The SECs Transaction Fee Pilot (the pilot) is about market structure reform. It is about aligning the interests of stock exchanges and brokerswith investors. The path to getting there requires unwinding the monopolistic and conflicted business models of the incumbent exchanges. In the end, we hope that simplifying the overly complex and fragmented market structure reduces implementation costs for all investors.

When over 50 pension funds and institutional investors managing $8 trillion dollars[1]on behalf of millions of households voiced their universal supportforthe pilot earlier this year, the New York Stock Exchange saw the writing on the wall. Their ability to pay rebates was in jeopardy, and they needed to act. NYSEs business model relies on paying rebates: NYSE buys market share with rebates, which helps to entice order flow to an exchange with poor execution quality.[2]In turn, market share is used to justify charging monopolistic prices[3]for market data and connectivity.

So NYSE has gone into crisis mode.

Instead of questioning the merits of the pilot?-?which would be difficult since the SEC pilot is well designed, informed by industry input, and universally supported by investors?-?NYSE decided to mislead their listed companies. In a blog post, they published a disingenuous analysis claiming the pilot would cause one billion dollars in harm to investors, ignoring the fact that every investor who has spoken out is overwhelmingly insupportof the pilot.

When we challenged NYSE on their work of fiction, they wrote in a comment letter, Our assumptions may be imperfect, but the IEX criticisms, issued without any alternative analysis, were devoid of any basis.[4]

Let this blog serve as basis.

It is clear NYSE is trying to bait IEX into a food fight, to avoid a debate over substance. As fatigued as the industry may be with the war of words, we felt that as the only exchange supporting the pilot, IEX is in a unique position to refute NYSEs arguments.

Flaws in the Foundation

In our view, NYSEs model, assumptions, and conclusions suffer three fatal flaws?-?no solid foundation for a pillar of capitalism:

The model published by NYSE gives anyone the ability to stress-test those assumptions…which we did. After we adjusted for a range of practitioner- and fact-based parameters, their headline-grabbing number of $1 billion in harm evaporated, reduced by as much as 90%. Furthermore, even assuming a marginal benefit to implementation costs from reducing or banning rebates would flip the script, showing that the pilot could dramatically help investors.

Crack #1: Investors dont add liquidity. Or do they?

If spreads widen, investors crossing the spread would incur a higher cost. But investors who add liquidity would receive additional benefit, as they capture a wider spread. Thats why identifying the correct rates of adding and removing is critical.

NYSEs initial premise was that investors only cross the spread and never add liquidity. While the table in NYSEs original blog positions the harm as the cost to spread-crossing orders, the $1 billion is consistently, and emphatically, presented as an overall cost to investors. The Excel model included in NYSEs follow-up blog suddenly walks back this critical assumption: the model now assumes that investors cross the spread 50% of the time (instead of 100%) and capture the spread 20% of the time.[8]This has an immediate, dramatic impact:

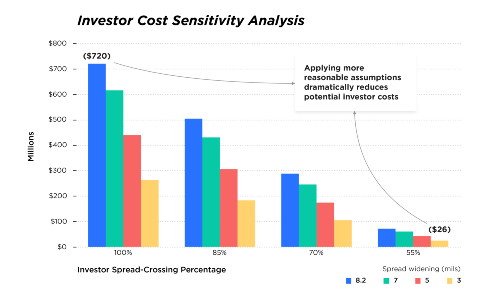

1. If we accept NYSEs assumption that 49% of market volume is Agency[9]and none of it adds liquidity, their model generates a cost of$720 million?-?matching their initial estimate of Agency cost. (Note: to arrive at the $1 billion, one needs to factor in the manufactured increase to the cost of principal orders.[10])

2. However, if we then update NYSEs model for the 50% remove and 20% add rates, the cost drops to$216 million?-?a far cry from both the $720 million and the total $1 billion estimate.

NYSE assumed?-?without support?-?that investors never add liquidity, so we did some fact checking. Across the agency and bulge bracket broker dealers we polled, adding rates across all types of institutional order flows ranged between 25% and 60%, with the mode at 40%.

A 40% add rate for investors, using NYSEs flawed model, would produce a $144 million cost to investors, an 85% reduction from their original $1 billion estimate.

In fact, evidence suggests that institutional liquidity add rates might actually increase following a rebate reduction. In 2015, Nasdaq conducted an experiment where, for a subset of highly liquid securities, they lowered the access fee to 5 mils/share and the rebate to 4 mils/share. Nasdaqs analysis of the results showed that thebiggest percentage increases in liquidity provision in the experiment stocks were from three buyside oriented firms, one retail firm, and interestingly one electronic market maker also increased liquidity provision.[11]Unsurprisingly,the biggest percentage decreases in liquidity provision in the experiment stocks were from fee sensitive electronic market makers.

In other words, lowering the rebate reduced hyper-competition to be first in line to provide liquidity, creating opportunities for investors to add liquidity more often and decreasing their need to cross the spread. So the 40% assumption for adding rate during the pilot might even be low.

