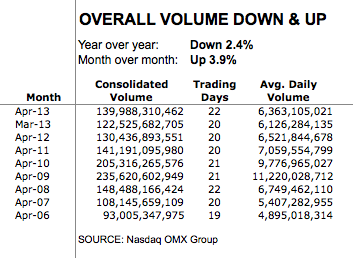

Volume on all public and non-public exchanges was 6.4 billion shares in April, according to Nasdaq OMX Group statistics.

That is up 3.9 percent from the 6.1 billion shares recorded in March, but down 2.4 percent from the 6.5 billion shares recorded in April of last year.

Trading volume is roughly at the same level as five years ago, by Nasdaq’s statistics.

NYSE Euronext reported a 10 percent year over year drop in stock trading activity, but a 2 percent gain from March to April of this year.

The New York Stock Exchange, NYSE Arca and NYSE-MKT handled average daily volume of 1.6 billion shares in April , the exchange operator said. That is a decrease of 9.5 percent from April of 2012, but up 2.3 percent from March.

Its share of trading in NYSE-listed stocks fell to 30.2 percent, from 31.3 percent a year ago.

Nasdaq OMX Group reported average daily volume on its three exchanges of 1.26 billion shares. That is up 11.2 percent from the 1.13 billion shares traded a day in March. But it is down 14.4 percent from the 1.47 billion shares it reported that its exchanges traded daily a year ago.

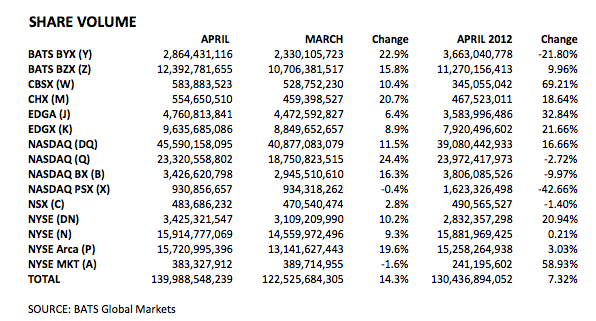

BATS Global Markets reported average daily matched volume on its two exchanges was 693.5 million shares in April, up from the 651.8 million share level in March, but down from the 727.4 million shares that changed hands in February.

That is also down from one year ago, when 746.7 million shares changed hands. Compared to a year ago, volume is down 7.1 percent.

In April BATS matched market share of its two national stock exchanges was 10.9 percent. That is up from 10.6 percent in March.

A year ago, BATS’ two exchanges had a 11.5 percent share of trading in equities in the United States.

Direct Edge has not posted its official April volume tallies to its Web site as of 7 a.m. Tueday.

But statistics kept by BATS Global Markets show the Direct Edge EDGA exchange handling an average of 216.4 million shares a day in April . That was down from 223.6 million in March, but up from 179.2 million a year ago.

EDGX, by the BATS stats, had average daily volume of 438.0 million shares in April, down from 442.5 million in March but up from 396.0 million a year ago.

Overall consolidated volume, including off-exchange trading, was at 6.4 billion shares.

That continues a downward trend that has persisted since 2008. Average daily volume in April 2008 was 6.8 million. But in April 2009, at the height of the credit crisis, volume on all public and non-public venues was 11.2 billion shares.