The U.S. economy is on the mend. The European debt crisis is under control. The financial crisis of 2008 is receding into memory. Volatility is tamed. And yet derivatives based on the Chicago Board Options Exchange Volatility Index have never been more popular.

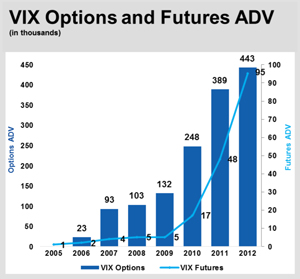

Last year, volume in futures and options based on the VIX reached new highs. From a daily average of 389,000 contracts in 2011, VIX options rose 14 percent to 443,000 contracts in 2012, according to data from the Chicago Board Options Exchange, where the contract trades. That’s more than triple the level of 2009.

Growth in VIX futures has been even more spectacular. From an average of 48,000 contracts per day in 2011, volume in VIX futures nearly doubled last year to 95,000 contracts, according to data from the CBOE Futures Exchange, where the contract trades. In January, the contract again surged to record levels, trading 138,000 contracts per day. That’s nearly 30 times higher than it was for the full year 2009.

Recent gains have occurred despite a relatively placid stock market. The VIX index, which gauges expected swings in stock prices over the next 30 days, spiked no higher than 28 last year. That compares with highs of nearly 50 in the previous two years, and 60 and 80 in 2009 and 2008, respectively.

So, with the VIX muted, why the strong demand for exposure to volatility? According to derivatives professionals, the onward, upward trend in the volatility instruments is not unusual. Despite a calmer stock market, traders have embraced volatility as an integral part of their strategies.

“The concept of volatility as an asset class has taken hold,” said Jim Strugger, a derivatives strategist with MKM Partners in Stamford, Conn. “And that will support volumes.”

VIX options are traded exclusively at the CBOE, where their value is roughly determined by the value of a same-month VIX futures contract, not the “spot” price of the index itself. VIX futures are traded exclusively on the CBOE Futures Exchange.

Despite the fact that the number of VIX options contracts traded was roughly four times that of VIX futures last year, the notional value of VIX futures is much higher. At an average of $2.5 billion per day last year, the value of trades was approximately double that of VIX options.

The VIX measures the market’s expectation of stock market swings by tracking the performance of options on the Standard & Poor’s 500 Index. The financial crisis of 2008 propelled the index to a high of 79.13 on Oct. 20 of that year, when, as recently as August, it had been trading under 21.

The surge led Barclays Bank to launch the VXX iPath S&P 500 VIX Short Term Futures exchange-traded note on Jan. 30, 2009, a pioneering security that gave users a direct way to gain exposure to volatility. Other financial institutions soon brought out similar products.

There are now 34 such ETPs, holding $3.1 billion in assets, according to CBOE officials. Over time, they have grown in sophistication, but in general, they all invest in the front two VIX futures months. Supporting these products requires their sponsors to trade VIX futures contracts. That, in turn, has led to trading by others hoping to get in front of the sponsors’ large trades, especially at the close.

The growth in VIX futures volume, in turn, has led to growth in VIX options volume. With more liquidity in the futures contracts, options traders could more easily hedge their positions. Previously, they used some sort of combination of S&P 500 Index options and futures to hedge.

For traders, the relationship between the two VIX instruments is not unlike that of S&P 500 Index futures and options. S&P 500 Index options traders use the comparable futures contract to hedge their options positions.

VIX options growth has been further fueled by the structure of the contract. Because a single contract has a relatively low notional value, institutional traders must buy or sell several contracts to achieve their goals. More contracts equal more commissions. That works as an inducement for brokers to push the product.

“People can trade a large number of contracts,” said Justin Egan, a volatility index trader at SG Americas Securities. “So, it’s a big commission generator for the firms. Everyone is incentivized to pitch it.”

While Barclays’ VXX set the stage, the explosion in volume didn’t occur until 2010. That’s when traders sought exposure to volatility directly by trading the VIX futures and options contracts themselves. Proprietary traders and hedge funds have jumped into VIX trading, and their volume now surpasses that of the ETP sponsors, according to CBOE executives.

“Whereas before, folks might have traded the VXX ETP to gain exposure to volatility, now they are direct users of the futures product or even the options product,” explained Jim Lubin, managing director of the CBOE Futures Exchange.

Traders of these products range from very sophisticated quantitative volatility funds and fast-money hedge funds seeking protection to long-onlys and insurance companies. The “buy and hold” investors tend to avoid the front-month contracts and trade a call or call spread dated four months out in order to obtain longer-term protection, Egan said. “It’s a little less costly,” he said, “because the option premium doesn’t bleed away quite as fast.”

Whether these folks continue to trade as aggressively as they have been is an open question. According to Strugger, volatility cycles last no more than five and a-half years, and the latest cycle may have come to an end.

“There is a relationship of volatility to underlying economic cycles,” Strugger told Traders Magazine. “So, for a long time, I made the argument that this cycle would last longer than five and a half years. I thought it could potentially end later in 2013. But what has happened is that the market has told us that it is probably over, and I’m not going to stand here and get run over by the market when all the indicators I look at are screaming lower vol, lower correlation, higher dispersion, lower skew, lower vol of vol. All my favorite indicators hit the point where this might really be over.”

If that is the case, Strugger added, then the market could see the VIX move in a range of 10 to 20 for the next five years.

At least one options market-making executive agrees that low volatility is the new norm. “We’re entering a new volatility regime that will be a low-volatility regime,” Denis Medvedsek, head of options market making at Knight Capital Group, said at a recent conference sponsored by the Security Traders Association’s Chicago affiliate. The market will act like it did after the dotcom bubble burst in 2000, Medvedsek said.

Strugger said trading of VIX products is likely to subside, but not tremendously. “We still live in a nasty little world,” he said. “But people will still be attracted to these products. I think they have gotten hooked to a certain extent. So I don’t want to say volume will collapse. I don’t know that to be true. But there’s no question that, at the margin, it will probably come in. It really remains to be seen what sort of dedicated volatility participants have been created in the last few years.”

Based on recent data, there is no indication traders are abandoning volatility products. The number of shares outstanding in the most popular volatility ETNs, for instance, stands at an all-time high. That implies there is no net redemption of the product, Egan explained.

Because the crisis of 2008 woke people up to the fact that volatility is an asset class, interest in the products will remain robust, Egan believes. But, “over time, if we continue to stay in a lower-vol environment, you will see less interest than you do now,” he said.

(c) 2013 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/