This phenomenon helps expose a key blind spot in NYSEs analysis: investors ultimately driverealprice discovery and will provide liquidity when not crowded out of a latency and rebate obsessed market structure. Both institutional and retail investors submit limit orders independent of a rebate consideration because rebates generally do not accrue back to their beneficial owner. Therefore, if rebates decrease it will not change the prices at whichinvestorsare willing to display orders.

Of course, Nasdaqs experiment and its outcomes arent a perfect proxy for what is likely to happen in the Transaction Fee Pilot. That experiment was done unilaterally and only in highly-liquid securities. It reduced their quoted size at the inside,[12]and Nasdaq lost 1.8 percentage points[13]of market share. Ultimately, we wont resolve the debate around rebates and access fees with conjecture. This is the reason the pilot is so important?-?it will provide the ability to gather real data on a critical and long-debated market structure issue, and its impact on market quality and the cost to trade.

Crack #2: Rebates uniformly narrow spreads.

NYSE states that since the pilot would reduce access fees for certain securities, rebates would decline commensurately.[14]The flawed assumption is that spreads would then uniformly widenby the same 8.2 mil amount as the rebate reduction.

As any market practitioner knows, spreads are narrow or wide for a variety of reasons: investor supply and demand at various price levels, market maker competition and risk tolerance, share price, volatility, average daily volume, and many other factors. In other words, the assumption thatonlyrebates keep spreads narrow is weak.

Many quotes at the NBBO (National Best Bid and Offer) are from exchanges that do not pay rebates to liquidity providers. For the 1,000 most active stocks, which represent nearly 80% of all market volume, at least one of the non-rebate paying exchanges (Nasdaq BX, Bats-Y, EDGA, and IEX) is actually onbothsides of the NBBOabout 50% of the time and on one side of the NBBO about 90% of the time. This suggests that NYSEs spread prediction is off byat least50% for the most actively-traded securities.

Once again, Nasdaqs real-world experiment reveals the weakness of NYSEs 8.2 mil assumption. When Nasdaq reduced rebates to 4 mils as part of its study, its time quoted on both sides at the NBBO (the inside), declined from 93% to 88%. If we assume that when Nasdaq wasnt at the inside, their spreads increased from 1 cent to 2 cents,[15]this would mean that their average spread increased ~5 mils a share, from 107 mils to 112 mils.[16]In contrast, NYSEs model would have you assume that spreads would have widened by 26 mils,[17]a 5-fold overestimate.

Cracks Cause the Pillars to Crumble

The below sensitivity analysis demonstrates how quickly the costs shrink when re-calibrating the spread-crossing percentage and the amount by which spreads might widen.

Crack #3: Eliminating rebates creates zero benefits.

NYSE focuses solely on potential harm and ignores the full range of benefits that investors could realize if rebates were banned entirely.

Blackrock also opined on the dangers of focusing on spreads as the only measure of market quality: Some market participants will be inclined to focus exclusively on bid-ask spreads and quoted display size; however, these are just a subset of the dimensions which reflect market quality. Further, wider spreads and lower display sizes may not necessarily be negative outcomes if they are associated with elevated price transparency over the net economics of trading or a reduction in excessive market intermediation.[18]

Throughout the comment letter process, Blackrock and other large institutional investors have detailed the various problems caused by rebates: they introduce potential conflicts of interest in order routing, they exacerbate market complexity through unnecessary intermediation, and they increase adverse selection costs.

Taking each of these problems in turn:

1. When trading on behalf of an asset manager or pension fund, rebate payments from exchanges to brokers are not passed onto the investor client, which creates a strong potential for conflict. Norges Bank, the largest sovereign wealth fund in the world, said[19]:[Rebates] can lead to a potential conflict of interest where routing decisions are driven by rebate considerations to the detriment of the execution quality of the trade program, particularly if rebates are tiered via volume discounts.

2. Equity markets are already complex, suffering from excess fragmentation and a proliferation of complex order types designed for proprietary high-speed traders, and not for investors. This creates an extra cost burden for investors and their brokers, as they try to navigate this complexity. Again, in Norges Banks words[20]:This has led to a remarkable complexity in exchanges access fee and rebate models. We believe that this complexity has the potential to be a net detriment to the well-functioning of markets overall.

3. Investor orders on exchanges often execute at the worst possible moments?-?when the stock price moves against them?-?increasing their overall cost of trading. Per AGF Investments[21]:resting orders placed on exchanges which charge the highest fees and, in turn, pay the highest rebates, experience the most adverse selection. Nonetheless, these exchanges have the longest order queues, suggesting that brokers continue to direct orders to venues offering worse performance.

Investors are indirect market participants, and their agents are generally not competing in the latency race to zero. They are not the fastest to the front of the line nor the quickest to get out of the way. In short,investors are not monetizing market complexity; they are taxed by it.

This pilot is designed to test removal of what we believe is the single largest source of complexity in U.S. equity market structure. It may not be the last step but it should be the first in trying to build fairer markets for all participants. If a reduction in complexity results in even a fraction of a basis point of implementation cost savings, investors will come out of the pilot better off than they went in, which is why they have universally supported it.

A Pillar ofCapitalism or A House of Cards?

