Equities traders are becoming increasingly responsible for sifting through huge volumes of information and data to find stocks capable of generating above-average returns. And they are spending more time working with portfolio managers to reach that goal.

“The way a trader is going to add value in the next 10 years is very different from the value proposition in the prior 10,” said David Brooks, head of global equity trading at the Boston Company Asset Management. Brooks joined the firm 15 years ago as a senior equity trader.

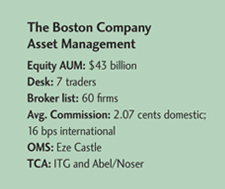

Now he manages a desk with seven equity traders, including himself. Three are focused on domestic equities, three handle international equities, and one is a junior trader and electronic trading specialist.

Technology is critical to supporting the changing role of the trader, Brooks says.

One key capability is what he calls “alpha profiling,” which “allows for a better alignment between the execution strategy and the demonstrated pattern of alpha occurrence in a given investment strategy,” Brooks said.

Alpha profiling involves comparing two sets of data for potential above-average returns.

The first set highlights the trading decisions made by a particular portfolio manager over the last one to two years. The data would typically be provided by the firm’s supplier of transaction cost-analysis services; they look at execution performance over the time frame from when a trade hits the trading desk until it is completed, Brooks said.

The second set of data is a longer-term alpha profile for the trades executed. The comparison might reveal that alpha for this particular manager typically happens before the traders get the order, for instance, he said.

By understanding a given alpha profile for a given portfolio manager or analyst, the trader can adjust the execution strategy to capture expected alpha, said Brooks.

“A portfolio manager or analyst may think he or she has certain triggers in their process that are the catalyst to a trade,” he said. “Alpha profiling allows us to see how you’re actually behaving and reconcile that with how you say you behave and how you think you behave, which offers more insight into when and how this alpha really occurs. If there are longer-term consistencies to that profile, you can take advantage of that in a systematic way.”

For instance, if a portfolio manager tends to miss alpha opportunities by waiting for confirmation from an earnings release before executing any portion of a given trade, then the portfolio manager should execute a portion of the overall trade ahead of the report. Then, get confirmation of the expected result from the release-and wait to complete the trade until a few days later. That’s when the stock price often reverts to an earlier price, after investors’ initial reaction to the news, Brooks contends.

To support this priority, the Boston Company recently deployed Portware’s Alpha Vision product, which the vendor developed in collaboration with the Boston Company. “Portware’s Alpha Vision has done a good job bridging the gap between the analytics that can lead us to good conclusions around these alpha profiles and automated strategies to take advantage of these profiles,” Brooks said. The product “allows us in an algorithmic fashion to access the market with tactics that are tuned to specific alpha profiles for a given strategy.”

But more technology is needed to help filter through all the data available to a trader, including social media, Brooks said. The Street historically was a primary source for the buyside of information, data and rumors and they still are important, he said.

“But they aren’t necessarily the gospel, and there are other sources that have a more specific level of expertise that we need to be accessing, whether it’s industry specific blogs or social media, such as what you are hearing in Twitter ahead of an impactful economic release overnight,” he said.

“It’s understanding where these sources of data exist” that matters, he said, and “figuring out a way to access that information and data.”

The biggest challenge? Eliminating “noise and irrelevance” to get to an “accurate mosaic” of opportunities to present portfolio managers.

Developing a solution for this problem will be a significant focus for the Boston Company over the next two to four years, Brooks said. Visualization technologies such as Tibco’s Spotfire are potential tools to help, he said.

Spotfire is a visualization tool that enables a trading desk to process large amounts of data and view it in an easily digestible manner, said Brooks. The data might include an analysis of the routing life cycle of every order, or alpha profiling over several years of trading, he said.

In the past, a good trader would be expected to have a deep awareness of price discovery, liquidity discovery, assessing supply and demand at a security-specific level, and maybe to understand correlation with other names in a group and industry drivers, Brooks said. “Now we need to have an awareness and at least a basic level of knowledge about global macroeconomic issues, geopolitical developments and market structure developments.”

The Boston Company’s trading philosophy involves collaboration with both portfolio managers and brokers on the Street-and mitigating trading conflicts.

The collaboration boils down to understanding what is driving the portfolio managers’ decisions, their alpha expectations, and staying aligned with those motivations, he said. “I do want my traders to integrate their own judgment and experience into the trading process, but in alignment with the portfolio manager’s expectations.”

Mitigating conflicts involves implementing trading decisions at the lowest possible cost to clients both in terms of explicit and implicit costs, Brooks said.

Some of the potential conflicts include paying for research. Traditionally, the only way to compensate brokers for research was to use them for execution services, but commission-sharing arrangements have allowed the firm to decouple the two. That allows the firm to fulfill its obligations for the research it uses and seek best execution at the same time, said Brooks.

In his role, Brooks is also responsible for a two-person commission management team and a seven-person portfolio implementation group responsible for tasks such as building out orders in the order management system based on a portfolio manager’s instructions, cash management and guideline compliance.

Two of the three domestic equity traders, including Brooks, are focused on small- and mid-cap stocks. Given the group’s focus, “we need to be in all relevant pools of liquidity, and that includes block crossing networks, alternative trading systems, broker dark pools, retail pools of liquidity,” he said. The firm is working more closely with sellside equity capital markets desks to access liquidity from issuers and sponsors including private equity and venture capital, he said.