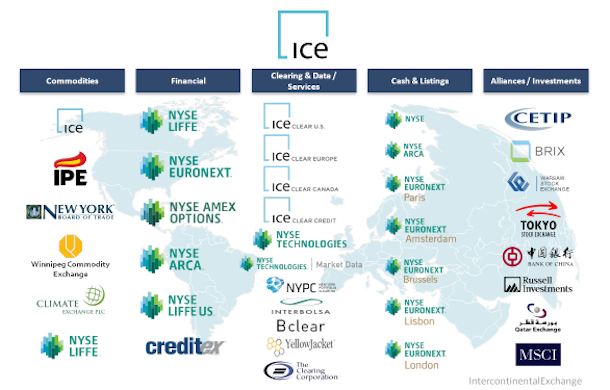

A first look at how ICE and NYSE Euronext line up against and with each other, as they head into a merger of their global activities in operating regulated exchanges and clearing operations.

INTERCONTINENTAL EXCHANGE

BASE: Atlanta, Georgia

OPERATES: Regulated futures exchanges and over-the-counter markets for agricultural, credit, currency, emissions, energy and equity index contracts.

BRANDS: ICE Futures Europe, ICE Futures U.S., ICE Futures Canada, ICE Clear Credit; ICE Clear Europe; ICE Clear U.S.; ICE Clear Canada; The Clearing Corporation; U.S. Dollar Index; ICE Link and Creditex.

MARKET WORTH: $9.3 billion

First nine months of 2012:

REVENUE: $1.04 billion

OPERATING INCOME: $634.6 million

% of REVENUE: 61.0%

NET INCOME: $429.2 million

% OF REVENUE: 41.6%

NYSE EURONEXT

BASE: New York, New York

OPERATES: Exchanges in Europe and the United States that trade equities, futures, options, fixed-income and exchange-traded products. Supplies technology to market operators.

BRANDS: New York Stock Exchange, NYSE Euronext, NYSE MKT, NYSE Alternext, NYSE Arca, NYSE Liffe.

MARKET WORTH: $5.8 billion

First nine months of 2012:

REVENUE: $2.46 billion

OPERATING INCOME: $725 million

% of REVENUE: 29.4%

NET INCOME: $506 million

% OF REVENUE: 20.6%

THE COMBINATION