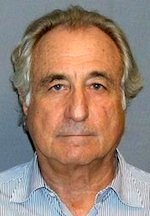

Liquidating Bernard L. Madoff’s defunct brokerage has cost $774.8 million, including lawyers’ and consultants’ fees and expenses of $737.1 million, the trustee for the firm said in a report.

Irving H. Picard, who has been liquidating the firm since Madoff’s December 2008 arrest, has paid customers about $4.6 billion, out of as much as $20 billion he says they lost in the Ponzi scheme. Another $802 million went to customers from the Securities Investor Protection Corp., which spent almost as much picking up the lawyers’ and consultants’ bills, according to the report filed yesterday in federal court in Manhattan.

Picard, a bankruptcy lawyer whose firm has billed SIPC for $440 million, files twice-yearly reports on his progress. Most of the money he has raised in more than four years has come from settlements with investors whom he accused of profiting from the fraud.

He has been less successful in his pursuit of banks such as JPMorgan Chase & Co., UBS AG, HSBC Holdings Plc and UniCredit SpA. Picard is appealing judges’ rulings that barred him from demanding a total of about $30 billion from those banks on behalf of Madoff customers.

The Madoff estate currently holds $4.4 billion of Treasury securities and $173.7 million in cash, Picard said in the report. Madoff is serving a 150-year prison sentence after pleading guilty to running the biggest Ponzi scheme in U.S. history.