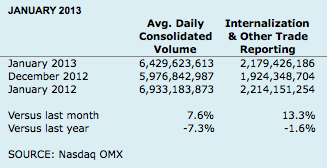

Consolidated trading in all venues picked up 7.6% in January, compared to December, according to Nasdaq OMX statistics.

But volume remained down 7.3% from a year ago.

Average daily volume reached 6.4 billion shares in January, according to Nasdaq. That’s up from 6.0 billion in December. But still down from 6.9 billion in the same month a year ago.

The biggest gains came in trading that occurred in brokers’ internal pools of orders and other off-exchange venues. Trading of 2.2 billion shares a day was up 13.3% from a year ago. And the drop from a year ago was less, at minus 1.6%.

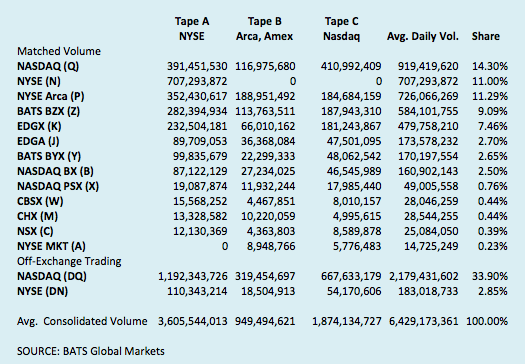

The Nasdaq Stock Market grabbed the most market share, according to separate statistics compiled by BATS Global Markets, which operates two national exchanges.

Average daily volume of 919.4 million shares on Nasdaq accounted for 14.3% of all consolidated trading volume. The New York Stock Exchange accounted for 11.0% and its sister all-electronic exchange, NYSE Arca, for 11.3 percent.

BATS’ main market, the Z exchange, came in at 9.1 percent and Direct Edge’s lead market, EDGX, came in at 7.5%. No other exchange picked up more than 2.7%.

Total off-exchange trading accounted for 2.4 billion shares a day of trading, or 36.7% of all trading, by the BATS count. Nasdaq’s count had the off-exchange share at 33.9%.

Off-exchange trading in some components of the Standard & Poor’s 500 Index, a broad measure of industry activity, reached nearly 50%.

Nearly half, or 48.9%, of all trading in Frontier Communications occurred in broker pools, dark pools and other alternate trading systems, according to BATS statistics.

Third on the list was off-exchange trading in Intercontinental Exchange, at 45.5%.

That Atlanta-based operator of derivatives exchanges and clearing services is in the process of trying to acquire NYSE Euronext, parent of the New York Stock Exchange, for more than $8 billion. Its chief executive office, Jeffrey Sprecher, has promised that the combined company would seek reforms of market structure, with Duncan Niederauer and the NYSE taking the lead.

Former Securities and Exchange Commission chairman Mary L. Schapiro as well as market participants and analysts have expressed concern about the ability of public markets do properly “discover” the right prices for stocks, when more than 40% occurs off public exchanges.