Moves by the U.S. Securities and Exchange Commission in the exchange-traded fund market, which are likely to lead to a proliferation of new products, have led to concerns that the balance sheets of authorized participants may become constrained.

The SEC has allowed Dimensional Fund Advisors to launch an ETF share class of an existing mutual fund, and the regulator is expected to quickly allow other fund managers to do the same.

In addition, the U.S. regulator has approved generic listing standards for exchange-traded products that hold spot commodities, including digital assets, rather than requiring them to be approved on a case-by-case basis, which can be a lengthy process. Under generic listing standards, SEC approval is virtually guaranteed as long as a filing meets the stated requirements, so approval should take less than 75 days.

The SEC adopted the “ETF Rule” in September 2019 which standardised requirements for the majority of ETFs and this led to a proliferation of new products. As a result, there are now more ETFs listed than individual stocks and generic listing rules for crypto products are likely to have a similar impact. Matt Hougan, chief investment officer of crypto asset manager Bitwise, said in his CIO memo that the adoption of generic listing standards is likely to usher in a “ton of new crypto ETPs.”

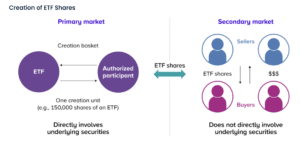

ETF shares are created when an authorized participant, or AP, who is typically a large financial institution, provides a creation basket consisting of securities, cash, or both to the fund. APs are the only investors allowed to interact directly with the fund and as as dealers in ETF shares

Jamie Harrison, head of ETF Capital Markets at asset manager MFS, told Markets Media that his desk focuses on accessibility for clients, making sure its ETFs products have tight spreads and are tax efficient. Therefore, the desk needs to partner with an AP for rebalancing through custom in-kind transactions.

“This requires the balance sheet of our counterparties so we need to secure that partner,” Harrison added. “As ETFs proliferate there is concern about capacity in the marketplace, because balance sheets are going to start getting constrained among ApPs, and securing that balance sheet becomes harder.”

Rich Lee, head of program trading and execution strategy at Baird, told Markets Media in an email that the past quarter involved significant ETF volumes. The broker heard from several clients that counterparties were told about balance sheet constraints or were trying to lock up rebalances so that they could manage balance sheet usage.

“As the assets under management of ETFs grow, so does the potential to soak up balance sheet to facilitate rebalancing needs,” Lee added.

Growth in active ETFs

SEC approval of the ETF share class is likely to lead to the launch of more active ETFs. Harrison said this was due to product innovation and investors realizing the benefits of the ETF wrapper such as efficiency, tradability and transparency.

“It is early days and hard to predict the actual impact of the ETF share class but it could result in a tectonic shift for the industry,” Harrison added. “At MFS are going to continue to stay close to industry partners and participants, and continue to vet and monitor the situation.”

He highlighted that a lot of work needs to be done to implement the ETF share class from the standpoint of compliance, legal, administration, custody and broker-dealer distribution.

MFS launched the firm’s first actively managed ETFs in December last year across five investment categories: US Value, US Growth, International Equity, US Core Plus and Intermediate Muni Bond. They have already gathered approximately $750m in assets as of 31 August 2025.

Harrison argued that the biggest differentiator for MFS is that the asset manager launched the first mutual fund in 1924 and has bought that same investment capability to ETFs.

“A fundamental research-driven investment process in the active space is in our DNA and clients and investors see a natural extension in the ETF wrapper,” he added. “You can expect us to continue that strategy and lean into our core capabilities and strengths.”

In September this year MFS added to its ETF suite with the launch of an Active Mid Cap ETF. MFS said its six funds represent major segments of both the equity and fixed income markets for investors to build core market exposures.

Active ETFs in Europe

MFS has launched ETFs in the U.S. but Harrison highlighted there has been an uptick in launches and growth in Europe, even though the region does not enjoy the same tax efficiency as in the U.S.

“We are eyes wide open about the growth in Europe, and continue to vet that space,” he added.

Assets in the ETF industry in Europe surpassed $3 trillion for the first time at end of September this year, according to ETFGI, an independent research and consultancy. Net inflows to the end of September this year were a record $290.9bn, beating the previous high of $176.2bn in 2024.

Active ETFs in Europe gathered $5.8bn in September taking year-to-date inflows of $27bn, more than double the $10.7bn collected in the same period last year

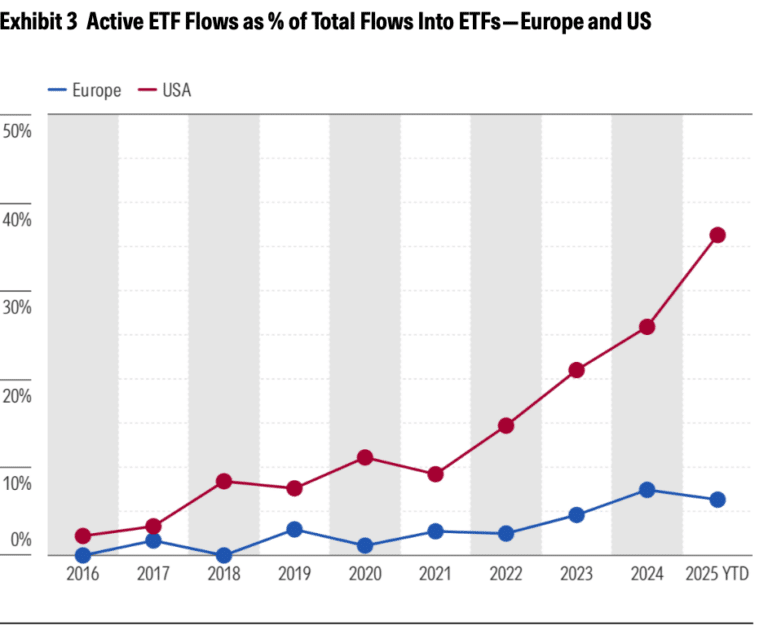

Morningstar, the fund management data provider, said in a report that assets in active ETFs in Europe were €62.4bn at the end of August this year, up from €55.5bn at the close of 2024. The active ETF segment has doubled in the past two years but still only accounts for 2.6% of total assets invested in ETFs in Europe, compared with 10.2% in the U.S., according to the report.

Flows into active ETFs in Europe accounted for 6.3% of total flows into ETFs at the end of August 2025, compared to 36% in the U.S.

Morningstar said the pace of new entrants in the ETF market in Europe has accelerated significantly in 2024 and 2025.

“Some have a long-standing passive ETF business and now want a slice of the growing active pie, but many are managers of active mutual funds who previously had shunned the ETF wrapper and now see a clear path to benefit from its popularity without having to set foot on the passive side,” added the report.