Knight Capital Group’s hire in June of 15 exchange-traded fund traders and salespeople from Newedge USA, the U.S. arm of the big French derivatives and commodities brokerage, highlights the growing interest from traditional asset managers in the products. The giant institutional brokerage and market maker has seen a tidal wave of volume and liquidity in the ETF space. But Knight has also taken note of the rise of a new ETF customer base: traditional asset managers.

"As mutual fund assets transfer into lower expense ratio exchange-traded funds, we’re witnessing a growing trend of asset managers listing ETFs," said Reginald Browne, co-head of the ETF team at Knight Equity Markets.

The increased ETF investment adds up to new trading customers for Knight, Browne said. And asset managers’ growing interest in listing ETFs should be a lasting trend in the mutual fund industry, he added.

"If you compare the ETF industry versus the mutual fund industry, there are some 8,000 mutual funds with about $10 trillion in them–half of which is cash money markets," he said. "I think you’ll see more of a trend of those 8,000 into the ETF format."

Traditional asset managers’ ETF use has grown steadily over the past few years, industry execs say. The money managers have mostly used them for quick exposure to the market.

"We’re seeing an increase in [ETF] usage among more traditional asset managers, such as long-onlys and registered investment advisers–and it’s been steady over time," said Matt Duffy, director of U.S. ETF trading at Citi. "They use them for core holdings, beta exposure, alpha generation, various hedging strategies. Whether you’re bottom-up or top-down, they can be very useful."

For fund managers, ETFs are also a good tool for forming sector rotation, Duffy said. They allow for immediate exposure, to help managers during the transitions.

Since their creation in the early 1990s, ETFs have long been popular with retail customers because of their tax advantages over mutual funds. Hedge funds and global macro funds led the institutional charge into the space. In recent years, traditional money managers, such as mutual funds, have begun to join them in larger numbers, trading execs say.

ETFs are similar to index-based mutual funds, but trade on exchanges like stocks. The reasons ETFs have attracted long-only managers are the same ones that drew in early adopters: their structure. They’re index-based, cheap to trade and allow for easy diversification. And highly liquid ETFs offer the flexibility to get in and out of big positions during times of uncertainty.

For traditional asset managers, ETFs help them manage their cash flows. Instead of trading out of securities as money flows into a mutual fund, ETFs that follow the underlying portfolio give managers easy exposure.

As an example, a traditional asset manager with money for a new account may want to be invested right away. Simultaneously, he also wants to wait to research some stocks. While doing research, he can invest in a value ETF and get the exposure until he has the stocks he wants to buy.

"ETFs generally provide market participants with very low barriers to a broad spectrum of asset classes and levels of diversification," Duffy said.

ETF traded volume spiked last September and has remained high. Greater long-only participation added to the rise.

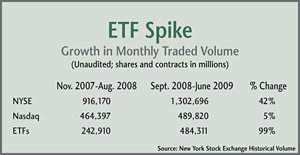

But it was market volatility that drove the real surge. Since last Sept. 15, rising volatility has increased volumes everywhere. Yet ETF volume growth far outpaced that of Nasdaq and listed stocks, according to New York Stock Exchange numbers.

From last September through this June, ETF average monthly consolidated volume doubled compared to the previous 10 months–November 2007 through August 2008–according to NYSE data. From September through June, ETF consolidated volume averaged more than 48 billion shares a month. That compares to more than 24.3 billion a month on average in the previous 10 months.

Volatility’s Effect

Over the same 10-month periods, the average monthly NYSE volume grew 42 percent from the preceding 10 months. And average monthly Nasdaq volumes grew a relatively paltry 5.5 percent from the preceding 10 months, according to NYSE figures.

Over this most recent 10-month stretch, volatility, as measured on the Chicago Board Options Exchange’s Volatility Index–or VIX–climbed to record heights. Though the volatility had dropped considerably by June, it still measured 29. Conditions are generally considered volatile when the VIX tops 25.

That volatility has goosed ETF trading, because a wide variety of traders use ETFs to hedge and gain exposure during turbulent times. As volatility increases, correlations across all equities tend to increase, whether from one stock to another or one sector to another, Duffy said.

For example, the prices of financial stocks or energy stocks may move in tandem up or down. And for long-onlys, these correlations lead to more ETF trading to get exposure. During a period of wild price swings, they might use a technology sector ETF rather than choosing Dell for their portfolio.

Ultimately, more institutional participants can only be good for ETF volumes, said Ira Walker, a senior portfolio and wealth manager at UBS who invests solely in ETFs. This is because more ETF participation means greater ETF volume.

"It’s like any other stock," Walker said. "If a stock is thinly traded, we would prefer to have more volume so we can trade bigger size."

(c) 2009 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/