One of the biggest debates in the stock market over the past decade has been over maker-taker rebates: the practice whereby stock exchanges pay brokers and high-frequency traders to trade on their exchange. The SECs recent proposal for a transaction fee pilot has brought this debate to the forefront and is viewed by many as a much-needed step towards a deeper understanding of the impact of exchange fees and rebates on execution quality for investors. We applaud the SEC for their initiative and were looking forward to the valuable data that this pilot could generate.

One common source of resistance to the SECs proposal has been the consistent stream of wheres the harm? questions. Some industry participants insist that rebates are a boon for investors, and that removing them would result in poorer execution quality. Most in the industry, including some of the largest investors in the world, know this is a false narrative.

To corroborate the widely held belief that rebates cause investors harm,[1]IEX has studied and quantified one specific way rebates distort competition for executions: a silent, repetitive, systemic wealth transfer where some high-speed traders?-?and the stock exchanges who sell them speed advantages?-?are benefiting at everyone elses expense. We call this the Rebate Tax, and it imposes significant costs on long-term investors.

Investors Suffer on Maker-Taker Exchanges

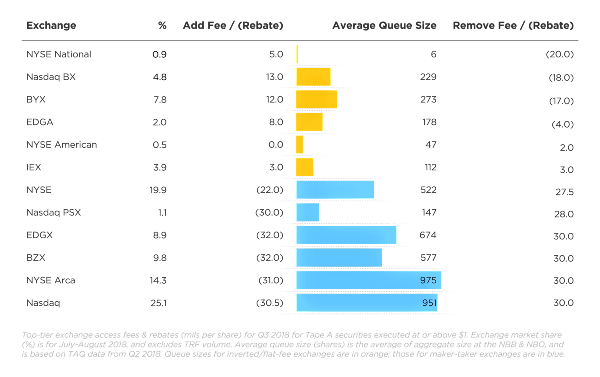

Heres how it works: publicly available data shows that maker-taker exchanges (those which pay rebates for adding liquidity) have the highest market share and the longest lines to trade.

An exchanges order book is comprised of limit orders that line up at their respective buy or sell prices, forming queues/lines at each price level. Orders at the front of a line will trade first, oftentimes without immediately moving the stock price in an adverse way. As an example, a small undersized marketable order that would not impact the supply/demand of a stock would trade with an order at the front of the line, and would be deemed a high-quality trade. However, orders at the end of the line wait longer to execute and are more likely to trade with larger marketable orders. Therefore, orders at the end of a long line are more likely to be adversely selected.

Compounding this issue is another feature of maker-taker exchanges: they charge thehighest fees to orders that remove liquidity. Consequently, smart order routers sending marketable orders will not target or prioritize maker-taker exchanges to avoid the high costs, which increases the wait time for resting orders on these exchanges. Furthermore, our prior research suggests a greater percentage of executions on maker-taker venues comes from market-wide sweeps that access multiple venues.[4]This is because firms needing to execute a large order tend to be more urgent and less cost-sensitive. Such executions are more likely to move market-wide prices.

Given the inherent nature of their business model, high-speed trading firms are much more likely to be at the front of the line than brokers representing investor orders. The ability of high-speed firms to form and quickly join any given price level within an exchanges order book usually relegates long-term investors to the back half of the line, where they tend to be the last to buy/sell at their price level. As a result, they repeatedly and systematically buy high and sell low on maker-taker exchanges.

Yet despite this, investors continue to wait in long lines to trade on maker-taker exchanges. Why? Rebates.

Whats the Cost of Trading at the End of Long Queues?

Venue data on performance doesnt tell the full story?-?it is simply the average for a given exchange, blending the experience and outcomes for both high-speed traders and long-term investors.Investors orders are more likely to be at the back of exchange order queues, so the average doesnt reflect their experience. Their brokers simply cannot compete with the speed and tools of high-speed trading firms, who purchase data, proximity and connectivity from exchanges to help them trade at the front of the line, consistently and reliably.

To understand how much investors may suffer because of the Rebate Tax, we need to know how joining (and trading) at the back of a long line affects performance and profitability, versus trading towards the front of the line.

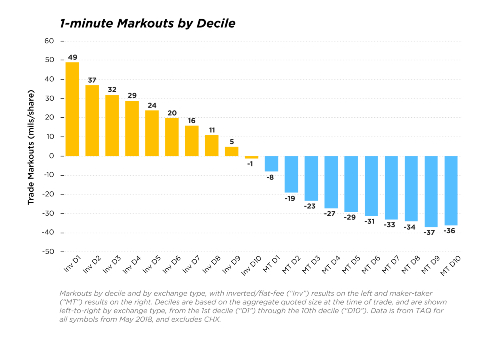

To do this we group trades at the best bid or offer based on the length of the line?-?as measured by aggregate quoted size?-?at the time of trade. Trades that happen when the quoted size is large (relative to a given symbol) are likely executing towards the front of a long line, whereas trades when the quoted size is small are more likely to be trading towards the back of the line, or when everything ahead has already been exhausted. We created symbol-specific deciles for queue position, with the first decile representing the first 10% of shares trading at the front of the queue, and the tenth decile representing the last 10% of shares trading at the back of the queue.[5]

To measure potential harm to investors, we look at 1-minute markouts,[6]a widely used metric across both industry and academia that assumes the position opened by an execution is closed out 60 seconds after the trade. Think of it as the 1-minute P&L or a measure of how much the market moved in favor of or against the buyer/seller. Positive markouts reflect greater potential profit, whereas negative markouts reflect adverse selection, or buyers/sellers remorse.

