(FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.)

One name jumps out from the list of venues Vinyl Countdown NJ has played.

The classic rock tribute band has appeared at Our House in Farmingdale, The Cabin in Freehold, and General Saloon in Old Bridge, among other central New Jersey watering holes. ($14.99 burger & beer special at The Cabin weekdays until 4 pm.)

There’s also … the New York Stock Exchange. 😮🤯‼️

It’s reasonable to assume the gig at the iconic center of global finance was landed by bassist Peter Cocuzza, who recently retired from a five-decade career in capital markets.

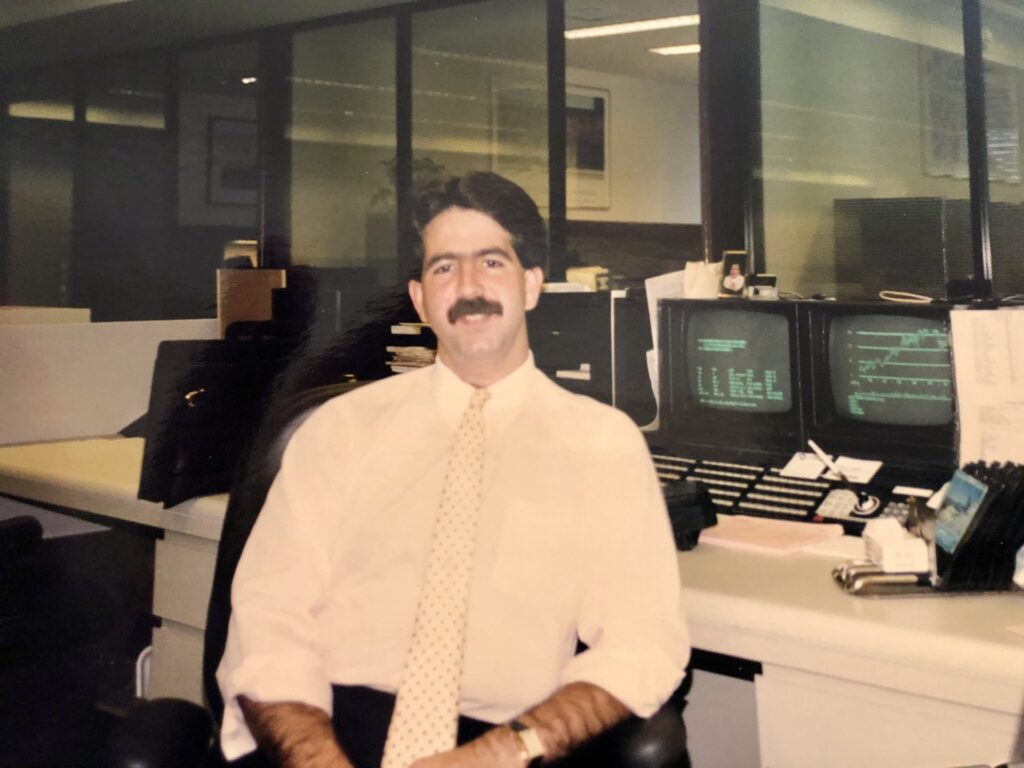

Cocuzza started his career in 1984 as an equity and options trader/analyst at PaineWebber before moving on to lengthy tenures in trading and business development at Oppenheimer Funds and Global Liquidity Partners. A longtime board member at the Security Traders Association of New York (STANY), Cocuzza is a well-known figure in the equity trading business.

Cocuzza, 67, retired this past May and now splits his time between family and music. Traders Magazine caught up with the trader/rocker to learn more.

How did you first get into the business?

I was very fortunate to get a job on Wall Street right out of college. I joined a firm called PaineWebber, which was eventually bought by UBS, and was put on the options trading desk. It was overwhelming. We didn’t really have electronics back then, but it gave me an amazing understanding of how stocks trade.

