Volatility caused by the Covid-19 pandemic has led to record data usage according to provider Refinitiv with a 50% increase in mobile usage as staff are forced to work remotely.

Andrea Remyn Stone, chief customer proposition officer at Refinitiv, told Markets Media: “We have seen record data usage during the pandemic, with some interesting trends in the ‘data on the data’.”

She continued that, for example, there has been an eightfold increase in demand for mortgage data. There has also been more demand for debt data such as leveraged loans, corporate bonds and credit profiles.

“There has been a 20% increase in web usage and 50% on mobile usage,” Remyn Stone added. “Daily messages across our platform have grown to 186 billion a day, compared to 80 billion after the Brexit vote, and between 40 to 50 billion on a normal day and we have not had any outages.”

As the volumes of data usage usage has risen, customers have needed help in making sense of the information deluge. For example, Refinitiv has overlaid economic data with news, markets data and physical data, such as shipping, in a Covid app. Users can drill down by country, sectors and companies to find opportunities, as well as assess risks.

The volume of digital queries has also increased by 60%. Remyn Stone explained that the buy side has been using REDI and AlphaDesk to trade remotely and sell side compliance issues, such as recording communications, are being solved.

“There is a new generation of users who are digitally savvy and a new working environment is emerging,” said Remyn Stone. “This crisis may be seen as the beginning of the end for the need for large workforces staffing a physical trading floor.”

In addition to wanting more data, there have been unprecedented demands such as central banks wanting to launch money market desks, which Refinitiv completed in three hours. “We have had to move fast to help customers respond to the crisis,” said Remyn Stone.

ESG data

Remyn Stone added that demand for environmental, social and governance data has not slowed down during the pandemic and it has become a “must-have.”

#ESG in #AssetManagement encompasses #CarbonEmissions to #DiversityInclusion. Can you include all these factors in the #SearchForAlpha? https://t.co/LqDJ3s97cj @Refinitiv pic.twitter.com/yP3BRbOBaO

— Lipper Alpha Insight – Refinitiv (@Lipper_Alpha) April 23, 2020

ESG data is one of Refinitiv’s most important strategic priorities, especially for private companies where the information is harder to find.

“We use 160 fields across ten different themes to compile a company’s ESG score and Lipper plans to start giving funds a score later this summer,” she added. “We always provide transparency, opening up the black box so users can see how the ESG score is calculated.”

Lipper provides fund performance data and tools for fund research.

Open platforms

Remyn Stone joined Refinitiv in London in February this year to lead proposition management and product and content development, reporting to chief executive David Craig. Her previous roles include chief strategy officer at Dealogic and global head of strategy and corporate development at Bloomberg.

At Refinitiv she will work with customers to develop offerings in open platform technology collaboration.

“An open platform and framework is essential in institutional financial services so users can move seamlessly between mobile, web and cloud,” said Remyn Stone. “The platform needs to open to third party apps as customers want the same flexibility as they get with Spotify.”

She continued that Refinitiv needs to focus on on delivering data in solutions that are mobile-first and API-first within a consistent framework.

Hear from @googlecloud and @Refinitiv to learn how to model Refinitiv’s Tick History dataset in Google BigQuery for a smarter workflow during Query-ready: Tick History data at your fingertips on April 20. Register for now https://t.co/k8vxa0dmhc #SmarterTrading #TrustedData pic.twitter.com/85DRCXzfyh

— Refinitiv Developers (@Developers) April 7, 2020

In addition, there are more than 35,000 external developers around the world working with Refinitiv data and they need the data taxonomy to be open. “We have a proactive program to engage with more developers and create an ecosystem,” she said.

Global Spend

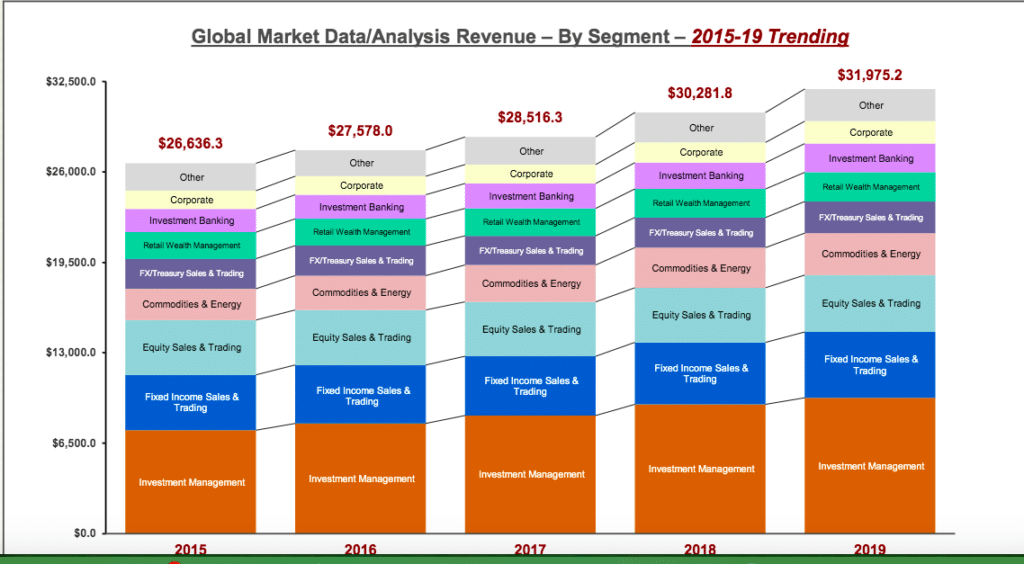

Global spend on financial market data/analysis was $31.9bn (€30bn), an increase of 5.6% from 2018 according to the Burton-Taylor annual study, Financial Market Data/Analysis Global Share & Segment Sizing 2020.

“In a world where the influence of Big Data leads capital markets firms to be relentless in their pursuit of correlation and solutions, firms are increasing their budgets for data acquisition and analytics to develop solutions solutions from that data,” added the study.

Investment management is the biggest spender at $9.7bn, nearly one third of the total.

The report noted that the shift of flows from active to passive investment has affected market data usage as spending on traditional equity and fixed income segments has fallen.

However Burton-Taylor also warned that the threats of market data fees and ‘speed bumps’ muzzle some of the opportunities for providers.

In addition, the London Stock Exchange Group has made an offer to buy Refintiv and the transaction is being reviewed by regulators.

“The promise of great business synergies keeps the market data providers opportunistic, as seen by LSEG’s acquisition of Refinitiv,” said the report. “Burton-Taylor sees similar activity as likely in the next 18 months.”