Our results above very clearly demonstrate that brokers and the investors they represent are generally worse off when trading on a maker-taker exchange.In fact, the adverse selection costs of trading in a long line on a maker-taker exchangeexceedsthe maximum rebate paid by such venues?-?so the rebate itself doesnt compensate for the worse performance.[7]

Moreover, performance of the back 10% of an inverted or flat-fee exchange line is oftenbetterthan performance of the front 10% of a maker-taker exchange line. This demonstrates the extent to which inverted exchange remove rebates?-?and the intermarket queue they create?-?influence the routing of marketable orders.

Simply put, the US exchanges have bizarrely fragmented the markets: there is a large (add) rebate incentive to send non-marketable limit orders to maker-taker exchanges, and there is a large (remove) rebate incentive to send marketable orders to inverted exchanges?-?which can ultimately prevent long-term investors from otherwise trading with each other. (As reflected in our first chart above: add rebates correspond to longer queues, whereas remove fees and rebates influence the sequence in which exchanges are accessed).This is a blatantly inefficient market for investors, but a brilliantly profitable market for middlemen like exchanges and high-speed traders.

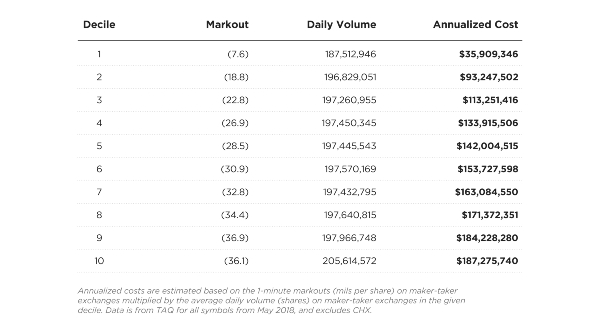

Investor orders being placed at the back of a maker-taker venues order queue are ultimately subject to a significant Rebate Tax. We present our estimated annualized costs from this Rebate Tax in the table below, where deciles represent relative queue position.[8]

We dont know where investors are exactly in the queue, so we refrain from reporting a single estimate of investor harm. We encourage investors to estimate their costs for themselves, depending on shares traded and their estimate of queue position on maker-taker exchanges. Ultimately, only the SEC and the proposed transaction fee pilot have the potential to provide more detail on this issue.

Even so, this represents significant value extraction in justthe first 60 secondsafter the trade. And it is just one measure of the harm from exchange rebates?-?our estimates dont include the opportunity cost ofnot tradingwhen investor orders wait on the longest lines without trading.

What Does This Mean?

The winners in the maker-taker regime are clearly high-speed traders who have the speed and market data to systematically beat investors to the front of the queue.

Exchanges also profit handsomely from this set-up, by selling high-speed data and technology at rising, monopolistic prices to aid and abet in this race to the front of the line.

Whos the loser in all this? Unequivocally, the investor. They are typically at the end of long lines waiting to execute and therefore are forced to pay a Rebate Tax?-?which is largely the reason that the largest investors in the world are fully supportive of the SEC transaction fee pilot.

[1]Public data now shows the negative impact on investors from the maker-taker pricing model where certain exchanges pay rebates to brokers in exchange for posting quotes on the exchange Brandes Investment Partners (https://www.sec.gov/comments/s7-05-18/s70518-3419059-162184.pdf)

[2]Rebates result in long queues of orders to buy and sell on the largest exchanges, which can result in delays in execution of trades for long-term investors (Brandes Investment Partners, April 10, 2018,https://www.sec.gov/comments/s7-05-18/s70518-3419059-162184.pdf), Better queue priority for orders leads to less adverse selection and better execution quality. Then, apart from the reduction in competition from market makers, to the extent that lowering fees and rebates reduces the amount of adverse selection on the venues where their orders are posted, investors execution quality may benefit a second way (Pragma, May 14, 2018,https://www.sec.gov/comments/s7-05-18/s70518-3643358-162401.pdf)

[3]See Elaine Wah, Stan Feldman, Francis Chung, Allison Bishop, and Daniel Aisen, A Comparison of Execution Quality across U.S. Stock Exchanges, (April 19, 2017), available at:https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2955297.

[4]Ibid.

[5]For a given symbol, we assigned executions at the NBB (NBO) to deciles based on the total quoted size at the NBB (NBO) in the symbol at the time of trade. We weighted deciles by volume to compare performance on a volume-equivalent basis. For a full description of our methodology, please see the accompanying white paper (https://iextrading.com/docs/Gone%20in%20Sixty%20Seconds%20-%20The%20Cost%20of%20Trading%20in%20Long%20Queues.pdf).

[6]We report 1-minute markouts as that is when we observe the performance curve flattening out, but our qualitative results are robust given other time intervals.

[7]We note that proprietary trading firms occupying the front of the line on maker-taker venues directly collect rebates, which offset the negative markouts of these executions. Part of the queue is also comprised of quantitative hedge funds, which typically employ cost-plus pricing models in which the rebate is passed through to the end client, and as such the rebate may offset any degradation in performance; however, we lack the data to estimate how much volume in each decile is due to these funds.

[8]We derive our cost estimates by multiplying the performance by the volume traded on maker-taker exchanges, on a decile-by-decile basis. We report annualized costs by decile as it is impossible to know the precise market participant composition in each decile.

About IEX