FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura Company.

In addition to the holiday season, end-of-year is also prediction season in capital markets, as industry professionals pontificate on what the stock market, interest rates, volatility, and a host of other quantitative and qualitative metrics will do next year.

One prediction that has been correct for each of the past 50 years or so is “there will be more electronic trading.” This was especially true in 2020, as remote work and decentralized technology amid the COVID-19 pandemic accelerated the electronifcation of markets.

But taking a step back to look at the bigger picture, it turns out that while many earlier prognostications about electronic trading were correct about the trend, they misjudged the pace of change.

Trading industry veterans Jack Hughes and Michael Ray each told Traders Magazine recently that they underestimated the rise of electronic trading and how it would transform trading floors.

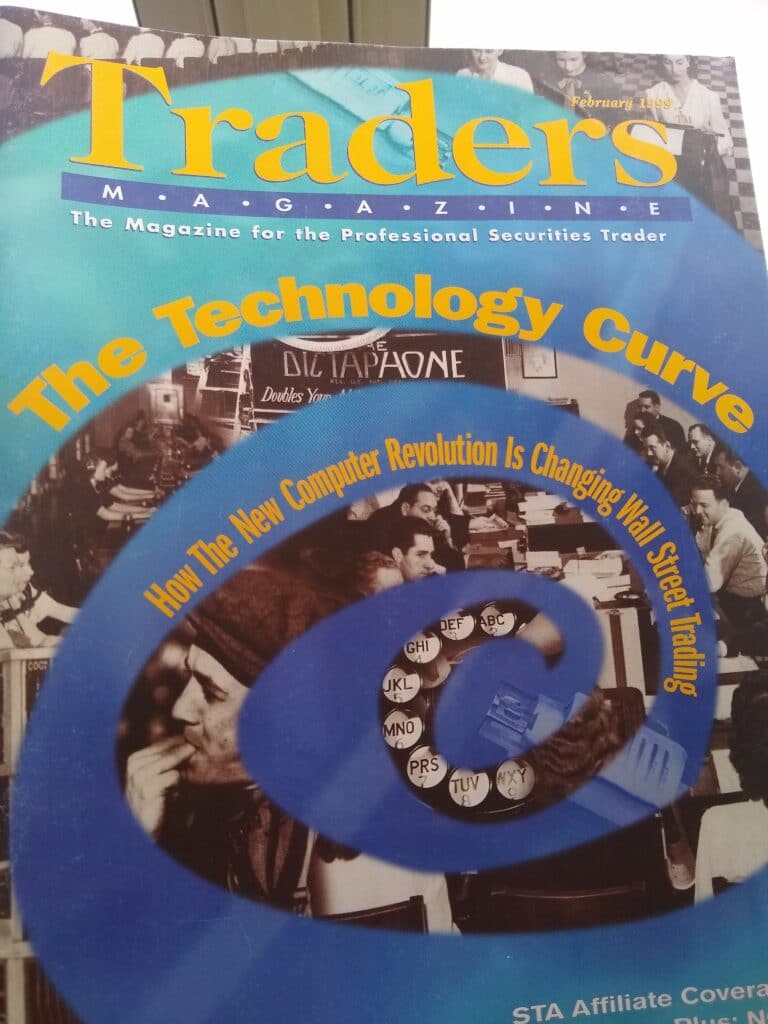

Going back further, a February 1999 Traders Magazine article “The Technology Curve: How the New Computer Revolution is Changing Wall Street Trading” had an interesting forward spin from a pioneer and visionary in the electronic trading space.

“Junius Peake, who in 1961 started running the 700-person back office at New York broker-dealer Shields & Co., was scoffed at when he presented his blueprint in 1976 for the creation of a nationwide electronic marketplace.

His vision was in line with the unbundling of commissions and most importantly, the National Market System mandated by Congress a year earlier.

Today, the realization of a national market system linking investors, market makers and price-quote vendors with the best-available prices at the moment of execution, is arguably taking shape….

…(Peake, then a finance professor at the University of Northern Colorado, then spoke about the evolution of electronic trading.) At the beginning, the pace of change is slow, gathering momentum toward the middle, later peaking at the top. “We are about one-third of the way along this curve, and I would say we have about another 50 years to go before we will peak.””

It’s difficult to pinpoint a peak in electronic trading, but it’s fair to say if it hasn’t already come, it will be well before the year 2049.

Even the best and brightest people cannot predict the future with full accuracy.

Junius Peake passed away in 2012 at age 80.