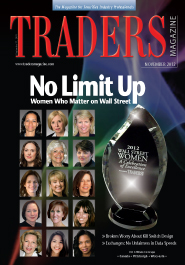

Investment banks, trading firms and exchanges have been dominated by men. But for the second year in a row, Traders Magazine is showing that this need not be so. Indeed, women are having increasing impact, as the “2012 Wall Street Women: A Celebration of Excellence” program shows.

There is, for instance, Sheri Kaiserman, head of equities at Wedbush Securities. She leads more than 130 professionals in equity research, sales and trading. She has increased revenue twentyfold in areas she’s responsible for. She has made Wedbush famous for its Best Ideas List, which focuses on a list of 10 to 20 names that are worth attention. And she’s not afraid to call a shot, like Apple hitting $800 a share because iPads are just starting to arrive in China.

Smart shots can also be safe shots, which is what the history of women on Wall Street has, so far, largely been about. About half a decade ago, women entered the world of finance in research, sales and wealth management, Dr. Melissa S. Fisher notes. The New York University scholar is the author of a study released this year, also titled “Wall Street Women.”

Experts, Fisher says, are now making a “business case” for women’s evenhandedness and leadership in global finance. In her words, women have “unique, biological abilities to be wary of risk” that enable them to see their way and their firms’ way through economic crises. For women, there is no upward limit to what they can accomplish in the post-crisis era of Wall Street.

But being “wary of risk” doesn’t mean hunkering down. Entrepreneur of the Year award winner Holly Stark says she, at times, has had to be “oblivious to risk” to work her way up from a spot as a marketing assistant at Oppenheimer Capital to head trader at Dillon Read Capital. She now is building up Efficient Frontiers, a capital markets consultancy that calls on financial analysts, academics and former CEOs on a project basis to help companies design trading platforms and run trading desks, among other tasks.

This year’s award winners were selected from a field of more than 70 nominees, and judging was done by an independent advisory board comprised of seven female leaders from the securities industry.

In addition to 15 individual Wall Street Women awards, Traders Magazine also recognizes Goldman Sachs with its Diversity Achievement award, which honors the firm for its pursuit of moving women into its executive ranks.

M. Michele Burns chairs the audit committee of the firm’s board of directors, for instance. Debora L. Spar, president of Barnard College, is also on the board. Edith W. Cooper has been global head of Human Capital Management since 2008.

But it is the firm’s work throughout its ranks that earns it this year’s recognition. Goldman Sachs a wide range of training programs, for employees as well as up-and-coming managers and executives. These include Women Leadership Camps and Summits, MBA and Undergraduate Camps for Black, Hispanic and Native American Studies, and its Women Partner Advocacy Group.

A five-year initiative known as 10,000 Women, in addition, tries to bring business and management education to female entrepreneurs in developing and emerging markets.

An event to mark the accomplishments of these and all Wall Street Women will be inn the near future at the Waldorf-Astoria Hotel in New York. It was originally slated to be held Nov. 7 but was delayed due to Superstorm Sandy.

The keynote will be delivered by Stephanie Ruhle, herself a woman who has made an impact on Wall Street. An anchor for Bloomberg Television’s Market Makers from 10 a.m. to noon on trading days, Ruhle knows what makes trading tick. Prior to joining Bloomberg, Ruhle served as a managing director in global markets senior relationship management at Deutsche Bank.

She also plays an active role in women’s leadership and business leader development, having founded the Corporate Investment Bank Women’s Network and co-chaired the “Women on Wall Street” steering committee.

Here are this year’s selection of women making a difference on Wall Street with their leadership and performance.

Diversity Achievement Award

This award is presented to the firm that demonstrates focused efforts and quantitative and qualitative results in the area of achieving gender diversity in the executive ranks.

Goldman Sachs Group

Excellence in Leadership

Presented to a woman who demonstrates exemplary leadership and exceptional performance throughout her career. This individual, selected by the advisory committee, is such an outstanding professional that she qualifies for multiple award categories and is considered to be the standard-bearer for women in the financial community.

