The Securities Industry and Financial Markets Association Thursday called on the nation’s stock and options exchanges to allow a wide range of market participants be involved in the design and governance of the system that will take in all stock and options transaction information overnight, for federal regulators.

SIFMA, which represents securities firms, banks and asset managers, said oversight and governance of the organization that will develop and operate the consolidated audit trail of stock and options quotes, orders and trade details should include “adequate industry representation on an appropriate governance or advisory body.’’

The SEC in July charged the national securities exchanges and the Financial Industry Regulatory Authority with coming up with a plan for an automated system that would establish a consolidated audit trail that would make it practical to monitor and analyze trading activity in the nation’s equities and options markets. The trail is being created in the wake of the May 6, 2010 Flash Crash, so regulators can monitor and react to market disruptions immediately.

That group includes NYSE Euronext, Nasdaq OMX Group, BATS Global Markets, Direct Edge, the National Stock Exchange, the Boston Options Exchange, the International Securities Exchange, the Chicago Board Options Exchange, the Chicago Stock Exchange and FINRA, the independent regulator of brokers. These groups are regarded as the industry’s “self-regulatory organizations” or SRO’s, by the SEC.

“The intent of the SROs is to get it right. To create the most effective, efficient system that they can,’’ said Tom Price, managing director of operations and technology for SIFMA. “ What we’re saying is that our interests are aligned there. So we should be more constructive in those conversations.’’

SIFMA envisions inter-dealer brokers, agency brokers, retail brokers, institutional brokers, proprietary trading firms, small broker-dealers, firms with a floor presence and trade associations getting involved in design and governance of the initiative. Price said involvement of such industry participants would “absolutely” not slow down the current governing group’s intent to submit its plan for creating the audit trail system to the SEC by December.

The SEC had originally mandated that the plan be delivered by April 26.

SIFMA, in a white paper issued Thursday, did however call for more time to be devoted to building brokers’ part of the system, when development is underway.

The trade group said the “proposed timeline for publication of broker-dealer interface specifications does not leave sufficient time for broker-dealers to complete their internal systems build and testing” by the time their systems are supposed to be oeprative in December 2015.

SIFMA said three or four rounds of industry-wide testing will be needed, each taking up to six months..

SIFMA said its members could be part of the Advisory Board set up as part of the governance structure for the development of the trail.

The SEC declined comment on whether its approval was needed for any administrative structure that involves a wide number of industry firms, beyond the exchanges and FINRA.

The rule that requires the creation of the trail, however, leaves it to the SROs and FINRA to resolve governance issues.

FINRA, NYSE Euronext and Nasdaq OMX Group had no immediate comment.

SIFMA also said the system, which former SEC chairman Mary L. Schapiro in 2010 projected would cost $4 billion up front to build and $2 billion a year to operate, should be funded by a combination of new revenue sources and cost savings, rather than fees to the industry.

One revenue source could be sales of portions of the data collected by the system, which would be the first comprehensive, centralized daily repository of options and stock market details, SIFMA said.

And savings could come through elimination of duplicative rules and elimination of outdated systems, throughout the industry.

A new system could replace the Order Audit Trail System maintained by FINRA, the Electronic Blue Sheets kept by the SEC and the Consolidated Options Audit Trail System and Large Options Position Reporting system maintained by the options industry, SIFMA said.

Transaction Taxes Don’t Help

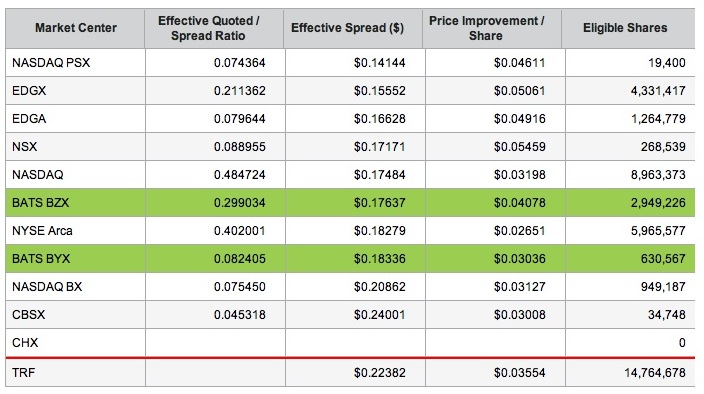

Transaction taxes result in more volatile markets, wider bid-ask spreads, greater market impact and a decrease in volume. Those are key findings of a recent study conducted jointly by the Bank of Canada and Rutgers University into the impact of a transaction tax administered by the State of New York until 1981.

Anna Pomeranets, an analyst with the Bank of Canada, and Dan Weaver, a professor at Rutgers, conducted the study, “Security Transaction Taxes and Market Quality,” in light of movement on both sides of the Atlantic to adopt trading taxes. Both European and U.S. politicians have pushed for trading taxes, arguing they would raise revenue and dampen speculative trading activity.

Opponents argue the tax would push up the cost of trading and shift volume to countries that don’t tax trades.

In Europe, 11 of the 27 European Union countries were recently given permission from the European Parliament to establish the taxes.

In the United States, Sen. Tom Harkin, D-Iowa, and Rep. Peter DeFazio, D-Ore., reintroduced bills recently they’d previously drawn up, proposing to impose such a tax.

Pomeranets and Weaver studied nine changes to New York State’s securities transaction tax between 1932 and 1981, when the tax was phased out. What they found was that increases in the tax were associated with a deterioration in market quality, including increased volatility, wider bid-ask spreads and lower volume.

(c) 2013 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/