New leadership often brings new approaches. Teachers Retirement System of Texas took a fresh look at trading three years ago, when T. Britton "Britt" Harris, a 25-year veteran, was hired as chief investment officer. Harris is the former chief executive of Bridgewater Associates and, prior to that, the chief investment officer at Verizon Investment Management. At TRS, he changed the structure and process of trading, said TRS senior director Claudia Williams, who oversees trading.

"Before Britt arrived, trading was not incentivized to change the status quo," Williams said. "After Britt arrived, every process, technology and method was reviewed and best practices implemented. We are continually encouraged to look at our processes to improve performance, reduce costs and improve efficiencies."

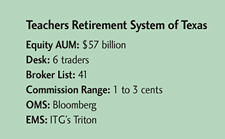

TRS is the eighth-largest public pension system in the U.S., with $57 billion in equities. What makes the pension fund’s charge daunting is that it is responsible for the retirement benefits of 1.27 million beneficiaries–or one of every 20 Texans.

Harris believes traders should add value to the entire investment process–not just handle and run with an order, but use the information they are privy to and help in the investment process.

"As full partners in the investment process, traders monitor active positions real-time, and identify hidden risks and opportunities to add value to the strategy," Williams said. Traders, given their direct access to the markets, more actively assist portfolio managers by providing market color, as well as give updates on block trading flow, sudden credit default swap movements and other rapid market developments, she added. Technical analysis is employed on the trading desk, too.

The six-person desk is led by Bernie Bozzelli. The desk trades primarily on an agency basis, with about 30 percent of its trading volume done electronically.

However, Bozzelli expects its electronic trading to increase because algorithmic trading offers more avenues for finding liquidity in fragmented markets.

The fund has gotten creative with its outside managers and held a best-execution meeting with them in April. TRS met with Morgan Stanley Investment Management, J.P. Morgan Asset Management, Neuberger Berman and BlackRock. The firms traded ideas and best-practices tips. TRS gained insight on topics such as market structure, dark pool usage and the effects of high-frequency trading.

According to Williams, these discussions sparked further conversations on trade-cost analysis–not only how to measure costs but also how to lessen them. As a result, TRS pared down its broker list to 41 firms. It once was a lofty 150 brokerages.

Assessing the strategy, Williams said: "It’s better to have a few relationships that are a mile deep and an inch wide than many that are an inch deep and a mile wide."

(c) 2010 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/