Sheri Kaiserman, Managing Director and Head of Equities, Wedbush Securities

Industry Trailblazers

This award is presented to high-performing Wall Street women who broke the gender barrier when it came to trading and advancing up the career ladder on the buyside and sellside. These trailblazers forged the opportunity for other women to become traders, managers and successful financial professionals.

Janice McFadden, Managing Director, Goldman Sachs

Donna Sims Wilson, Executive Vice President, Castle Oak Securities LP

Lifetime Achievement

Given to women with more than two decades of senior management experience on Wall Street, who have achieved the pinnacles of success and acted as role models to younger generations of women and men.

Peggy Bowie, Senior Trader, Manulife Asset Management

Nancy D. McLaughlin, Managing Director, Sales and Business Development, ConvergEx Group

Entrepreneur of the Year

Given to women who have pursued, and succeeded on, an entrepreneurial path in the financial markets.

Dana Dakin, Founder, Dakin Partners LLC

Holly A. Stark, Managing Member, Efficient Frontiers LLC

Mentors of the Year

Given to women who have shown dedication to the cause of mentoring other women in financial services.

Renee DeGagne, Managing Director, RBC Capital Markets LLC

Amy Ellis-Simon, Global Head of Specialist Sales and Americas Head of Corporate Access, Bank of America Merrill Lynch

Charitable Works Award

For women who devote considerable resources and energy to philanthropic causes.

Cathy Wilson Rosen, Senior Trader, Zweig-DiMenna Associates LLC

Angela Sun, Chief of Staff to the President and CEO, Bloomberg LP

Crystal Ladder

For women who began in an entry-level job in a financial firm and climbed steadily through the ranks to reach senior management.

Kerry Byrne, Senior Vice President, First Eagle Investment Management

Jennifer Litwin, Senior Director, Greenwich Associates

Rising Stars

Recognizing today’s and tomorrow’s leaders. The Rising Star Award is intended for high-impact professionals who will continue to lead the industry for years to come.

Lisa Cavallari, Director, Fixed Income Derivatives, Russell Investments

Christy Oeth, Director of Corporate Compliance, Knight Capital Group

TM Diversity of the Year Award

Goldman Sachs

For the firm. For its people. For its clients.

Those three tenets form the bedrock foundation elements of Goldman Sachs’ commitment to diversity. If the firm is to succeed, it must be able to attract the best talent, regardless of sex, religion, orientation or age.

To provide the best service to its clients, the firm believes it first must be able to function wholly as a group and draw from a global workforce. And as part of a global and diverse workforce, employees themselves must feel they operate in an environment that supports differences and brings out the best in all.

Lastly, but most important, for Goldman to thrive, it must be able to provide its clients with exemplary service that is global and diverse.

That’s the Goldman way, said Carol Pledger, managing director in human capital management.

“One of the firm’s strategic goals is to have a diverse workforce,” Pledger said. “Senior management is committed to promoting diversity and inclusion in all our talent processes.”

That inclusion begins right at the recruitment level, continues through an employee’s career development path and culminates in promotion.

Goldman Sachs offers its 32,600-person workforce myriad opportunities to learn about the benefits of diversity and how to tap into the resources a multifaceted workforce can provide. The firm supports 52 different training programs, including Women Leadership Camps and Summits, MBA and Undergraduate Camps for Black and the Hispanic and Native American Studies.

Pledger added that the firm employs a three-pronged approach to diversity that spans its entire workforce. First, employees are required to complete a minimum of two hours of diversity training per year. Second, managers must complete workshops and programs that focus on building diverse teams. Lastly, Goldman sponsors ongoing education programs designed to develop and accelerate diverse employees’ careers.

TM Excellence in Leadership Award

Sheri Kaiserman

Firm: Wedbush Securities

Years in Industry: 23

Previous Firms: CIBC Oppenheimer

Status: Managing Director, Head of Equities

Meet challenges head on because they’re fun. Those are some of the principals behind her success, said Sheri Kaiserman, head of equities at Wedbush Securities.

“I’m one that, if I can make something better, I don’t wait for other people to do it. I try to reach out and see if I can help,” she said.

Her willingness to take on more and more chores has led Wedbush and others to increasingly depend on her since she came to the Los Angeles-based brokerage some 13 years ago.