NYSEs analysis was the basis for an inflammatory comment letter, aggressive issuer outreach, and headline-grabbing television appearances?-?all tactics to distract regulators and the industry from the real issues.

Investors and brokers told us they were surprised by the visceral campaign from such a storied institution as the NYSE. The only plausible explanation is that NYSE believes a thorough examination of the data and facts will lead to the elimination of rebates, undermining the core of their business model.

Market share in todays equity landscape is finely carved up with little change year-over-year. Exchange families have evolved into portfolios of venues, mainly differentiated by their rebate price points. If rebates were eliminated, there will be a huge jump ball for market share among trading venues, now forced to compete on execution quality. Its understandable that incumbent exchanges would rather not face this threat.

The last time the industry was roiled in such a divisive debate was during IEXs exchange application. At that time, exchanges and select high-speed trading firms were pitted against the investor community and IEX. This time around, NYSE has tried a different tactic, rallying issuer support with an eye-popping number that, at its heart, is a scare tactic meant to advance NYSEs own commercial interests while defending its conflicted business practices.

Our markets deserve better. Better behavior from its stewards and better execution quality from its market structure. The Transaction Fee Pilot is a critical step to getting there. It would be a shame if the Commissions attempt to meaningfully improve our markets were derailed by incumbents trying to protect the status quo. Over $8 trillion of U.S. household wealth and savings shares this view. Now thats an eye-popping number we can get behind!

[1]In U.S. equity assets.

[2]As measured by adverse selection and markouts.

[3]Because an exchanges trading services are a necessary prerequisite to its data business?-?an exchange would have no data to sell without executing transactions?-?the production of market data requires exchanges to incur high fixed, joint, and common costs. (Nasdaq response to Patomak petition, February 26, 2018)

Today, for-profit exchanges enjoy an oligopoly over the dissemination and sale of market data. (Patomak petition, December 6, 2017)

The market for proprietary data feeds is not fully competitive. (U.S. Department of the Treasury, A Financial System That Creates Economic Opportunities: Capital Markets, October 2017)

[4]Seehttps://www.sec.gov/comments/s7-05-18/s70518-4022871-167340.pdf

[5] NYSE Group estimates that annual trading costs to investors would increase by at least $1 billion per year during the course of the Transaction Fee Pilot as a result of these widening spreads. (Seehttps://www.sec.gov/comments/s7-05-18/s70518-3755194-162578.pdf)

[6] Estimated Costs to Liquidity Takers table fromhttps://www.nyse.com/equities-insights

[7] NYSE Excel model (https://www.nyse.com/publicdocs/nyse/Fee_Pilot_Interactive_Model.xlsx), cell D26.

[8]5% of trading occurs in Auctions, and another 25% occurs at the midpoint.

[9]NYSE and the entire industry know that many proprietary trading firms trade through a large brokers pipes under an arrangement called sponsored access. Such flow is marked agency, but exchange fees and rebates are often passed through to these customers, significantly changing how their orders should be accounted for in NYSEs analysis.

[10]The Principal Cost sub-bullet inNYSEs second blogapplies the fee reduction savings only to maker-taker venues, but applies the cost from wider spreads to all volume. NYSE assumes that spreads on maker-taker venues will widen, since there will be a reduction in rebates paid. That will be offset by the lower access fees one-for-one. However, they then assume that spreads will widen on non-rebate-paying markets, despite the fact that these markets were not reliant on rebates to maintain their spreads to begin with. These wider spreads would not be offset by lower access fees (since their access fees today are mostly lower than the caps in the Transaction Fee Pilot groups).

[11]http://people.stern.nyu.edu/jhasbrou/SternMicroMtg/SternMicroMtg2015/Supplemental/Nickel%20access%20fee%20pilot%20slides%20for%20NYU%20May%208%202015%20v3%20(1).pdf

[12]Nasdaqs Liquidity Share, which measures quote quality using both time and size at the NBBO, declined 10%.

[13]Page 5 ofhttp://people.stern.nyu.edu/jhasbrou/SternMicroMtg/SternMicroMtg2015/Supplemental/Nickel%20access%20fee%20pilot%20slides%20for%20NYU%20May%208%202015%20v3%20(1).pdf

[14]We assume that a reduction in access fees would result in a corresponding reduction in rebates. (https://www.nyse.com/equities-insights, July 10, 2018 blog)

[15]Each symbol was extremely liquid, so we are assuming that the spread was 1 cent, the minimum tick increment.

[16]93%*1 cent + 7%*2 cents = 1.07 cents or 107 mils; 88%*1 cent + 12%*2 cents = 1.12 cents or 112 mils

[17]30 mils – 4 mils = 26 mils of rebate reduction = 26 mils of spread increase, according to NYSEs logic

[18]Seehttps://www.sec.gov/comments/s7-05-18/s70518-3701799-162463.pdf

[19]Seehttps://www.sec.gov/comments/s7-05-18/s70518-3911490-166673.pdf

[20]ibid

[21]Seehttps://www.sec.gov/comments/s7-05-18/s70518-3920103-166993.pdf