Transaction cost analysis (TCA) has transformed from a compliance-driven routine into a mission-critical tool for institutional trading desks. What was once a post-trade “checkbox” for regulatory purposes is now deeply embedded in the buy-side’s performance optimization and broker evaluation strategies, according to Crisil Coalition Greenwich.

The recent U.S. equities TCA: The buy-side view report from Crisil Coalition Greenwich found that approximately 85% of buy-side traders now use TCA not only for post-trade insights, but as a key tool in evaluating broker performance.

“We expect both [broker-client relationships and broker competition] to be more data-driven as the buy side continues to generate more data around their trading,” said Jesse Forster, Senior Analyst at Crisil Coalition Greenwich and author of the U.S. Equities TCA report.

“This includes not only performance versus their benchmarks but quantified aspects such as sourcing liquidity (finding blocks), operational issues (failed trades), and overall customer service,” he told Traders Magazine.

That growing transparency presents new challenges and opportunities for brokers: “This could be a double-edge sword for brokers,” Forster said.

“While some will no longer be able to get by leveraging existing relationships, others will be able to capture more order flow based on their performance around not only trading, but these adjacent aspects.”

In some cases, it’s created openings for smaller or regional players, according to Forster: “This is an area in which the smaller, more regional brokers seem to excel, and how they are earning valuable spots on buy-side broker lists.”

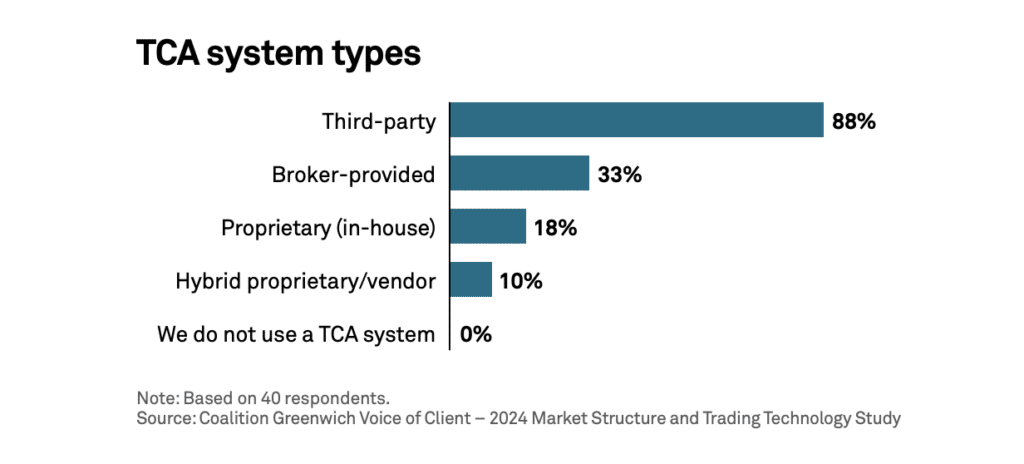

The build-versus-buy debate for TCA platforms has also shifted. According to the findings, 88% of buy-side traders rely on TCA systems provided by third-party vendors.

“The days of buy versus build are over—we are well into a buy, build and integrate world,” Forster stressed.

While most firms continue to lean on vendor platforms for TCA, about one in five buy-side firms have opted to build their own proprietary systems, according to Crisil Coalition Greenwich.

These are typically larger asset managers with complex trading strategies, multiple asset classes, and diverse investment products. The move to build in-house reflects not just scale but a need for highly customized solutions tailored to unique workflows and performance metrics.

“It really seems to be the largest managers who are building entirely (or even mostly) in house at this point. Most simply don’t have the resources or the need to do so on their own. Nor do they generate enough trading data on their own to conduct meaningful analyses,” he said.

Ease of integration has made third-party platforms the default for many. “Interoperability is vital and more important than ever, but it’s no longer the dirty word it once was,” Forster noted. “TCA providers have made their systems so easy and cost-effective to incorporate into the buy side’s workflow that it’s kind of a no-brainer for most at this point,” he added.

While post-trade analysis remains the most trusted feature in a TCA platform, there’s increasing interest in expanding TCA’s role into the pre-trade space—especially as more desks adopt automation and algorithmic execution tools.

“It should become more important as the buy side continues to embrace algo wheels and trade automation in general,” Forster said. “There’s definitely been skepticism around pre-trade, but that should subside as platforms generate and incorporate more robust post-trade data into their pre-trade models.”

As technology evolves, AI continues to generate excitement—but Forster believes the biggest impact will come from improvements in automation and usability. “That’s the $1m question, isn’t it!” he said. “I’ll continue to put my money on the customer service aspects, same as for other trading technologies such as OEMSs. This includes customized proactive alerts before an issue arises and enhanced chat bots for ad hoc queries. Anything that helps automate the button-clicking.”

Buy-side firms are also demanding greater flexibility and personalization from their TCA tools. “Both are vital. No one’s going to buy a platform they can’t seamlessly integrate into their own workflows and fully customize to their needs,” said Forster. “There are too many options out there otherwise, so that ship has sailed.”

As more desks embrace automation and data science, the firms that can integrate TCA effectively into their workflow will be the ones best positioned to adapt—and outperform.

“The good news is the providers know this, and upstarts like Spacetime and others have already built their systems accordingly. The only issue now is for a few legacy providers who haven’t gotten that memo yet for one reason or another,” Forster concluded.