Kaiserman started her career as a junior equity sales person at CIBC Oppenheimer. Within two years, she was covering accounts through a large part of the West Coast because she had learned so much about equities. “I got the ball and I ran with it,” she said.

After 10 years at Oppenheimer, and faced with the news that she would need to move to San Francisco or find another job, she understood she would “have the opportunity to build something at Wedbush.”

Initially hesitant about moving, she believed that she would “have the opportunity to build something.”

She has helped Wedbush establish its Private Shares Group. As it grew, she took on more and more jobs. So Kaiserman’s responsibilities include overseeing Wedbush’s equity research, sales, trading, Private Shares and Decision Metrics.

Wedbush has tripled its number of analysts. But her willingness to “help” has always had a bottom-line result.

“During her tenure, she grew revenues in her designated areas twenty-fold,” said vice president Gary Wedbush, head of capital markets. “Sheri is one of Wedbush’s critical leaders, and a great inspiration to women in the trading community.”

Kaiserman credits Wedbush with establishing a culture that led to her success. “There’s a trust and a loyalty here,” she said. “And we figure out how to get past things together.”

TM Mentor of the Year Award

Renee DeGagne

Firm: RBC Capital Markets

Years in industry: 24

Previous Firms: RBC-related companies

Status: Managing Director, Global Trading Client Management

Sometimes people just need someone to listen to them – an ear to bounce an idea off of or someone to offer guidance or even just say, “It’s going to be OK.”

That’s what a mentor does, Renée DeGagné said. Whether it’s a woman or a man, her door is always open to a colleague who needs a place of refuge. And that is what makes a successful mentor.

“Sometimes people need a little support,” she said. “They are looking for someone who will just listen to them.”

While life on the trading desk can be frenetic and consuming, DeGagné always makes time to assist staff who are in need of counsel. With almost a quarter century of experience behind her, she can speak to almost any subject someone might approach her on: professional, personal or emotional. Chances are she has probably lived it and has something to offer. She can relate.

She began her career at RBC began in 1988 as a management trainee working on Brady Bond refinancings in the chief accounting office. DeGagn̩ credits her mentors РMichael Harvie, Mark Hughes and Stephen Walker, all of whom shared their unique blend of experience and lessons. Harvie, her mentor for the first 12 years of her career, holds a special place.

“He taught me important things, one of which was about making tough decisions and how that relates to people,” she said. “Our decisions have a human cost in our sphere – for those we know and those we don’t know.”

She added that Harvie’s working relationships with partners across the firm have helped in her career journey.

Now it’s about paying it forward to the nearly 30 people she counsels regularly and the 300 people in the firm’s Women’s Resource Group, an RBC program she help create and establish. Helping these junior colleagues is not only satisfying to her, but also a necessity in today’s trading world.

TM Mentor of the Year Award

Amy Ellis-Simon

Firm: Bank of America Merrill Lynch

Years in Industry: 18

Previous Firm: Merrill Lynch

Status: Global Specialist Sales and Americas Corporate Access

Being a good mentor means telling like it is and not tickling an apprentice’s ears.

It’s that ability to be honest and candid with a student that is essential to helping junior financial professionals maximize their potential and thrive in life overall, and not just on the trading floor, according to Amy Ellis-Simon.

“My job is not to be a cheerleader, but to be able to have that uncomfortable conversation with someone in order to help them get better,” Ellis-Simon said. “Both the mentor and student need to be willing to honestly assess the opportunities and how to meet them.”

Honest conversations and candor were a part of the 18-year veteran’s ascent on Wall Street, ranging as far back as her years at the University of Michigan in the early ’90s. Ellis-Simon recalled that back then, she was involved in collegiate and extra-curricular activities that required her to demonstrate leadership and teaching – years before the term “mentor” became part of the vernacular.

“The goal is to use your personal capital to help someone else with the expectation that capital gets well spent,” she said.

And many professionals have invested in Ellis-Simon. She credits several clients both on the sellside and buyside who have helped her excel in the world of finance and prompted her to become a mentor in her own right. One such person sits just feet away from her on Bank of America Merrill Lynch’s trading floor: 2011’s Wall Street Women Mentor of the Year winner, Sylvia Rocco.