Eventually I switched from the sell side to the buy side, co-heading trading for Mitchell Hutchins, the mutual fund division of PaineWebber. That’s when I really started learning about portfolio management and the importance of communication between the portfolio manager, the analyst, and the trader. I’ve said this before: the tighter that relationship is, the better the execution is and the better the outcome is.

Then I moved to OppenheimerFunds in 2000, where I spent 13 years. That was more family-oriented and it was a really smart company. I was the head trader for the Value Funds, and I loved it.

How did the business change over your 44-year career, and how did you change with it?

The business changed dramatically. It went from a relationship-based, phone-driven world to full-blown electronic execution. When I started, you had to call people at the NYSE to make a trade. Now, you hit a button and the trade executes in Hong Kong before you blink.

I was fascinated by the rise of algorithms and worked at Global Liquidity Partners for the last 10 years of my career. We built highly sophisticated algos to help traders like me execute better. Dark pools came in, multiple exchanges — 18 of them now — and the markets just got more fragmented but more efficient. I stayed with it all the way through.

What was the biggest accomplishment of your career? What about the biggest screw-up?

One of my proudest moments was ringing the closing bell at the New York Stock Exchange with the STANY team. But really, what I’m most proud of is the relationships. The people I worked with, the connections I made. That’s what matters most to me.

As for the biggest screw-up… I’ll never forget this: a PM at PaineWebber told me to buy 100,000 shares of IBM at $100. I went out and bought 95,000 at $95. That’s a huge savings. But I didn’t fill the last 5,000 shares. The stock closed at $101. He lit me up. I said, “But I saved you a ton of money.” He said, “Doesn’t matter. You didn’t follow my instructions.” That stuck with me. From then on, I really focused on setting expectations with PMs and communicating better. That moment shaped the rest of my career.

When did you know it was time to step away?

I officially retired on May 1, 2025, but to be honest, it took a while to feel good about it. I wasn’t doing great for the first couple of months. I had been going 200 miles per hour for 40 years. I was struggling to adjust.

But I’m very family-oriented. I’ve been married a long time to the love-of-my-life wife Abbe, and I have the blessings of my two children, Danielle and Andrew, and three grandchildren, Luca (5), Gianna (3) and Logan (2). My grandkids live close and I get to take my grandson to school now. That kind of time, I wouldn’t trade for anything.

And I started seeing how strong the next generation was. With STANY’s Emerging Leaders group, I was watching these 30-somethings take charge, and I knew it was time. I did my part.

As the old saying goes, “Old traders never die, they just fade away.” Is that true?

Absolutely not! I’m not going away. I’m still very current. STANY keeps you sharp. Regulations, trends, market structure — I stay up on all of it. You might hear from me again. Maybe in consulting, maybe in mentoring, who knows? But I’m still here.

Do you still follow markets and keep in touch with the industry?

Oh yeah. Always. I follow the markets every day. I’m very interested in 24-hour trading. It’s already happening. Firms like Schwab and Webull are doing it. Crypto too. That whole digital asset space is evolving fast, and I’m excited about it. If anything would pull me back in, it would be that.

What’s your day-to-day like now? What do you enjoy in your free time?

When I’m not with the grandkids, I’m playing bass for Vinyl Countdown NJ. We’ve been together since 2014. We’re a classic rock cover band. We play everything from Tom Petty and Elton John to The Pretenders and Billy Joel.

We try to stand out by playing songs other bands don’t. And we try to play them exactly how they sounded on the record. That’s what sets us apart. I’m also the manager of the band so I talk to the bar owners and book the gigs.

One of my favorite shows was when we played the NYSE trading floor during a STANY event. I was upstairs on a panel, then ran downstairs, changed into my outfit, and played the set. I’ll never forget that one.

What does the future hold?

Family comes first, always. The band won’t last forever, but right now, it brings me joy. I’ll keep following the markets, maybe take on a bit of mentoring or consulting. But mostly, I’m grateful. I had a heartfelt, meaningful career, and now I get to enjoy what’s next.