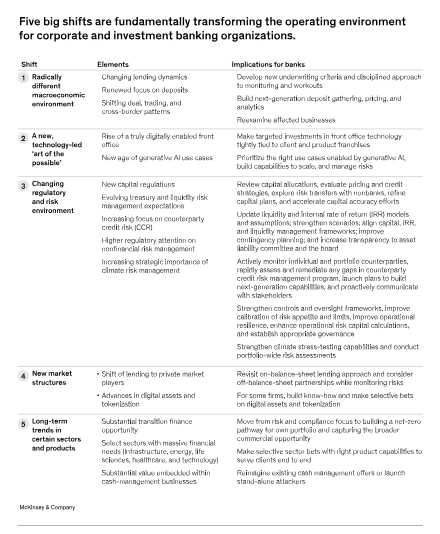

New market structures and a technology-led ‘art of the possible’ are two of the five big shifts affecting corporate and investment banking according to consultancy McKinsey

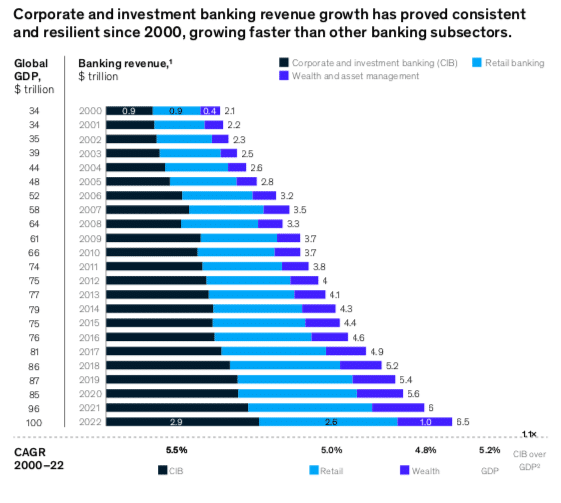

In a report, Five big shifts shaping a new world for corporate and investment banks, McKinsey’s financial services practice said corporate and investment banking revenues were 44% of the global banking revenue pool in 2022, with an average annual growth rate of more than 5% percent since 2000. Core commercial lending and cash management accounted for more than more than 80% of corporate and investment banking revenues in 2022 while complex and volatile products, such as specialized lending, investment banking, and sales and trading, were less than 20% of the total revenue pool.

New market structures

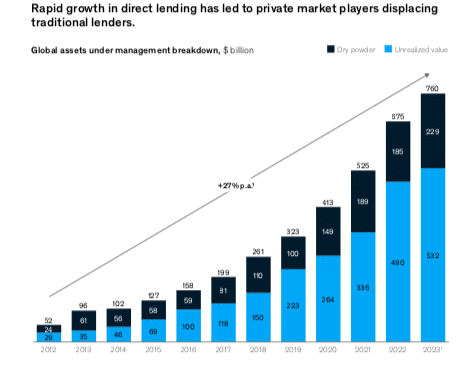

However, corporate and investment banks face increased competition from non-banks who can benefit from better economics, lighter capital requirements, superior technology, and lighter regulation. McKinsey gave the example of alternative asset managers engaged in direct lending, who grew at an average rate of 27% annually from $52bn in 2012 to $760bn in March 2023.

As a result, one of the shifts highlighted by McKinsey is new market structures due to increased lending by private credit organisations and also the rise of tokenization.

“The biggest disruption under way, however, is arguably in lending—a core activity for CIB organizations—particularly in leveraged lending,” added McKinsey. “The rapid growth of private equity over the past decade—deal volumes saw a 10% annual increase from 2012 to 2022—has significantly increased demand for leveraged financing solutions to fund these deals.”

McKinsey recommended that corporate and investment banking organizations should consider revisiting their on-balance-sheet lending approach and taking advantage of off-balance-sheet partnerships and funds, while monitoring and managing the associated risks.

Tokenization is less established but McKinsey said this is another new market that could be equally disruptive although challenges include an immature infrastructure, the lack of a short-term business case, regulatory uncertainty, and limited industry alignment.

“On the one hand, not many types of assets have yet been tokenized,” added McKinsey. “But there have been signs of change in the past year. Most notable are the significant advances in cash tokenization ($120bn of tokenized cash in circulation), emerging regulatory frameworks outside the United States, better short-term business case fundamentals driven by higher interest rates, and a maturing infrastructure maturity. Adoption may well accelerate.”

Technology-led ‘art of the possible’

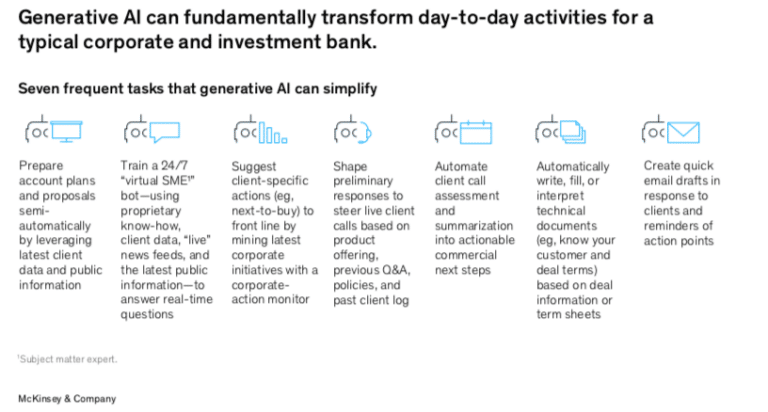

McKinsey highlighted that a range of technologies, including machine learning, cloud adoption, and generative artificial intelligence have shifted the “art of the possible” in how firms engage with their clients. However, to capitalize on these opportunities, CIB businesses need to choose the right use cases to achieve the highest return for their investment, build capabilities that can scale and manage the associated risks.

“The current wave of digital innovation focuses less on using technology to replace front-line bankers, salespeople, and traders, and more on maximizing workers’ productivity and effectiveness by equipping them with the best and latest tools to do their work,” added McKinsey. “These tools include real-time client dashboards, advanced analytics for behavioral segmentation, automated pitch book production and financial modeling, and digital recommendations on “the next product to buy” or acquisition targets. “

Even mergers and acquisitions and initial public offering, are seeing digital tools and capabilities embedded across the process according to McKinsey.

The McKinsey Global Institute has estimated that across wholesale and retail banking, generative AI could add between $200bn and $340bn in value. So far, corporate and investment banks are using generative AI for new product development to accelerate software delivery; to extract, search, and summarize unstructured data; and to increase efficiency in post-trade.

“In our experience, gen AI can improve productivity in core CIB activities by between 30 and 90% (in individual use cases), depending on the application. We’ve seen heavy users halve the time to market for many code releases, for example,” added McKinsey. “All told, productivity and other benefits could add up to about 10% of CIB operating profits in the long run.”

The other three shifts highlighted by McKinsey were a radically different macroeconomic environment; changing regulatory and risk management environment; and long-term trends in certain sectors and products.