“She’s my go-to person,” Ellis-Simon said.

Like Rocco, she continues to mentor junior staff and relishes the ideal of “paying it forward.” That is, giving something back to the firm, the trading business and to others. For her, it’s just the right thing to do.

“I’ve been mentored throughout my life, so if I’m viewed as giving back, it’s because someone took the first step and mentored me.”

TM Entrepreneur of the Year Award

Dana Dakin

Firm: Dakin Partners LLC

Years in the Business: 48 years

Previous Firms: Callan Associates

Status: Founder, Director

Don’t tell Dana Dakin she can’t do something. Because then the highly competitive entrepreneur will do it.

One challenger inadvertently helped her break the glass ceiling. Dakin was working in the 1970s as the first woman executive at Callan Associates. She was calculating time-weighted returns and managed staff. But she was told by a well-meaning boss to forget about becoming a consultant.

She said he told her: “Men would never listen to women’s investment advice, so I would never be able to move into the consulting side of the business.”

Dakin would ultimately start her own consulting firm. She credits her former boss – who she says is “a great guy, but old-school,” with jump-starting her career.

“You betcha. He did me a big favor,” Dakin said.

In 1976, she founded Dakin Partners, a marketing consulting practice geared to institutional investment management and trading firms. It began as a creative agency, focusing on packaging firms competing within the institutional arena. Today it is creating designs for big institutional brokerages on the buyside and sellside.

Dakin’s efforts over the last nine years have led to other ventures. She is the founder of WomensTrust. It provides micro-lending programs to women in the town of Pokuase in Ghana. Dakin’s WomensTrust responsibilities have included managing the nonprofit as a sustainable business, public relations and fundraising. “The WomensTrust model has been replicated by others,” she noted.

What would she say to those who want to her follow her but run into naysayers?

“If you are blocked, go through a process where you use this barrier to get to know yourself better. Figure out your competitive advantages and line them up with your experience, and line it up with something you’re passionate about. And don’t let them stop you.”

TM Entrepreneur of the Year Award

Holly Stark

Firm: Efficient Frontiers

Years in Industry: 34

Previous Firms: Kern Capital; Dalton, Greiner, Hartman, Maher & Co.; Dillon Read Capital Corp; Oppenheimer Capital Corp.

Status: Director, Managing Director

Try everything because every new skill or experience can be valuable.

Such is the advice to young people starting out at Efficient Frontiers, said Holly Stark.

And sometimes, she added, success comes from the eagerness to try.

“It’s a matter of being open to opportunities,” she said. Stark says she wasn’t afraid of trading, which led her to working on market structure and consulting at Efficient Frontiers.

Stark began as a marketing assistant at Oppenheimer Capital, preparing marketing materials and RFPs for potential clients. Writing about trading was part of the job, but she didn’t intend to become a trader.

She followed a colleague to Dillon Read Capital. He was starting an investment management operation. Stark was presented with an opportunity: trading for a new money manager because she understood performance analysis.

“In my ignorance I said ‘OK. I don’t know anything about trading, but I’m willing to give it a try,” she said. Stark’s openness made a trading career. Her successes have included five years as director of trading and a principal at Kern Capital Management. Stark says those beginning in the business should try to do many things.

“One should simply jump in and work hard, and take advantage of the opportunity to learn,” she said.

Dillon Read Capital became Dalton, Greiner, Hartman, Maher. As head trader and principal there in the late 1980s and 1990s, Stark immersed herself in market structure.

“I was fortunate enough to speak on many industry panels and testify before Congress on market structure issues,” Stark said. “Through speaking, I met Benn Steil, who started Efficient Frontiers. He asked me to join. I decided it was a worthwhile career move.”

TM Charitable Works Award

Cathy Wilson Rosen

Firm: Zweig-DiMenna Associates LLC

Years in Industry: 25

Previous Firms: Steinhardt Partners

Status: Senior Equity Trader

For Cathy Wilson Rosen, it’s all about the children. It began back in 1987, when she joined Steinhardt Partners. Some of her colleagues, John Lattanzio and Elizabeth Larson, started doing charity work with St. Jude Children’s Research Hospital. Seeing them lead, she followed suit.

