TECH TUESDAY is a weekly content series covering all aspects of capital markets technology. TECH TUESDAY is produced in collaboration with Nasdaq.

As the U.S. Federal Reserve and other central banks raise interest rates aggressively to fight inflation, stocks have taken it on the chin, and the technology sector has been among the hardest hit.

This year’s underperformance is not unexpected: tech companies are typically fast-growing, which means they’re more constrained by higher rates, and tech stocks usually have high price-earnings multiples and low dividend payouts, both of which are unhelpful amid market downturns.

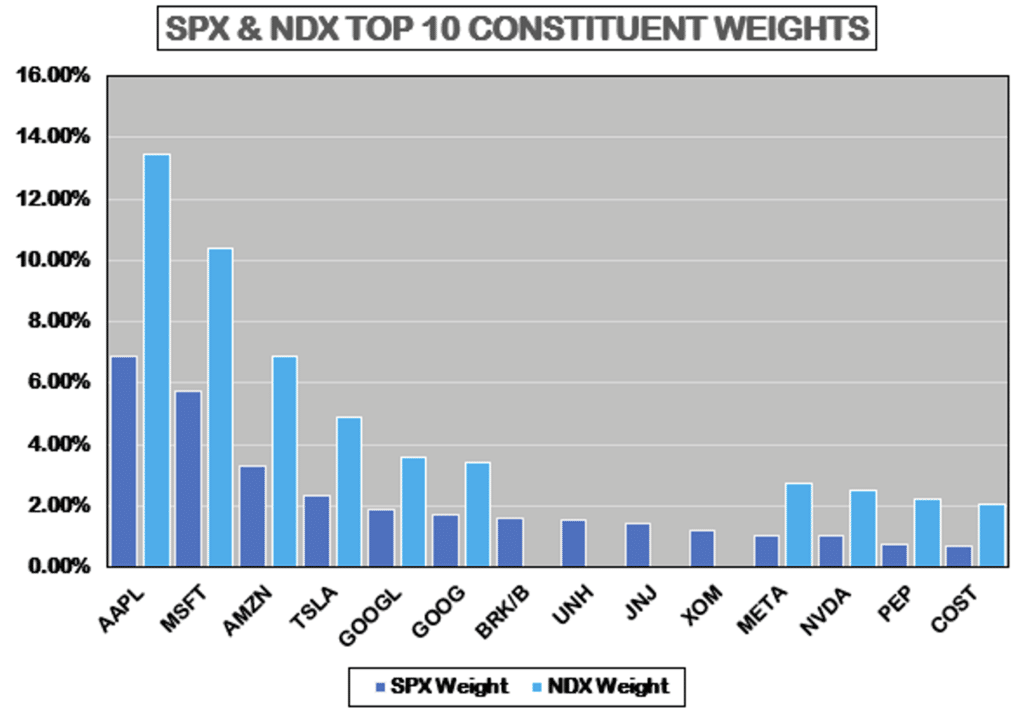

But well-known names such as Apple, Microsoft, Amazon, Tesla and Alphabet have gained influence over time such that they aren’t just the biggest technology companies in the S&P 500 Index (SPX) – they’re the biggest companies, period. “The ‘recipe,’ or makeup, of an index matters,” said Kevin Davitt, Head of Nasdaq Index Options Content. “Technology companies have come to define the world around us, as well as the global economy.”

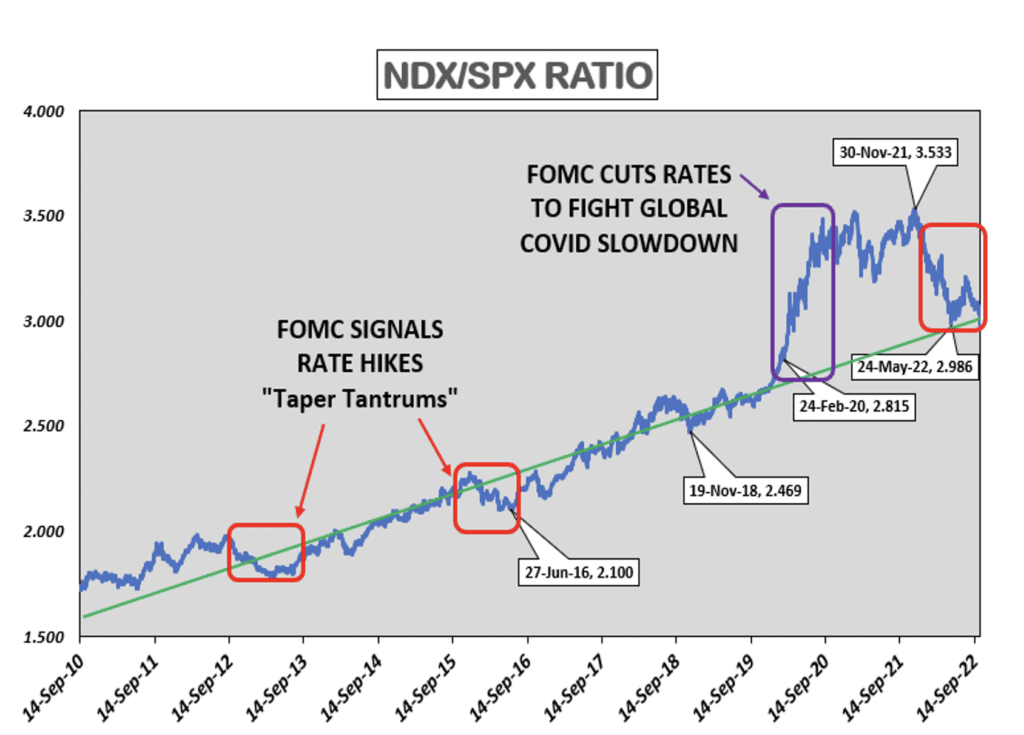

And long-term patterns show that tech stocks’ slumps should be ridden out because there’s always a turning point. “Technology has been the key ingredient for portfolio growth and outperformance,” Davitt said.

Information technology comprises 55.3% of the large-cap Nasdaq-100 Index® (NDX), more than double the 27.3% proportion in the SPX.

Source: Nasdaq, DJ S&P

The below graph of the NDX-SPX ratio over the past 12 years shows two modest troughs amid hawkish rate signals from the Federal Reserve and a spike coinciding with interest rates being cut to 0-0.25% early in the COVID pandemic. The long-term pattern of the ratio is steadily higher.

Source: Nasdaq

The benchmark Fed Funds rate is currently 3.00-3.25%, up from 0-0.25% at the beginning of the year, and there are expectations for another 75-basis-point increase when the Fed meets again in early November. Following the October 13 CPI reading, the terminal rate projection bumped to 4.75%. However, if inflation data cools in the coming months, the ‘dot plot’ might adjust lower.

That could be good news for tech stocks, potentially manifesting itself in the form of higher valuations. “Arguably much of the future rate hikes and quantitative tightening (i.e., the FOMC letting assets mature and selling assets to reduce balance sheet) has been priced in” to current levels, Davitt said.