Jean-Marie Mognetti, chief executive of CoinShares, said the European digital fund manager aims to have as many assets under management in the US as in Europe within three years after completing its acquisition of the Valkyrie exchange-traded fund business.

Mognetti told Markets Media: “Within three years, the US should also become a key revenue generator, if not the key revenue generator, for the business.”

On 12 March CoinShares said in a statement that it completed its acquisition of the Valkyrie Funds, which provides the European manager with a platform to expand its digital assets expertise into the US. The acquisition contributes approximately $530m of new assets under management taking CoinShares’ assets to approximately $7.3bn globally as of 11 March 2024.

“We love to be the one attacking the leader and we like to do it in a very different way,” Mognetti added. “We may not have the firepower of the big houses but we have a very reliable batting average.”

Prior to acquisition CoinShares already had a US presence through being a licensed broker-dealer allowing it to sell private securities and hedge funds. CoinShares had launched Hedge Fund Solutions in the US in September last year.

“The Valkyrie opportunity presented itself and it is a good risk and reward opportunity for the company,” added Mognetti.

He continued that Valkyrie’s regulatory licences are complementary to CoinShares’ existing U.S. permissions and contribute to establishing solid foundations for CoinShares to continue executing its U.S. asset management expansion plan.

The US ETF market is already very competitive but Mognetti argued that CoinShares has been managing digital assets in Europe for 10 years, and has diversified into other products in the region, which it can potentially introduce in the US.

He believes CoinShares can gain share in the US with a clear focus on product innovation with funds such as $WGMI, the Valkyrie Bitcoin Miners ETF, which he described as the highest-performing non-leveraged ETF in 2023 across all sectors and $BTFX, the Valkyrie Bitcoin Futures Leveraged Strategy, which CoinShares helped Valkyrie to launch in February this year.

“The platform we have acquired in the US gives us a lot of flexibility to start offering more actively managed strategies and to operate as a forward-looking thematic asset manager,” added Mognetti. “We have a strong legacy of innovation and being first to market, and our expertise and experience in crypto will allow us to offer products which are a little bit out of the box.”

CoinShares can also leverage its expertise in quant trading into an ETF wrapper, which Mognetti said allows extraordinary distribution. In addition, its hedge fund expertise, Mognetti argued that CoinShares can provide quantitative research and equity analysis to build the new US platform.

Mognetti expects Valkyrie to be fully integrated into CoinShares’ framework by the end of this year and plans to rebrand Valkyrie as the company’s US asset management platform.

“We will start having more presence in the US and we can start making a dent in the US market,” he added.

He said CoinShares is not purely targeting growth in assets under management, but rather targeting profitable AUM, as it cannot compete with firms such as BlackRock and Fidelity on cost.

“We want to be able to offer high value-added products to our clients which are a bit more tailor made,” he added. “The addressable market might be smaller but it will be higher on the fee scale.”

Bitcoin ETFs

Valkyrie had four ETFs, including a spot bitcoin ETF which was amongst the group approved by the US Securities and Exchange Commission on 10 January this year.

CoinShares had started discussions with Valkyrie in early October last year and worked with the US firm to ensure the spot bitcoin ETF ready to go once SEC approval was received. Mognetti said the SEC approval of spot bitcoin ETFs is a great opportunity for the crypto market.

“I think it will transform the market as well because it moves liquidity to regulated venues as securities can be integrated customers’ brokerage accounts,” he added.

He compared the launch of bitcoin ETFs to when technology moved from users having to manually load music files on their devices to having YouTube integrated into their iPad to provide a seamless user experience.

US ETF market

Mognetti said more than 50% of global assets under management comes from the US and is allocated in the US, so the market is total in building a global franchise. He added: “The US increases our total addressable market by a factor of 15.”