“I’ve worked with St. Jude’s since the Wall Street initiative’s inception,” Wilson Rosen said.

Throughout her career, Wilson Rosen has seen generosity firsthand. During her 17 years with Zweig-DiMenna, she has been privileged to see the generosity of Marty Zweig and Joe DiMenna and their extensive philanthropic activities, and now follows their lead.

“I am very blessed and lucky to be in this business and do what I can for the children,” she said.

In 1995, wilson Rosen became a co-chair of the hospital’s Wall Street committee. Since her involvement with St. Jude began, she has helped raise more than $2 million per year at its annual dinner and spearheaded the funding campaign to name a floor in honor of the Wall Street community.

But there is work still to be done, she said. St. Jude’s campus now has 2.5 million square feet of research, clinical and administrative space dedicated to finding cures and saving children. Every dollar is important, she added, because the daily operating cost for St. Jude is $1.8 million, which is primarily covered by public contributions. No children are turned away because they cannot pay.

Wilson Rosen has also served on other charities, such as the Muscular Dystrophy Association’s Wings Over Wall Street; she was the recipient of its 2003 Michael P. Beier Award. She was also the 1999 Volunteer of the Year for the National Hemophilia Foundation.

In the end, Wilson Rosen still wants to pay her blessings forward. As the beneficiary of a successful Wall Street career and mother of four young children, she has always recognized, and continues to recognize, her responsibility serving others.

TM Charitable Works Award

Angela Sun

Firm: Bloomberg LP

Years in Industry: 16

Previous Firms: City of New York, McKinsey & Co., J.P. Morgan, Henry L. Stinson Center

Status: Chief of Staff to the President

It all started with Dad and his compassionate heart.

That’s how Angela Sun remembers being raised as a child. Despite coming from a modest and thrifty family, she credits her father with instilling in her a charitable heart.

“He got me started and put me in the practice of giving,” Sun recalled. “He’d notice these people who had so much less, bring it to my attention, and remind me that we have little to complain about.”

Sun remembered learning as early when she was four years old that when he found money on the street or got too much change back from a clerk, that money belonged to others.

“We’d ask for the money when we needed it, but he refused,” she said. “And at the end of a year, he’d take all that money and make a contribution to charities.”

She told Traders Magazine of a time when she and her father came across a homeless person and he made her give that person some money. “I’d resist,” she said, “but he forced me to do it, and as a result I developed a subconscious sensitivity. “

Another time, Sun and her father came across a Vietnam veteran with a cup full of pencils on a subway platform, Again he insisted she give the ex-soldier some money. In return, Sun took a pencil.

“And to my surprise, he made me give the pencil back,” she said. His point was to give and not take anything from those less fortunate.

Picking up her father’s torch, Sun continues her father’s legacy by involving herself in myriad causes, including the Muscular Dystrophy Association’s Wings Over Wall Street, which benefits the fight against ALS; the Museum of the Arts and Design; Women’s World of Banking; and the Puericultorio Perez Aranibar Orphanage in Lima, Peru.

“He never had a lot to give” she said of her father, “but to him it was a matter of faith, and that really touches me.”

TM Crystal Ladder Award

Kerry Byrne

Firm: First Eagle Investment Management

Years in Industry: 25

Previous Firms: ASB, Nikko Securities

Status: Senior Vice President

Some people are lucky in a trading career. Others make their own luck. And some careers involve elements of both, which is the story of First Eagle Investment Management’s Kerry Byrne.

Trading was in Byrne’s blood, but she was always upbeat about the business and happily has taken on any job, no matter what it is.

That’s because from an early age, Byrne, whose father was a Big Board specialist, knew what she wanted. She was looking to a trading industry career. So when she went to college, she studied economics and management. The trading bug bit hit her early.

“I was one of six kids, and I was always the one who asked him about the market,” she said of her father. “I loved the business and used to visit him on the floor on breaks from college.”

In the beginning, it might not have seemed like such a smart career move; She started at the bottom, working summers on records for First Eagle, then known as Arnhold and S. Bleichroeder Inc.

