Hiring slowed at Cboe Digital in the second quarter, partly due to ongoing regulatory uncertainties according to Jill Griebenow, new chief financial officer at Cboe Global Markets.

Griebenow spoke on Cboe Global Markets’ second quarter results call on 4 August. She said: “While we are still incredibly committed to the digital business, we continue to watch the regulatory landscape closely and adjust our spending to match the revenue environment.”

Edward Tilly, chair and chief executive of Cboe Global Markets, said on the call that Cboe Digital was a top strategic growth priority alongside derivatives and data and access solutions and all three businesses grew revenues during the second quarter.

Tilly said: “During the quarter Cboe Digital recorded solid volumes with $4.6bn total traded on our spot market.”

During the second quarter Cboe Digital also received regulatory approval for margin futures contracts which are due to launch later this year.

“This makes Cboe Digital the first U.S. regulated crypto-native exchange and clearinghouse platform to offer leveraged derivatives products,” he added.

Cboe Digital will then have the ability to execute spot, margin cash and physically settle futures on one platform, which the firm said is unique within the U.S. The initial product rollout will include physically and financially settled Bitcoin and Ether contracts which will help customers to trade futures with more capital efficiency.

Before the approval Cboe Digital could only offer fully collateralized trading and clearing of Bitcoin and Ether futures, which require customers to pay the full amount of a futures contract upfront. Margined futures are more capital efficient as customers only have to post a percentage of the contract value as collateral.

The next stage is to obtain CFTC approval for the contracts that Cboe Digital wants to list, trade and clear. Once approved, the contracts will have to be executed and cleared through a Futures Commission Merchant (FCM) in a fully intermediated model.

“We continue to see engagement from market participants about the opportunities this asset class affords, and we’ll continue to leverage our trusted, transparent and regulated market structure to advance the industry forward,” said Tilly.

David Howson, global president of Cboe Global Markets, said on the call that the exchange has applied for regulatory approval of spot Bitcoin ETFs on behalf of five issuers and has surveillance sharing agreements in place with a number of crypto trading platforms. He said that if they get approved it will be positive for the industry and for investors who want regulated exposure to crypto.

“The market makers involved in those ETFs and the create and redeem process are going to need to hedge that potential exposure,” Howson added. “They’ll look to a spot and futures market in order to do that.”

Options trading

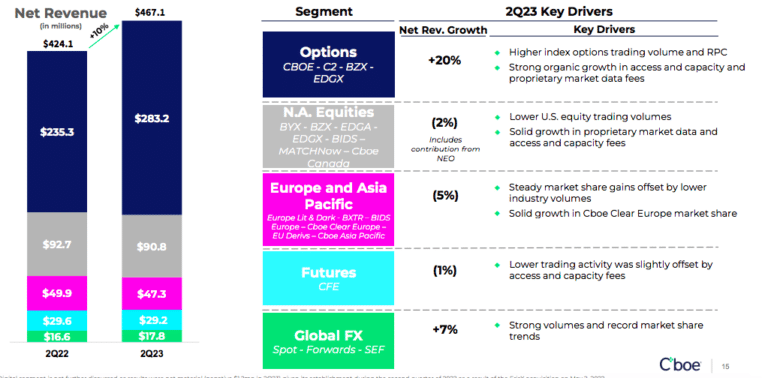

The options segment delivered the highest growth of any segment for the second quarter with net revenue increasing 20%.

During the second quarter SPX (S&P 500 index options) volume increased 33% to a record 2.8 million contracts during the quarter. Annual daily volume for SPX options opened on the same day of expiration was nearly half, 44%, of overall SPX volumes in the second quarter.

Tilly said: “As we’ve noted before, we believe there has been a fundamental evolution in how customers are trading this product, and we anticipate this volume to continue.”

He expects to see continued increased volumes from retail traders who came into the options market during the pandemic. Cboe will continue to focus on developing a short-term tradable product that is designed to allow customers to more effectively trade in the market.

