TECH TUESDAY is a weekly content series covering all aspects of capital markets technology. TECH TUESDAY is produced in collaboration with Nasdaq.

The vibes changed in capital markets just over a month ago, and whether you like it or not, vibes can have a powerful knock-on effect.

We’ve seen that play out broadly over the past five weeks. From my perspective, vibes are a byproduct of what Daniel Kahneman would call “System 1” or “fast thinking.” In his profoundly influential book, Thinking Fast and Slow, Kahneman argues that human brains are designed for two (distinct) types of thinking. Fast thinking allows for us to operate at the pace of modern life. In antiquity, that type of thinking kept our ancestors alive.

As a reminder, early homo sapiens were comparatively insignificant creatures. We were somewhere in the middle of the natural food chain. The ability to make quick, often emotionally driven decisions was critical. Those that made reflexive decisions were more likely to avoid the wrath of a saber-toothed tiger and pass on their genes. Point being, “fast thinking” is hardwired into the human experience… and for good reason.

Our survival instinct remains finely tuned. In 2025, the average human makes around 35,000 conscious and subconscious decisions a day. Today it takes plenty of resources (economic-speak for “money”) to survive. Periodically, concerns about potential future resource scarcity leads to quick market declines.

I’m of the opinion that the most recent market gyrations are driven by our survival instinct in the modern economic savannah.

The first disconcerting noise came from the release of a potentially much more efficient artificial intelligence (AI) model. “DeepSeek Day” rattled sentiment (vibes) as global investors began to question the future growth path and valuation of market leaders.

The second (probably more concerning) caterwaul was also headline driven, specifically, the plans for imposing meaningful tariffs on some of America’s largest trade partners. Those “noises” (headlines) continue to reverberate, but the first two were enough to trigger a stampede of sorts. In 2025, we’re not running from a predator, we’re hitting the sell button and asking questions later. Fight or flight.

More investors have chosen “flight.” It’s our survival instinct.

2017-2018 Corollary?

Analog comparisons have limited practical value. It’s always at least a “little different this time.” However, there are enough parallels to pique my attention. In 2017, U.S. large-cap indexes exhibited some of the lowest volatility in history. There was a consistent grind higher that accelerated in Q4 ahead of the Trump Jobs and Tax Cut Act.

- Nasdaq-100® Index (NDX) 2017 Performance: +31.5% on 10.3% realized volatility

- S&P 500® Index (SPX) 2017 Performance: +21.8% on 6.7% realized volatility

It was, in some ways, a halcyon era:

- NDX 2024 Performance: +24.9% on 18.2% realized volatility

- SPX 2024 Performance: +25.0% on 12.6% realized volatility

Chasing Returns

Throughout 2017, capital poured into “short volatility” funds. In aggregate, at the end of 2017/early 2018, there was roughly $6 billion in assets under management for “short volatility” products. Without going into unnecessary detail, those exposures unwound in a very “Hemingway…” gradually, then suddenly. (See also: XIV and SVXY). Sentiment soured quickly. Flight.

For the past handful of years, capital has been streaming into mega-cap tech and the “Mag 7+,” in particular. Valuations got stretched and the vibes changed. In a few short weeks, about $3 trillion in market capitalization has been lost in those handful of names. The markets of today reprice risk with incredible velocity. Flight.

Sell now. Ask questions later.

Survive.

To be clear, there’s a very real difference between levered short volatility and owning highly profitable large-cap equities. The point is that changes in sentiment can trigger very real drawdowns. Some are cataclysmic. Others are manageable. The last spat of volatility has been manageable. Put more directly, it’s been very normal.

Chasing returns is also very normal.