But, she said, reviewing her early years in the back office, she was in a trading firm, and that was what mattered. She later learned to trade at Nikko Securities. It was trial by fire, since she came on board only month before the crash of October 1987.

By 1989, she had been hired by First Eagle for its U.S. equity desk, trading small hedge funds and institutional money. Six years later she was running it.

“First Eagle is different. It is a unique place. I found a home here, as a lot of people have. Management values the employees and what they can bring to the firm,” Byrne said.

Her advice for young people?

Byrne said one key is to be enthusiastic about a job in a trading firm, no matter what it is.

“I would say have a positive attitude,” she said. “Attitude brings everything to the job. People want to be around positive people.”

TM Crystal Ladder Award

Jennifer Litwin

Firm: Greenwich Associates

Years in Industry: 17

Previous Firms: RPC-Mitchell/Titus, AIG Financial Products, UBS Investment Bank.

Status: Senior Director, Relationship Manager

Few people can sing arias and also develop sales relationships with investment managers.

But that has been the unique experience of Jennifer Litwin, who has a master’s degree from the Yale University School of Music. Litwn began her working life as a singer and musician, but ultimately went from a being a temporary secretary trying to earn a decent living to becoming a senior director and relationship manager at Greenwich Associates, where she works with equity and fixed-income professionals.

Would she ever have thought she would end up an executive at Greenwich Associates?

“Absolutely not. Never in a million years would I have believed I would be here. Back then I was still actively pursuing my operatic career,” she said.

When she was at AIG Financial Products, Litwin said, she became “curious” about the back office and decided that, even though it wasn’t her dream job, “I was going to do my best” working there. Told that musicians had many of the qualities that could help one succeed in the trading world – they are competitive and disciplined, and are good performing under pressure and in public – Litwin decided to accept a full-time job. She saw it as a stepping stone to music. But in the meantime, she did her best for AIGFP. “I am not a mediocre kind of girl,” she said.

She learned trade tracking. Litwin dealt with client questions and started developing relationships with traders and portfolio managers. These relationships led to a GICs sales trading position at UBS.

Litwin found her years of hard work paying off with a role she enjoys. “I found that the favorite part of my job has been speaking to the clients and then meeting them in person. I realized I was really good at developing relationships,” she said.

Litwin added her parents’ values were essential: “Perseverance, patience, old-fashioned hard work and don’t be afraid to ask questions.”

TM Lifetime Achievement Award

Peggy Bowie

Firm: Manulife Asset Management

Years in Industry: 40

Previous Firms: MFC Global Investment

Status: Senior Trader

Peggy Bowie has seen it all.

The 40-year trading veteran has seen trading evolve from its telephony origins and paper-and-pencil roots to the warp-speed electronic marketplace. But one thing that hasn’t changed, she said, was the value of relationships and their impact on a career.

“People will still need people in this business. Whether you are 65 or 25, you need those relationships to make it in this business,” she said.

Even in this era of high-speed algorithmic trading, tools and technology will not replace the human element on each end of an order, she added.

Bowie’s relationships are countless. Whether a person is at a sellside or buyside firm, both are of equal importance and value to her. The same holds true whether a person is in her native Canada, the U.S. or in Europe.

“They’re all important. We all work as a unit to get trading done,” she said.

And she knows trading. She started her career in 1969 as a bookkeeper at a mutual fund and then landed on the trading desk in 1972. She remains on the desk today.

Aside from her passion for trading, Bowie has served the industry in other roles. Given her depth of knowledge, she has been very active shaping the industry and its agenda. She is a past Canadian Security Traders Association chairman, a co-chair for the CSTA’s Institutional Committee and serves as a director at the Buyside Investment Management Committee.

So what’s next for Bowie?

“Now, I want to educate the regulators on how we do our business so that the rules they create are fair and equally levered,” she said.

TM Lifetime Achievement Award

Nancy McLaughlin

Firm: ConvergEx Group

Years in Industry: 25

Previous Firms: Execution Services Inc., BNY Brokerage

Status: Managing Director of Sales and Business Development

Life’s road can be long, winding and bumpy. Surviving it is the key to long-term success.

