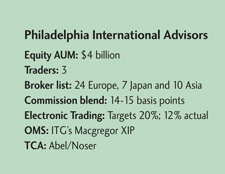

Independent analysis and market intelligence are critical for Hugo Molina, who runs the desk and trades international equities for Philadelphia International Advisors.

That’s why he has a growing list of more than two dozen-research and execution-only counterparties around the world. He prefers to trade directly with them and doesn’t use commission sharing arrangements (CSAs). So recently he found himself more frequently using niche brokers. These brokers–from Japan to South Africa–are skilled at making specialized liquidity calls and know "where the bodies are buried," Molina says. Those skills can add basis points to performance.

"We are free to deal wherever we want," says Molina, who took over the desk in 2005.

"The global (bulge bracket) brokers also do a great job, but you need to have niche brokers all over the world," he says.

The 37-year-old Molina, still uses bulge bracket firms, but now he employs niche brokerages and execution-only firms more these days.

When he began at PIA in 2005, he estimates he used bulge brackets for 70 percent of his executions. Now it’s about a 50/50 split. That’s a measure of the independence and liquidity that the desk values.

Owing to that preference, Molina sometimes has trouble keeping limits on his niche broker list.

"I’m finding it hard to keep the number down because there has been such a huge migration to these brokers from the bulge brackets," Molina says.

The migration is happening because there are so many niche brokers, each possibly offering some unique insight into a corner of a market. It’s the same as when algos went mainstream, he adds. He notes that even today his firm uses almost every algo.

So he uses the niche brokers even though he concedes that using them sometimes can be "difficult to justify to our portfolio managers."

Nevertheless, he says results are what matter. And many of his portfolio managers change their views of niche brokers when they see "great execution prices and the ability to pick up blocks."

Another example of this independence is its CSA policy. PIA won’t use them. Molina would rather cultivate a relationship.

He says the policy isn’t costly. Molina thinks the firm’s blended commission rate of 12 basis points is on par with other firms. In competing, Molina also closely watches the condition of the trader. The nature of international trading requires that he and his staff work odd hours. That leads to "a high rate of trader burnout."

Molina, who is also hooked into the office at home, also faces pressures. He commutes from Hoboken, N. J. He is almost constantly on call.

Independence has its costs.

(c) 2009 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/