Sales traders instinctively know if they’re in the right seat, if they’re comfortable where they work. For Melissa “Missy” Heathcote, a migration from the sellside to the buyside might sound like a familiar story, but her move included a two-year stint in real estate in between. Those two years were long enough for the former Alex. Brown & Sons sales trader to discover that showing houses isn’t the same as shopping a large block—nor as rewarding.

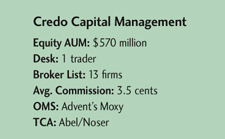

“I didn’t realize I missed the business as much as I did until I came back,” said Heathcote, who joined Credo Capital Management in 2007. Her 15 years on the sellside. included 10 years at Alex. Brown—five as a trading assistant under head trader Mickey Misera and five as a sales trader. She also spent four years at Wachovia Securities as a liaison to the trading desk for high-net-worth brokers from 2000 to 2004. She later took a similar role at Deutsche Bank for a year before her foray into real estate.

The buyside was new for Heathcote, so that was one challenge. Another hurdle was understanding Reg NMS, which had just been put into effect when she returned. The good news was, she got the hang of both in short order. After all, trading hadn’t changed, only the tools. In fact, she liked the increased control electronic trading offered. “When I left, you still gave an order to a market maker and you had the floor,” Heathcote said.

At growth manager Credo Capital, 75 percent of the firm’s $570 million in equities it manages is in mid-cap stocks, with the balance in small caps. Its turnover is about 80 percent annually. Heathcote executes about 10 percent of the desk’s flow via algos and crossing networks. She’d like to do more electronic trading, but she doesn’t because of the liquidity characteristics of her firm’s holdings and the need to pay bills.

Heathcote offers a few observations about trading and her brokers. For one, she thinks the industry has replaced too many experienced veteran traders with a new crop that lacks the same market feel for trading blocks. Heathcote admits blocks aren’t a big part of her business, given Credo’s level of assets. But this new group of traders is too reliant on technology, she said.

She sees this when she gives an order to a sales trader, whose first reaction is to ask what percentage of the trading volume she would like to be in the machine. Heathcote wants her orders worked so she can take advantage of price swings. Dependence upon technology has come at the expense of trader know-how, she said. Her trade-cost analysis figures tell her which firms work orders to get a better average price, she added.

She also doesn’t understand why a firm would cannibalize its own business and offer an electronic product in exchange for its high-touch flow. But firms do it all the time. “I could see if I was asking for it, but I’m not,” Heathcote said. “You’re only taking money out of your sales trader’s pocket and putting it into someone else’s.”

(c) 2012 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com