That’s how Nancy McLaughlin views things. With two daughters and a golden retriever, she made her way to the Big Apple in search of a fresh start after one of life’s most traumatic events: divorce. With a little help and encouragement from her brother-in-law and a “can-do” attitude, she landed her first job on Wall Street at ESI, a subsidiary of Morgan Stanley, as an institutional sales trader.

“There were 11 people on the trading desk at our Wall Street office,” she said. “And I had no idea what they were doing. But I loved the energy, the people, everything.”

It was love at first sight for McLaughlin. Thanks to her “I’ll do anything” attitude, a quarter-century love affair was born while matching trade tickets -a n affair that continues today.

One thing McLaughlin takes pride in is her ability to be a generalist. She was willing to perform any task on the desk, whether it was executing a trade or back-office work, and she did it gladly. That ability to adapt has been integral to her longevity.

“I’m passionate about keeping busy, doing whatever needs to be done,” she said. “And the upside was, the day was over before you blinked.”

And she has been busy. AT ESI, she was responsible for relationship management and business development with money managers and major banks. As the business became more complex, she led the creation of ESI’s Client Service Department, taking on soft dollar sales, management and administration.

And her flexibility has enabled her to endure several management and ownership changes, which included Morgan Stanley, International Bank of Japan and Bank of New York.

“Cultures and management change, and the secret to survival is that you have to be willing to morph into what was needed at the time,” she said.

TM Rising Star Award

Lisa Cavallari

Firm: Russell Investments

Years in Industry: 15

Previous Firms: ZGI Group, Ibbotson Associates, Barclays Global Investors

Status: Director, Fixed Income Derivatives, Russell Investments

Being a specialist has its advantages.

Ask James Imhof, managing director of global trading at Russell Investments what the key to Lisa Cavallari’s success is and he’ll respond it’s her being a specialist.

What does she specialize in? Highly esoteric fixed-income derivatives such as listed futures, to-be-announced mortgage-backed securities and interest rate swaps, to name a few things. And because of her depth of knowledge in these, Cavallari has been able to thrive.

“When I hired her back in 2005, we were just getting into fixed-income derivatives and the business was too much for our staff,” Imhof recalled. Cavallari had just the knowledge that was needed.

Cavallari started at Russell in 1991 as an analyst. She left the firm in 1999 to go to Barclays Global Investors, where she spent about six years as a portfolio manager and trader on its structured products trading desk. She returned to Russell in 2005.

“We were very fortunate to get her back,” Imhof. “She’s very important to the team.”

How important? Cavallari not only trades fixed-income derivatives, but also manages its derivatives team, conducts research, speaks with clients, does her own research and manages some of the firm’s $13 billion in its internal funds. A far cry from her analyst days.

“At the end of the day, everything that is traded in derivatives goes through her – from trading, to settlement to clearing,” Imhof said. “I have a lot of confidence in her.”

During her time at Russell she has thrived during the birth of derivatives as an asset class, endured the credit crisis and thrived during its recent rebound. And that endurance has paid dividends as Cavallari is embedded into the manager’s fixed-income strategy.

So what does Imhof see Cavallari doing next? “She’ll do more on the portfolio management side and grow out her team,” he said.

TM Rising Star Award

Christy Oeth

Firm: Knight Capital Group

Years in Industry: 17

Previous Firms: Chase Manhattan Bank, Church Capital Management, Clearbrook Financial

Status: Director of Corporate Compliance

Having a broad skill set is the secret to success.

That’s what Christy Oeth said was integral to her journey from Harvard, where she majored in social studies to the upper echelons of compliance.

“I got into this business through a friend who really took a chance on me – someone with no regulatory experience but some financial experience,” Oeth reminisced. “The transition from school to landing my first job in the credit training program was the result not so much of my experience, but my drive and diverse skill set.”

That was in the early ’90s when she began her financial career at Chase Manhattan Bank. Back then excellent verbal, written and analytical skills were in demand and preferable to the technology and programming knowledge sought today.

“Those broad skill sets are what were desired and have served me so well,” said Oeth.

Harvard’s social studies program helped, as it was an interdisciplinary major – made up of several core subjects, such as economics, social theory and history, all of which prepped Oeth for her career ascent.

