Old line dark pools are losing ground to newcomers.

A new study shows a slew of newcomer crossing networks, or dark pools, winning business at the expense of older “independent” pools. Systems operated by Credit Suisse, Goldman Sachs, Level Trading and others are overtaking those run by Investment Technology Group, Pipeline Trading, Liquidnet and NYFIX.

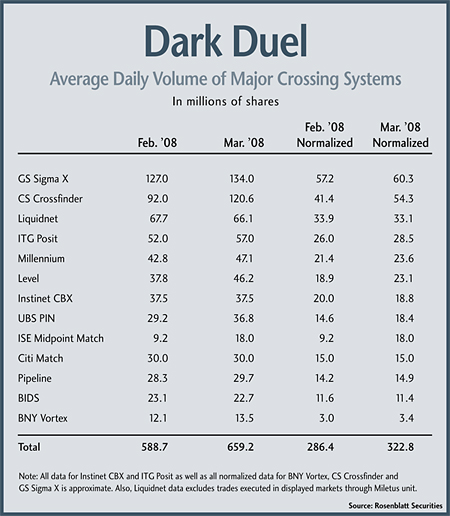

On an adjusted basis, for example, the Boston-based broker-dealer consortium Level executed 23.1 million shares a day in March, more than the older Instinet CBX and Pipeline pools.

“From the outset, we really went after attracting a lot of the algorithms, because there was a good amount of order flow coming out of the algos,” said Whit Conary, president of the 18-month-old Level. “And now that we have this critical mass of order flow, we’ve really been concentrating on getting some of the larger resting liquidity to come into the system.”

Conary said he saw existing customers increase their usage as they became more familiar with the system. Also, Level has kept its pricing low, he added, and has used its 4-billion daily share order flow to attract diverse types of liquidity.

The report, prepared by Rosenblatt Securities, found that the group of new dark pool operators was processing about 204 million shares per day in March. Pools operated by Goldman Sachs and Credit Suisse accounted for over half that volume. Older pools operated by independent agency brokers did 119 million shares in March.

All told, dark pools executed an estimated 323 million shares a day in March. That represents approximately a 13 percent jump from an estimated figure of 285 million shares executed a day in February.

For its report, Rosenblatt “normalized” the data by discounting firms’ multiple countings of traded shares. Most non-displayed markets count the volume of each side of the trade, effectively double-counting, Rosenblatt noted.

Joe Gawronski, Rosenblatt president and co-author of the report, believes dark pool volumes will continue to grow. “I think non-displayed liquidity pools will continue to gain share over the next six-to-12 months,” he said.

After the calculations were made, the figures showed that dark pools continued to jockey furiously for order flow. Broker-sponsored pools kept the lead they grabbed recently from the independent pools, such as Liquidnet and ITG’s Posit.

Goldman Sachs’s Sigma X remained the industry leader in March at approximately an adjusted 60.3 million shares a day. But its lead has been shrinking.

Credit Suisse’s CrossFinder saw its volume jump to approximately an adjusted 54.3 million shares a day in March. This represented a growth of 31.2 percent from February, versus a 5.4 percent growth for Sigma X over the same period.

But Rosenblatt analysts calculated that dark pools accounted for 3.88 percent of U.S. consolidated equity volume last month, compared to 3.94 percent in February.

Next to the prevailing proportionate execution volume estimates of others in the industry, Rosenblatt went on to say that dark pools “account for a much smaller piece of the trading pie than the 15 percent or more often cited by other analysts, pundits and industry professionals.” Analysts have taken the numbers from dark pool venues at face value and, in turn, have grossly over-estimated the overall percentage of the market that is being completed in those pools, he said.