An amendment to the financial reform bill that many think would restrict off-board trading has drawn opposition from a securities industry trade association. The Security Traders Association opposes the amendment which, it says, would push orders away from dark pools and brokerage internalization.

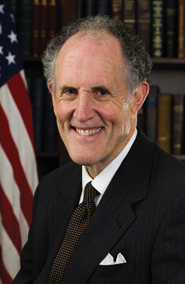

Sen. Ted Kaufman, D-Del., looking to increase transparency in equities markets, authored an amendment that would, in its own language, "minimize conditions under which quotations and orders are hidden or selectively disseminated." On May 5, Kaufman filed amendment S.AMDT. 3845 to the financial regulatory reform legislation, or S. 3217, the Restoring American Financial Stability Act of 2010.

The amendment would modify Section 11A of the Securities Exchange Act of 1934, the section that instructs the Securities and Exchange Commission to facilitate the development of a National Market System.

The STA believes that forcing more volume to the displayed markets would increase trading costs for all investors, according to a letter it sent to Congress.

"Sen. Kaufman’s amendment would have the effect of directing the SEC to restrict markets that currently provide liquidity to long-term investors and price trades with quote and trade information obtained through their linkages with other markets," the STA wrote. "The impact on investors will be predictable: Execution costs will go up as liquidity providers pass the greater costs of doing business on to their customers."

Kaufman’s office, though, wrote in an email to Traders Magazine that encouraging the SEC to limit or prohibit dark liquidity–and, by extension, dark pools–is not the amendment’s intent. Instead, its focus is to direct the SEC and the Commodity Futures Trading Commission to formally add the concept of "promoting transparency" to all markets to the list of principles that steer their regulatory decision-making processes.

"Somewhat surprisingly, Congress has never explicitly directed these agencies to include transparency as a factor to weigh in the balance of the regulatory rule-making process," Kaufman said. "Without transparency, there is little hope for effective regulation of our financial markets. This amendment would codify the promotion of ‘transparency of our markets’ as one of the guiding principles behind regulations decided by the SEC and CFTC."

As far as transparency goes, Kaufman’s heart is in the right place, said Brett Mock, a senior sales trader at BTIG and the current STA chairman. But the amendment, and specifically minimizing dark liquidity, is the wrong way to go about promoting it, Mock added.

Through the amendment, Kaufman is trying to create a central limit order book, Mock said. But market participants have always resisted such a development, he added.

"Forcing people to display their orders is not going to happen; you’ve got 200 years of stock market history to tell you that," Mock said. "The people won’t go for it. If I have a million shares to buy, I’m not going to post that order in the marketplace, because that means I’m going to telegraph to everyone what my intentions are."

Attorneys at the Washington, D.C. law firm Williams & Jensen, which lobbies for the STA, took a closer look at the amendment’s language. They concluded that the amendment shows Congressional intent for the SEC to "require as much disclosure as is possible of currently undisclosed quote and order information." Furthermore, the law firm wrote, it would have a "substantial" impact on dark pools, indications of interest, internalization and discussions currently underway, such as the "trade at" concept.

(c) 2010 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/