A little more than one year after its launch, OTC Markets Group has completed the myriad changes required to keep its venture-type exchange transparent and humming right along.

Introduced last spring as a marketplace for companies, OTCQB Venture Market, is designed to provide a transparent secondary trading market for small companies that don’t yet qualify for OTCQX, the operator’s top marketplace, or a stock exchange listing but are interested in providing enhanced disclosure to their investors.

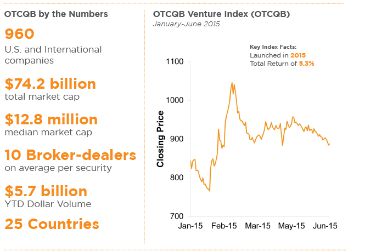

There are now 960 U.S. and international companies traded on OTCQB which have met OTC Market’s newly beefed up transparency requirements. Also, the operator has actually removed more than 2,000 companies from OTCQB for failing to meet these new standards either because they failed the bid price test, were delinquent in their financial filings or unwilling to provide background information on company management and shares outstanding or for another compliance reason. Those companies have been downgraded to our OTC Pink market.

On May 1, 2014, OTC Markets Group introduced standards and eligibility requirements for companies to trade on OTCQB, including a minimum one penny bid price test and an annual verification and management certification process. Companies already traded on OTCQB as of May 1, 2014, had a choice of complying with the new standards within 120 days after their fiscal year-end date, choosing to qualify for the OTCQX Best Market with high financial and disclosure standards and third-party sponsorship, or being downgraded to the OTC Pink Open Market. June 30, 2015, was the last 120 day deadline for companies that traded on OTCQB prior to the introduction of the new standards.

“The introduction of our OTCQB standards and eligibility requirements has truly transformed OTCQB into a better regulated, more transparent, world-leading public venture market for developing companies,” said R. Cromwell Coulson, president and chief executive of OTC Markets Group.

The 960 companies currently on OTCQB have a median market cap of $12.8 million, more than six times the size of companies on the TSX-Venture Exchange, according to OTC Markets data. Also, OTCQB companies have an average of 10 market makers per security, nearly twice the average number of market makers for companies on the London Stock Exchange’s AIM market.

As of July 1, 2015, 1,033 securities from 48 U.S. states and territories and 25 countries are traded on the OTCQB Venture Market, representing a combined market capitalization of approximately $74.2 billion.