Be very,very quiet, were hunting IPOs…

Thats the outlook and state of the initial public offering calendar so far, according to Triad Securities.

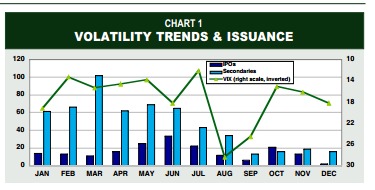

This new issuance drought comes amid the sharp IPO and secondary issuance drop off seen during the fourth quarter of last year. And things dont look to have changed much given the market volatility in the global equity markets.

The new-issue market has been quiet in 2016 as equity volatility has increased, Triad published in a note. Overall, in 2015, 170 companies issued initial public offerings and raised $30 billion – the lowest amount raised since the bear market of 2008-2009. In the fourth quarter, the number of IPOs was 36, down from 40 in 3Q and a peak of 74 in 2Q – when stocks were establishing all-time highs.

The noted added that the pattern was even more pronounced for secondaries. In 4Q, 61 companies raised additional equity compared to 90 in 3Q, 196 in 2Q and 229 in 1Q.

The biggest deal in 2015 occurred in 4Q: First Data Corp (FDC), a technology company, raised $2.8 billion. But First Data also symbolized the struggle of the IPO market, as the deal was priced below the low end of its estimated range.

Looking ahead, Triad reported that there are a handful of unicorns (AirBnb, Uber, Pinterest, etc.) are waiting in the wings but unlikely to go public until theres more exuberance in the market. Indoor cycling chain SoulCycle and the TV manufacturer Vizio are among the approximately 120 companies that have actually filed for IPOs. The sectors with the most companies in the backlog are Healthcare, Technology and Consumer Services.

Jefferies & Co. and Goldman Sachs were the leading banks in terms of IPO transactions during the quarter, with nine. Jefferies, BofAMerrill Lynch and Allen & Co. were among the leaders in terms of opening price performance compared to the issue price.

The leading secondary bookrunners in terms of total transactions were Citigroup Global Markets, JPMorgan and BofA Merrill Lynch. On average, the opening prices for the leading issuers were 1.4% above the issue price. The top performers on this metric in 4Q included Cowen & Co. and Credit Suisse