FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

Of the 14 slides Henry Schwartz presented in the State of the Industry panel at last week’s Options Industry Conference, the final one – which showed SPX 0DTE option volume per minute in 2025 – caught the most buzz on social media.

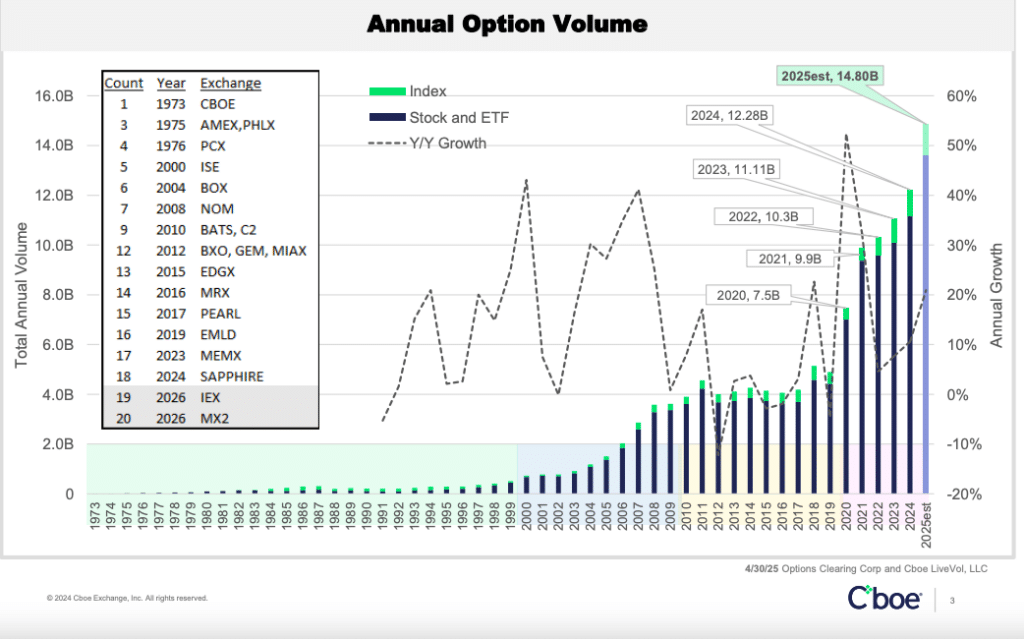

But here at Flash Friday we are obsessed with the past, so we were most interested in the first slide presented by the Vice President, Market Intelligence at Cboe Global Markets, which showed annual option trading volume from 1973.

One takeaway from the chart is that any old-timer who talks about the good ol’ days of the options market is either misremembering, or they were a broker who feasted on enormous bid-ask spreads in the pre-electronic and opaque markets of the 1970s, 80s and even well into the 90s.

Schwartz said the first approximately 25 years of the chart showed a sleepy options business with little or no growth and a monopolistic infrastructure of no more than four exchanges.

So just what was the US options business like through Watergate, the disco era, Reagan/Thatcher political conservatism, the Beanie Baby craze, and the lead-up to the Internet revolution?

We found some glimpses.

The New York Times ran an article entitled ‘The Crisis of Confidence in Options’ on the front page of its April 24, 1988 business section. This was just six months after the Black Monday stock market crash, so you’d think an article about options wouldn’t be sunny, and indeed it was dour and befitting of a market stuck in the doldrums.

“Much of the confidence that the options industry painstakingly built up over the past 15 years has been lost,” the article stated. “Small investors, the bread-and-butter of the industry, are staying away. Many are lining up instead in court or before arbitrators, accusing brokers of never fully explaining the dangers of these sophisticated financial instruments.”

Also from the 1988 article: ”Options are a dirty word right now,” added John R. Power, a market maker for the Standard & Poor’s 100-stock index options contract. ”We need something to restore the confidence of people who feel the whole thing is just a crap game.”

The Times article was prescient in foreboding tough times in the options market – as Schwartz’s slide shows, trading volume increased from 1984 until 1987, but then declined after Black Monday and 1987 volumes weren’t reached again until 1997.

Another interesting find was a Times article from October 1990, ‘Two Year Options Off to Slow Start’. This article reveals that a light-bulb moment for increasing volume was … wait for it … extending maturities.

“Suffering from a decline in trading activity, the nation’s options markets have begun trading a new product – options that do not expire for almost two years,” the article stated. “Traditional stock options now go no farther than eight months, a fact that brokers think has kept some investors from using them.”

Presumably attention spans were longer in 1990, because that approach is the opposite from the shorter-dated approach taken 30 years later, which has resulted in an explosion in trading volumes of same-day options.

One further stark contrast to today lies in an academic description of what options were all about back then. Where recent growth has been largely driven by retail profit seekers, in the 1970s and 1980s the primary purpose of options was as a hedging tool for banks, utilized to reduce rather than increase risk.

Commodities, Futures, Options and Swaps, 1970-92 provides insight as to why many people viewed options trading as the equivalent of a casino: “The public perception of the denizens of the pits as wild speculators, whose antics easily spill over into and damage the sober process of capital accumulation elsewhere in the economy, is remarkably stubborn, and apt to resurface when anything at all goes wrong.”

So the options market was a bit of a backwater from 1973 through the mid 1990s, but today it’s roaring rapids. The good old days weren’t all that good.