Tools work, but people are better. That sums up the philosophy of Ryan Larson, head equity trader of Voyageur Asset Management. He believes human judgment in trading has become more important as markets have become more electronic and fragmented. Larson says traders shouldn’t overly rely on electronic trading tools. Why? They open up opportunities for gaming.

Consequently, in the race to achieve better executions through electronics, some tool-addicted traders fail when they give away strategies. It’s like driving with your high beams on, says Larson, who trades both growth and value stocks. Larson is a passionate trading lifer. He went to work for Voyageur eight years ago, after graduating from Creighton University. He says successful trading remains simple: Find good information fast, obtain a quick execution and also have “the ability to operate without the headlights on.”

That means, Larson explains, knowing when and how to use or not use an electronic tool. Larson says about half of his desk’s trades are done by a human being. And he stresses that every trade has some human element, even if it’s just someone choosing from among various algorithms.

He adds that algos can have historical and mathematical data, but that tools also have a weakness: “They are not able to build in a gut decision. What we’re doing is trading from our conviction, and sometimes from a gut instinct,” he says.

The gut instinct in using an electronic tool, he adds, is finding a way to use one inconspicuously. All trades must be completed in such a way that no one sees the “headlights” of a move, Larson says.

“Information is kept close to our vest,” he says. As an alpha preserver, Larson notes, the desk should leave little or no trail before and after: “Our greatest value added is when it appears that we add no value at all.” Yet algos and ECNs can actually sometimes hinder the best-execution process, he cautions.

“Let’s say a print went up and the algorithms look at historical data, and it starts to spin its wheels because it just realizes it missed volume, and it ultimately drives up or down the price of a stock,” Larson says. “That’s where we say that sometimes the human element needs to be exerted, to have the wherewithal to pull that trade out of the algorithm.”

It takes human judgment to know how to be proactive before there is news in a stock or to have patience sometimes when a news announcement is already made. Reacting to events requires the use of “human capital.” That is something no electronic tool can supply, Larson says.

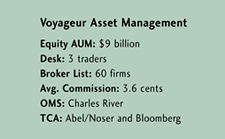

Yet Larson, whose parent firm is Minneapolis-based RBC Dain Rauscher Corp., likes these electronic marvels. Indeed, his desk has access to almost every algo, dark aggregator and crossing network.

Still, a good gut is necessary because the buyside now has more control over the trading process. “With greater control comes more responsibility,” he says. And that means turning off the high beams.

(c) 2009 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/