BATS Global Markets has begun publishing rankings of 12 national stock exchanges by measures of “market quality.”

The operator of the BATS Z and Y exchanges is publishing daily rankings by how narrow the effective spreads are between the best bids and offers on orders executed across all exchanges.

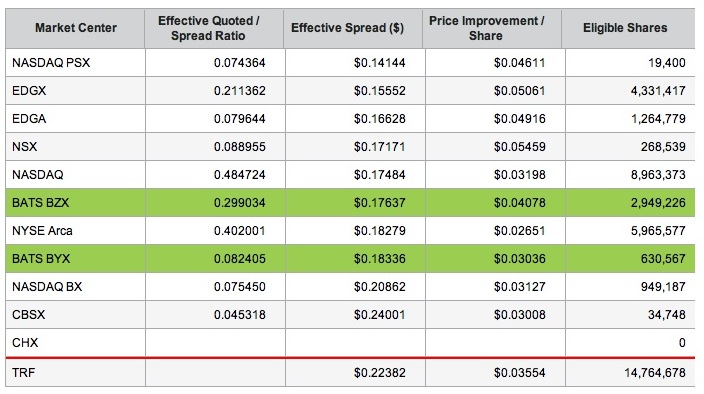

The spreads, which are published here, are drawn from consolidated tape data supplied by Securities Information Processors. The spreads are calculated against the best bid and offer nationwide at the millisecond an execution occurs.

The lowest effective spread indicates that investors are getting the greatest improvement in prices, both in buying and selling shares, in these rankings.

The exchanges are ranked by the effective spreads on stocks in the Standard & Poor’s 500 Index and the BATS 1000 Index. They are also ranked by the top 100 corporate issues and top 100 exchange-traded funds and similar products.

Exchanges gain standing in the rankings if they rank first, second or third in effective spread on a given stock.

Besides the broad rankings, exchanges are also ranked on individual stocks.

For instance, Nasdaq’s PSX exchange on Wednesday ranked first on the effective spread on shares in search engine leader Google, at 14.1 cents a share. BATS Z came in at 17.6 cents and BATS Y at 18.3 cents.

Rankings of exchanges by effective spreads on an individual stock can be produced here.

On S&P500 stocks, BATZ Z came in first and BATS Y last of the 13 exchanges. BATS Z had the lowest effective spread on 252 of the 500 issues, the second lowest on 99 and third lowesst on 63. BATS Y was unranked.

“We are please to provide these objective statistics free of charge to investors and our members to assist them in making informed decisions about where best to execute their trades,” said Chris Isaacson, chief operator officer of BATS Global Markets, in a prepared comment.

The company said it would have begun publishing the rankings, if its flagship Z exchange had not been the highest ranking exchange on effective spread at the outset.

“Yes. We would have published the market quality stats if we did not rank as favorably,” according to BATS senior vice president Randy Williams. “For the same reason we put our market share stats out there every month, whether the numbers are up or down.”

The company acknowledged that it hoped the rankings would influence decisions of existing and potential customers about where to execute their orders.

BATS also publishes rankings of itself and its rivals by share of market for shares of stock traded in U.S. markets, each day.