Fidelity Capital Markets launched a new anonymous trading venue designed to help institutional traders find buyers or sellers of large blocks of stock, using retail order flow.

The invitation-only venue, called the Block Liquidity Opportunity Cross, is an extension of the company’s alternative trading system, CrossStream.

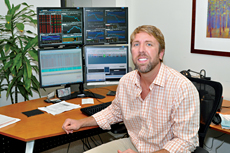

The trading system, known as BLOX, has been in beta testing since Oct. 1 and currently has 15 clients trading on it, said John Donahue, head of equity trading at Fidelity Capital Markets. The dark venue was launched to help institutional investors access retail order flow from a variety of retail sources and avoid the toxicity sometimes found in dark pools, he added.

“We have internal order flow that is untapped and clean, and that is what the buyside is interested in,” Donahue said.

Donahue added that buyside traders are increasingly interested in executing block trades to improve execution quality. Still, they are worried about a lack of clarity on how trades get executed, leakage of information about their trades or trading strategies and control of the process of finding liquidity. BLOX, he said, offers an environment for investors to seek price and size improvement with confidence and minimal market impact.

At least two buysiders contacted by Traders Magazine are interested in BLOX.

“At first glance, it does interest me,” said David DeVito, head trader at Madison Investment Advisors. “Any time the conversation turns to technology that helps buyside traders avoid the mediocrity of average [trade sizes] and helps traders execute large blocks with conviction, I listen.”

Thomas (Chip) Coleman, director of trading at Thompson, Siegel & Walmsley, will try it, with caution. He already is plugged into CrossStream.

“I will try it because we have a connection to them, but I haven’t had a lot of success with CrossStream in the past,” Coleman said. “I’m not holding my breath.”

To safeguard the integrity of the venue, Fidelity said buysiders are allowed to tap into BLOX, increasing the likelihood of a block trade, but high-frequency traders are kept out. Donahue said 34 percent of the shares coming from its retail brokerage business are considered block size, meaning typically they involve 10,000 shares or more.

Fidelity’s retail brokerage business trades 535 million shares on average per day, Donahue said. Fidelity also takes in order flow from other large fund firms and asset managers.

“We’re looking at retail order flow from other firms like Fidelity within the dark pool,” Donahue said. “And our goal is to have the top 100 buyside clients interacting with all this retail order flow by the end of 2013.”

Two “non-wholesaler sources” of retail business have approached Fidelity about having their order flow posted and executed in the venue, Through CrossStream, BLOX anonymously matches Fidelity clients’ orders against the diverse order flow of Fidelity’s brokerage businesses. The system does not publish bids and offers before clients’ orders are routed to the market. All executions occur at midpoint, providing price improvement for trades.

(c) 2013 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/