Dark pool OneChronos ATS has gone live and added to the periodic auction mechanisms available in the US after Cboe Global Markets began offering the order type in April.

Periodic auctions last for very short periods of time during the trading day to help market participants find liquidity quickly with low market impact, while prioritizing size and price.

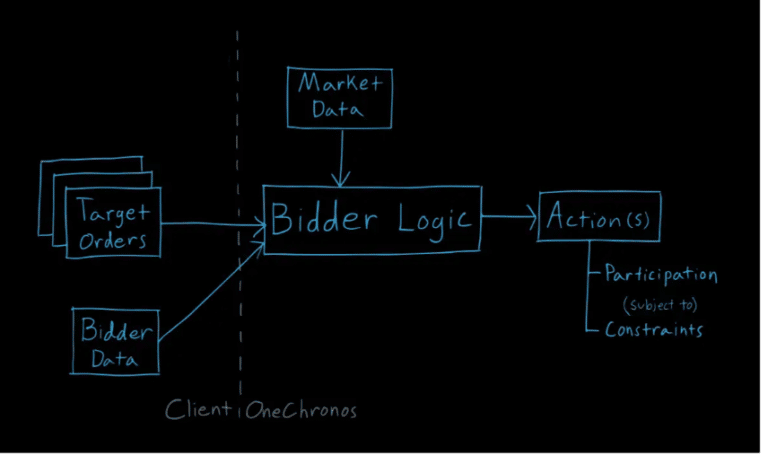

OneChronos describes itself as a smart market that matches counterparties using mathematical optimization so that its periodic auctions seek optimal matches across all orders, instead of matching orders one-by-one based on speed. Each auction looks for the configuration of “winning” orders and per-security clearing prices that will result in the most price improvement dollars cleared, taking into account all orders’ constraints.

Richard Suth, co-founder at OneChronos, told Markets Media: “We’ve been live for a couple of months with roughly 20 broker subscribers sending orders, a good mix of the banks and algo providers. Another eight to 10 subscribers are in the process of joining.”

All auctions are initiated by the venue at randomized start times and not by the user which aims to make predatory trading strategies ineffective on the venue. OneChronos aims to conduct an average of 10 auctions per second throughout the trading day.

“Volume is at the top of our projections and materially above other venues that we have benchmarked ourselves against,” added Suth. “Performance metrics are also looking good at this early stage and the platform has been very stable.”

OneChronos has been working with NYSE on physically connecting to the exchange which entailed a multi-month regulatory approval process.

“This is their first directed route to an ATS and we are extremely excited to be working together,” said Such.

The connection is important as any firm connected to NYSE can easily access OneChronos through their existing pipes by using a FIX identifier which Suth described as very “plug and play.” As a result OneChronos fits easily into users’ existing workflow through algos and smart order routers.

An NYSE spokesperson said: “Providing access to OneChronos’ unique combinatorial auctions is another way the NYSE provides its members with superior execution quality.”

Expressive bidding

The ATS accepts limit orders and peg orders but as a smart market, OneChronos can also enable expressive bidding which allows users to set specific execution instructions which are specifically tailored to their objectives. Suth explained that expressive bidding removes a significant portion of execution risk by giving users much more precision and control over orders.

For example, a trader could set instructions to buy one stock only if they can also sell another stock at a defined spread or greater, in the same auction; or only trade when an imbalance is above a certain magnitude.

“The unique value of expressive bidding and its ease of use will be a big differentiator for OneChronos,” added Suth. “It is similar to building a custom algo very quickly and it sits at the matching engine level.”

He continued that OneChronos has had interest from multiple subscribers on designing expressive bids so they can create their own very flexible, customized order that fits their client’s specific execution needs.

Cboe Global Markets

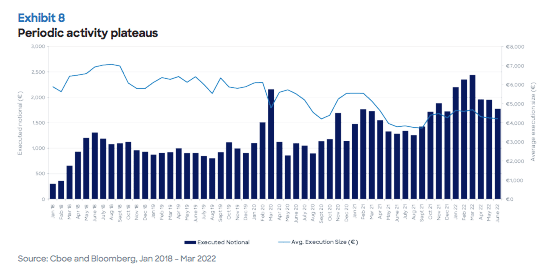

Cboe Global Markets launched periodic auctions in the US in April this year after pioneering them in Europe.

Adam Inzirillo, head of North American Equities at Cboe Global Markets, told Markets Media at the time that the exchange has a global transaction strategy across Canada, US, Europe, Asia, and Japan and so could launch the order type in other geographies.

The exchange launched periodic auctions in Europe in 2015 ahead of the incoming MiFID II regulations which changed equity market structure. In Europe periodic auctions declined back to 3% market share, following a recent increase to 4%, in the first half of this year according to Liquidnet’s H1 Liquidity Landscape Report.

“Given the regulatory intention to limit small-sized dark trading by increasing the minimum threshold for the Reference Price Waiver (RPW) to 2x Standard Market Size (SMS), along with pre-trade firm quotations for SI also increasing to 2x SMS, the potential for their continued increase still remains,” added Liquidnet. “With Frequent Batch Auctions out of scope of the MiFID II reform, our view is that market participants will once again increase their use of periodics rather than return to continuous lit markets.”