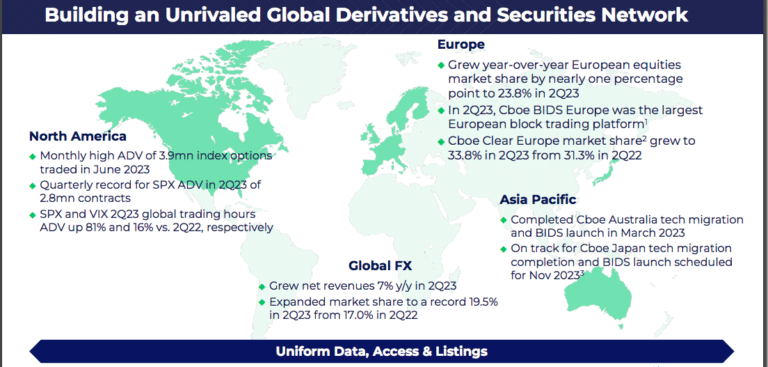

In addition, demand for SPX and VIX options grew during global trading hours with annual daily volume increasing 81% and 16% respectively from a year ago.

In July Cboe also launched options on its corporate bond index futures which Tilly said it can use for additional products in the future. In partnership with S&P Dow Jones Indices, Cboe also plans to launch a new Cboe S&P 500 dispersion index, which aims to standardize the measurement of S&P 500 dispersion, a measure of market risk.

Tilly continued that CBOE expects to receive regulatory approval for new margin requirements related to cash-settled index options against ETFs that track the same index, which will provide customers with greater capital efficiency.

“Additionally, we are preparing to launch single stock options on our Cboe Europe Derivatives exchange in the fourth quarter of this year with active engagement from market participants who share our vision of growing the market and delivering a simpler and more efficient pan-European trading and post-trading experience,” he added.

Global growth

In the second half of this year, the group anticipates new opportunities across data and access solutions, including demand for Australian equity market data following Cboe Australia’s migration to Cboe’s uniform trading platform.

Griebenow said: “In Australia we saw a solid uptick in data sales and access since the migration, in line with what we have witnessed following past technology migration.”

She expects this momentum to continue and add to the enhanced distribution capabilities of Cboe Global Cloud, providing incremental sales potential for Cboe’s data products.

Tilly said Cboe remains on track to migrate Cboe Japan technology in the fourth quarter of this year and launch Cboe BIDS Japan, subject to regulatory approval.

“With the launch of Cboe BIDS Japan, the BIDS network will now extend to seven of the top 10 global equity markets, creating a one-of-a-kind global equity block trading network,” he added.

Cboe has also announced the launch of Cboe Global Listings which aims to facilitate access to capital and secondary liquidities for companies and ETFs.

“The expansion of our listings business rounds out our global equities offering, helping to enable market participants around the globe to utilize Cboe markets for more uniform access to equity trading, market data and listings,” Tilly added.

Howson explained that Cboe’s strategy is not to compete for blue-chip listings at Nasdaq and NYSE. Instead, Cboe will build from the existing ETP listings business, which he said is at number two in the United States, and its trading, market data, indexing, and derivatives expertise to engage with with customers and issuers from the $50m to $500m market cap range which he described as a niche underserved portion of the market.

He continued that these companies are driven by technology, research and by the key drivers of the new economy such as fintech and critical minerals.

“If you take the example of critical minerals, we’ve got issuers in Australia who are interested in those investors who have appetite and interest in critical minerals companies in Canada,” Howson added. “So that’s a great opportunity for us to be able to give access to that global capital in partnership with our global liquidity providers and legal capabilities and common technology platform.”

In addition, Cboe Clear Europe has said it will introduce securities financing transactions in 2024, subject to regulatory approvals which will ease capital requirements by providing a centrally cleared service for stock lending.

Financials

Cboe reported that net revenue grew 10% year-over-year in the second quarter to $467m and adjusted EPS increased by 7% to $1.78 over the same timeframe.

Tilly said the group reported its ninth consecutive quarter of double-digit, year-over-year net revenue growth. He continued that strong results were driven by the derivatives and data and access solutions categories.

Griebenow said on the call that derivatives delivered a 21% year-over-year net revenue increase in the second quarter of 2023.

Data and access solutions net revenue grew by 9% year-over-year. In contrast, cash and spot markets net revenue decreased by 11% which Griebenow said was due the challenging volume environment across geographies in the second quarter.

“Moving forward, we expect to be at the higher end of our unchanged organic total net revenue growth target of 7% to 9% for 2023,” she added. “The positive revenue and expense guidance revisions for 2023 speak to our ability to effectively monetize the near-term environment while continuing to invest prudently in future growth.”