After Chase, she moved to Church Asset Management as chief compliance officer, and then to Clearbrook Financial in 2006, where she held the same position. While at Clearbrook, she expanded her reach and became involved in a joint venture with Knight Capital, a firm she would join full time in 2009.

At Knight, she melded the clearing business into the compliance area and helped the group expand from equities and options to fixed-income and correspondent clearing.

And she is still not done. Now fully immersed in compliance, Oeth plans to focus on industry working groups and educating others on market structure.

“I have the unique luxury of being in a role where I can work with very knowledgeable staff and play a pinch-hitter role,” Oeth said.

TM Industry Trailblazer Award

Janice McFadden

Firm: Goldman Sachs

Years in Industry: 22 years

Previous Firms: None

Status: Director, Managing Director, Goldman Sachs Asset Management

Don’t get too comfortable in your job even if you’re a master of the universe.

Be willing to do lots of things at the same time and try new things, especially if they seem challenging – or maybe even impossible, at first. Constantly communicate with clients.

Those are the philosophy components of Goldman Sachs’ Janice McFadden. It’s a philosophy that took her from compiling numbers as a trainee to her spot as trading desk chief. She started with Goldman Sachs in 1990. She worked as a trainee. She recorded P&L for the highly profitable arbitrage desk. She learned the desk while studying for an MBA.

A few years later she was offered a unique opportunity.

“I was offered a job as an assistant trader,” said McFadden, who had never thought of becoming a trader. “I had to make the decision about whether to stay where I was, and where I was comfortable.”

McFadden opted for discomfort.

But there were days when she might have thought she’d made the wrong choice.

“It was very hard the first four months of trading,” she said. “After the first three or four months I didn’t think I was getting this. I went from knowing what I was doing to the low person on the pole.” She thought about whether she had made the right decision. Still, she persisted. Then, around five months into her new job, “it clicked.”

Suddenly, McFadden had the same confidence in her trading ability she’s had in her previuos role. Later, her ability to help others led to another job and the challenge of today running a desk.

How can someone duplicate McFadden’s remarkable career path?

Traders must able to multi-task and must be in constant contact with clients throughout the day, she said. “A person must be persistent in continuing to develop skills and learn to be a problem solver, a team player and a good communicator with clients.”

TM Industry Trailblazer Award

Donna Sims Wilson

Firm: CastleOak Securities

Years in Industry: 25

Previous Firms: Lehman Brothers Kuhn Loeb, Loop Capital Markets, M.R. Beal & Company, Bear Stearns

Status: Director, Executive Vice President

The road to Wall Street success can take many unusual turns, but one must be open-minded.

That’s what Donna Sims Wilson found. Wilson, who now runs the mortgage and equity departments for CastleOak Securities, initially wasn’t interested in Wall Street as a young woman. Then, at age 19, she took a summer job at Salomon.

“The trading floor at Salomon Brothers was a huge rush and I kind of knew instinctively that this was where I was supposed to be,” she said. Even though Wilson never was a higher-mathematics whiz, she said her considerable ability to memorize formulas helped her. She discovered she enjoyed trading.

After college, she became a corporate junior analyst at Lehman Brothers Kuhn Loeb. She traded junk bonds. Wilson’s numbers skills earned her a reputation as a problem solver.

She received an offer to take an associate position at Bear Stearns selling mortgage-backed securities. In the mid-1980s, Wilson made lots of sales and was one of the few African-American women on the Street.

Her mortgage-backed securities expertise, along with a fateful party she attended with a friend, led to another turn in a successful career. She inadvertently attended a Congressional Black Caucus Brain Trust meeting. There, she learned that a Resolution Trust Corporation law required women- and minority-owned firms to participate in thrift assets dispositions. Wilson, on behalf of Bear Stearns, worked on a joint venture with a minority firm.

“I got a very up-close and personal education in how politics and laws directly impact our economy and banking system,” Wilson said. This RTC knowledge would help her with laws such as Troubled Asset Relief Program and Dodd-Frank. She understood their effect on minorities. And this led to her current job. Her firm is a partnership between Cantor Fitzergerald and a minority-owned brokerage, CastleOak Securities.