm sits on data that enables it to deliver key performance indicators that highlight potential inefficiencies which might hinder finality in a compressed settlement cycle, including DTCC affirmation rates, straight through processing, manual interventions, and settlement rates.

“Our challenge for the last two years has been to take our wealth of data and create alpha for our clients by giving them data in a contextualized, analytical manner,” he said. “Giving raw data to clients can be counterproductive. Ideally, we would create persona-driven, contextualized and actionable data and deliver it to clients, while being easily accessible for follow-up.”

For example, if a trade is going to fail and there is a corporate action event record date or an FX repatriation coming up, BNY Mellon can connect the data, create context and action to clients to resolve exceptions before they happen.

In August last year the US Depository Trust & Clearing Corporation opened its testing environment for T+1.

DTCC said that the industry needs to achieve the 90% affirmation rate by 9:00 PM ET on trade date to be ready for the US shift to T+1. In a report in January, Hitting 90% Affirmation by 9:00 PM ET on Trade Date: The Key to T+1 Success, DTCC encouraged market participants to automate their post-trade operations to meet the deadline.

“Affirmation rates show that the industry will largely get there for the May deadline,” Watson added. “I believe that clients that haven’t yet determined their affirmation model still have time.”

Impact on FX

The move to T+1 will also impact on how firms will approach foreign exchange execution and settlement due to the amount of overseas investment in US securities.

Gensler said: “Looking forward, I think it’s appropriate for regulators and market participants around the globe to start to consider the possibility of shortening the settlement cycle for currency trading from T+2.”

Chris Gothard, partner at BBH and responsible for the global markets group within the investor services division, which includes foreign exchange and securities lending, said the financial services group has seen a spectrum of reaction across asset managers, based on their global reach and operating model.

“It is becoming a challenge if managers do not have a US desk for execution or operations,” Gothard added.

As a result Gothard expects outsourcing to increase managers that do not have global infrastructure, as well as an accelerated trend towards using more automation.

He said: “A lot of our clients are looking to write a set of rules for a platform to execute FX on their behalf and manage pre and post-trade workflows.”

In addition, Gothard said some managers who cannot automate or outsource by May are looking at estimating their FX risks, which could be inaccurate and therefore, increase risk. He also warned that FX spreads could rise.

“We foresee an increase in FX trading at the end of the trading day, which has historically faced liquidity challenges, so there is a risk of increased spreads,” Gothard added.