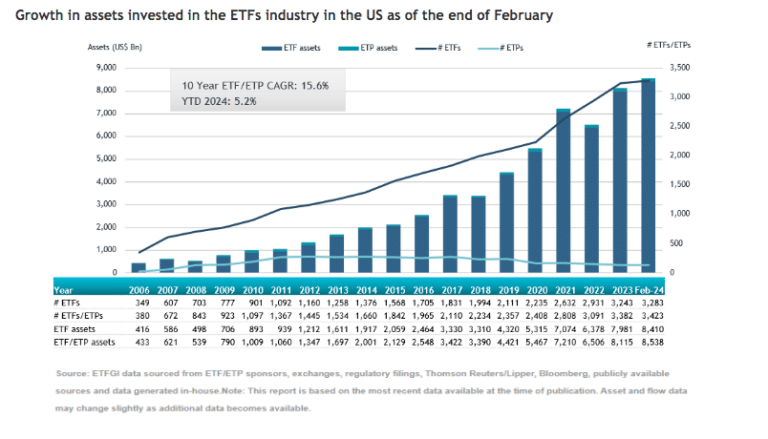

Assets under management for ETFs listed in the US reached a record of $8.54 trillion at the end of February this year according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs ecosystem. ETFs listed in the US reported net inflows of US$58.3bn in February this year, bringing year-to-date net inflows to $129.4bn, the second highest on record.

ETFGI said substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $48.3bn in February. The Vanguard S&P 500 ETF (VOO) gathered $6.47bn, the largest individual net inflow.

Financial results

CoinShares is headquartered in Jersey, with offices in France, Sweden, Switzerland, and the U.K. and publicly listed on the Nasdaq Stockholm.

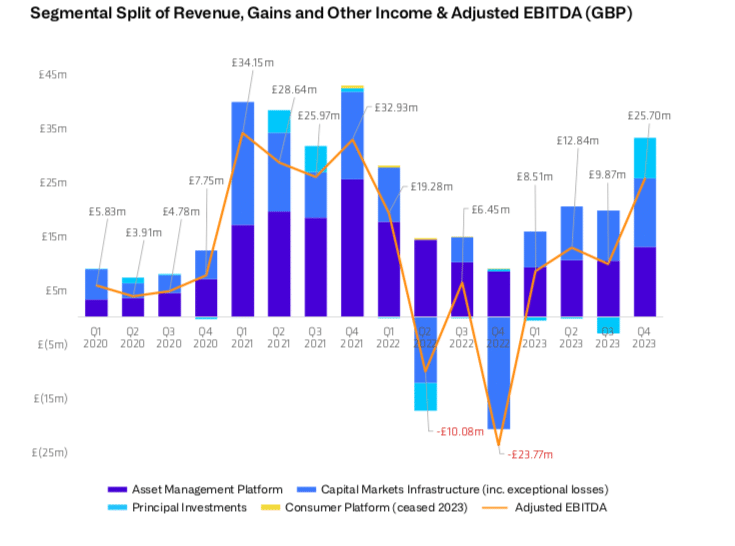

The company reported in its fourth quarter results for last year that it had four consecutive quarters of profitability and an adjusted EBITDA for the year of £56.9m.

In the group’s fourth quarter report Mognetti wrote it is clear that we are witnessing a momentous shift in the digital asset industry with the SEC’s approval of spot bitcoin ETFs representing a significant milestone, and reinforcing CoinShares’ long-held belief in the institutionalisation of bitcoin and potentially other digital assets.

“Since the launch of Europe’s first digital asset ETP in 2015, XBT Provider, we have observed the European crypto ETP category flourish, reaching over $8.8bn at the end of 2023.,” he wrote. “The SEC’s recent decision is poised to catalyse a shift, encouraging European institutions to reconsider their stance on crypto exposure. This is evident in countries like France, where we’re seeing a growing openness to offering crypto exposure through regulated products such as ETPs.”

In addition to expanding in the US, the report said that in 2024 CoinShares will be enhancing Hedge Fund Solutions with a series of new strategies. In addition to these new strategies, CoinShares Asset Management will expand in Europe through its French AIFMD licence.

“Integral to our plan is a concentrated effort on distribution and marketing of our funds, particularly in the US, UK, and other regions where our products are eligible” wrote Mognetti. “The importance of distribution in these key markets cannot be overstated as it is a critical factor in raising assets under management.”

In 2024, CoinShares will also continue to assess opportunities to realise gains within its principal investments portfolio.

Mognetti said: “Our objective remains to establish CoinShares as a comprehensive one-stop shop for digital asset investment, providing a diverse and sophisticated range of options to investors.”