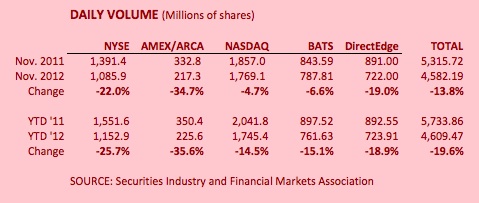

Trading volume on the nation’s 10 largest exchanges dropped 13.8 percent in November, according to statistics released Wednesday. That is the smallest monthly drop in market activity since July.

Daily volume in November on exchanges operated by NYSE Euronext, Nasdaq OMX Group, BATS Global Markets and Direct Edge averaged 4.6 billion shares, according to the Securities Industry and Financial Markets Association. That was down 13.8 percent from the 5.3 million shares traded a day in November a year ago.

The SIFMA stats of the major exchanges closely track Nasdaq’s compilation of consolidated volume from all sources. For November, Nasdaq pegged daily volume in 21 trading days at 6.2 billion shares. That is down 15.1 percent from the 7.3 billion shares it recorded, on average, for 21 days in November 2011.

The activity charted by SIFMA is slightly up from October, when 4.4 billion shares changed hands each day, according to tallies reported to SIFMA by the exchanges.

That followed a series of much larger drops in the past four months, including a year over year plunge of 47.4 percent in August. Volume in that month came far from matching the volume in August 2011, when Standard & Poor’s downgraded U.S. debt for the first time in ratings history.

But volume for the year, through November, is still down 19.6 percent. The ten markets’ average daily volume for the first 11 months also is 4.6 billion shares.

That compares to 5.6 billion shares on an average day in 2011. And 6.9 billion in 2009.

Nasdaq had the smallest drop of the exchange operators, at 4.7 percent, year over year, in November. Activity on the NYSE Arca and MKT exchanges dropped 34.7 percent.