Volatility returned to the cryptocurrency markets in August as Bitcoin and Ethereum failed to break key resistance levels at $25,000 and $2,000, before a sell-off occurred following Fed Chairman Jerome Powell’s speech in Jackson Hole.

Bitcoin and Ethereum closed the month at $20,050 and $1,554 respectively, falling 14.0% and 7.47%. This volatility was reflected in the trading volume as spot trading on centralised exchanges jumped 36.8% to $1.91tn.

Download the full report here for all the latest insights.

Key takeaways:

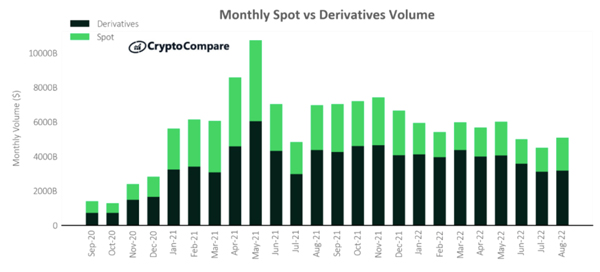

- Spot trading volumes spiked 36.8% in August to $1.91tn – marking August as the second largest month by spot volume so far this year. This rise in spot trading volume, however, led to a 9.59% decline in derivatives market share – with the derivatives market falling to a yearly low of 62.4% market share.

- Although derivative markets saw a decline in market share, derivatives trading volumes across all centralised crypto exchanges increased 1.91% to $3.16tn, registering its first rise in three months. Historically, the derivatives market has dominated crypto trading volumes.

- BinanceUSD has also seen its BTC spot trading volume rise in recent months. Although the BTC spot trading into BUSD only slightly rose 0.44% to 2.14mn BTC in August, the token has seen its volumes increase by 394% from the start of the year. This is also the all-time high volume traded for the BTC/BUSD pair.

- The aggregate volume of BTC and ETH futures contracts on the CME fell 20.7% to $28.9bn in August. This is the lowest volume recorded for the exchange since December 2020.

- The number of BTC futures contract trading on CME also fell, declining 22.7% to 182k, the lowest value in four months. This combined with the falling price action of the markets has led to a decline in the BTC futures volume on the exchange to $19.9bn, the lowest volume registered since November 2020.

Derivatives Volume Market Share at the Yearly Low

Spot trading volumes spiked 36.8% in August to $1.91tn – marking August as the second largest month by spot volume so far this year. This rise in spot trading volume, however, led to a 9.59% decline in derivatives market share – with the derivatives market falling to a yearly low of 62.4% market share.

Although derivative markets saw a decline in market share, derivatives trading volumes across all centralised crypto exchanges increased 1.91% to $3.16tn, registering its first rise in three months. Historically, the derivatives market has dominated crypto trading volumes.

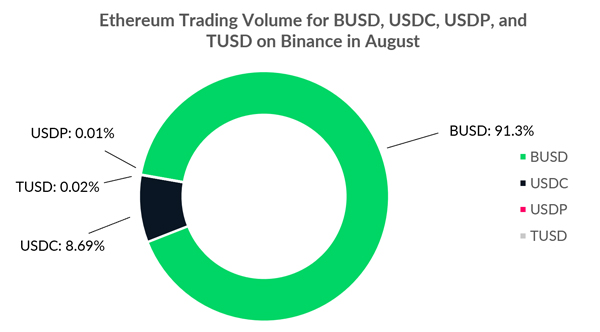

BUSD Most Popular Stablecoin for Ethereum Trading on Binance

In August, Binance launched zero-fee trading for ETH/BUSD in anticipation of the Ethereum Merge on September 15. This feature differs from the zero-fee trading for BTC trading pairs announced last month as BUSD is the only beneficiary of the zero-fee Ethereum trading.

On September 5, the exchange announced its decision to auto-convert users’ existing balance and deposits of USDC, USDP, and TUSD stablecoins to BUSD. The move was made to enhance liquidity and capital efficiency as it avoids fragmentation of liquidity on trading pairs. BUSD has seen its trading volume increase significantly in the past six months.

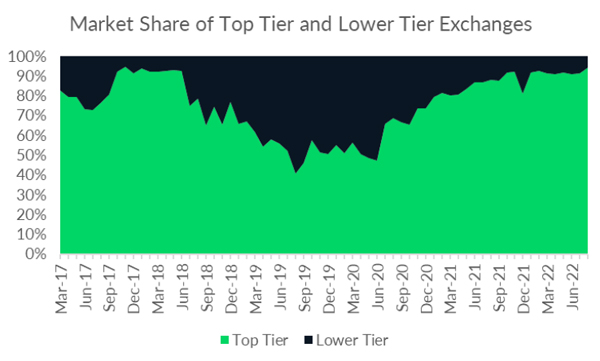

Top Tier Exchanges Continue to Dominate the Markets

In August, the spot trading volume on Top Tier exchanges rose 41.6% to $1.79tn, the highest monthly volume recorded in 2022. Meanwhile, the spot trading volume on Lower Tier exchanges fell 12.3% to $108bn, continuing its decline for the third consecutive month.

The market share of Top Tier exchanges is currently at 94.3%, the highest since November 2017. The rise in the market share of the top-tier exchanges is a welcome sight, indicating an influx of trading volume on more reliable exchanges.

Source: CryptoCompare