Uncertain Future

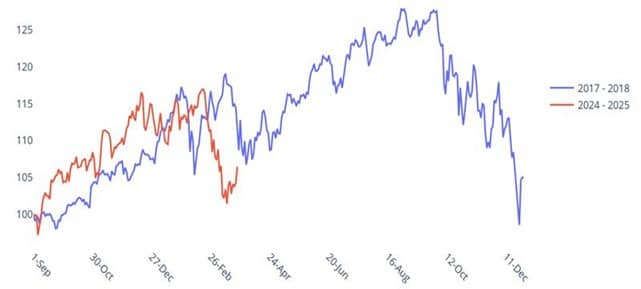

Source: Nasdaq Index Options

The chart above plots the price performance of the NDX during two, arguably similar periods. Both lines start on September 1. The blue line shows the path for the NDX between late 2017 and the end of 2018. The red line illustrates NDX performance over the past ~seven months. There are some clear similarities: end of year advances followed by meaningful drawdowns in Q1. In both cases, investors were spooked. Uncertainty was elevated. Trump administration was threatening to impose tariffs. It was confusing, and the NDX closed 2018 down just over 1% and the economy did not fall into recession.

Forward Vol View

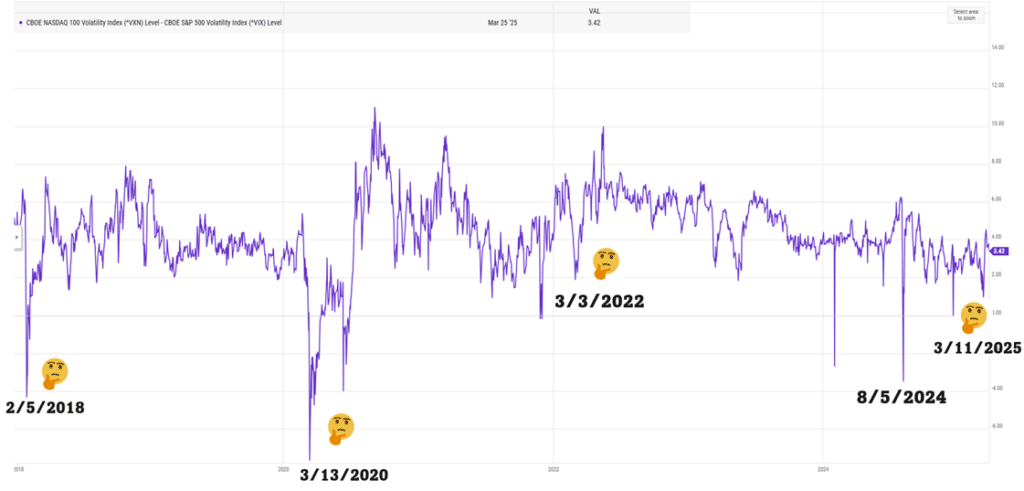

- In February of 2018, the Cboe Nasdaq-100® Volatility Index (VXN)’s closing high was ~34 and it briefly (February 5, 2018) measured below the Cboe Volatility Index (VIX).

- In February of 2025, VXN’s closing high was ~29, and intraday (March 11), it briefly measured at a discount to the VIX.

I’m in the habit of taking note when that forward volatility relationship inverts. It’s unusual and may signal opportunity.

Source: YCharts & Nasdaq Index Options

In an overt attempt to stick with the “savannah” and survival of the fittest theme, VXN is like a young cheetah in the wild. It can move very quickly, but in some situations it’s slower to react. Imagine the VIX is the young cheetah’s mother… she’s experienced uncertainty throughout her life. When she senses a predator, it’s time to go. Flight. Survival.

In those rare instances, the VIX tends to move first and fastest, but in this case, it plays out in the index options market as opposed to on the Sahara (or on Planet Earth via your favorite streaming app). Furthermore, this signal, while less entertaining in the moment, could provide financial opportunities.

The discerning observer may find spots where NDX implied volatility appears cheap relative to similar SPX facing exposures. Perhaps the signal could be more directly viewed as a capitulation. In any case, it’s part of the data we’ll continue to track, and periodically, call to your attention.

In the interim, Think Fast… and Slow.

Creating tomorrow’s markets today. Find out more about Nasdaq’s offerings to drive your business forward here.