FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

Editorial Staff at Traders Magazine often receive, shall we say, “interesting” pitches, that suggest public relations firms sometimes carpet-bomb rather than target their outreach.

For example, just this week we received an unsolicited e-mail pitch for a new book about “a family saga that centers on one woman’s struggles to navigate the unexpected twists and turns of a life that veers dramatically off course.”

We heard from a “Los Angeles-based activewear brand specially designed for those who love to strengthen and lengthen…the only U.S. brand that crafts its pieces with recycled yarn using a seamless knitting process.”

And we received a press release that leads with “Porch Pirates Beware!”, about a new technology meant to halt package theft.

We’re not at all criticizing the book or the products, rather we’re just highlighting that they’re not relevant for Traders Magazine, which focuses on, well, traders and trading in financial markets.

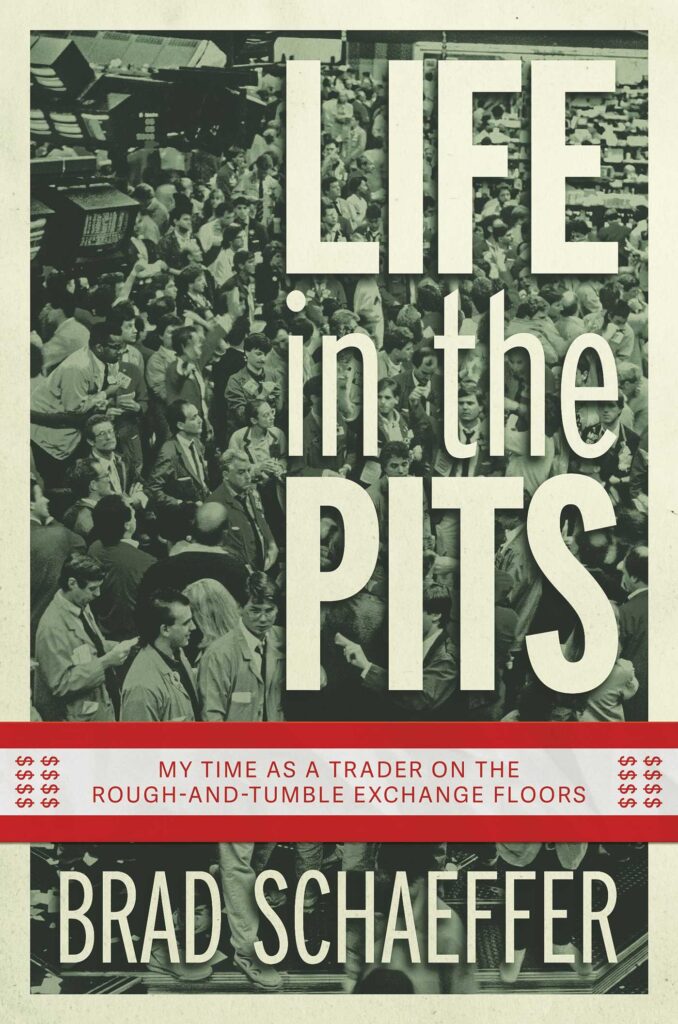

But sometimes we hear from someone we don’t know and the pitch is spot-on. We heard about a book coming out, written by former commodities trader Brad Schaeffer, which gives an intimate glimpse into what it was like to work on the raucous exchange floors in the trading pits of Chicago and New York.

LIFE IN THE PITS: My Time as a Trader on the Rough-and-Tumble Exchange Floors, due out on Dec. 5, recollects those last, most glorious days when red-faced alphas in colorful jackets performed thousands of transactions per hour, even as computerized trading heralded the floors’ ultimate demise.

The following author Q&A was kindly provided by Blankenship Public Relations.

Q: What prompted you to write this book?

A: It started off as an expansion of an article I wrote in the Wall Street Journal called “I’ll Miss the Trading Floor.” I felt that now that the exchange floors are closed and the pits are no more, the time was right to, in effect, write their epitaph, for lack of a better term. And I figured as both a former trader as and writer myself, it made sense that I do it. I’d spent years on several exchanges and watched some of the more significant historical events from the Gulf War to 9/11 and how they were processed in the trading world. The floors are gone now, and I wanted to tell their story while they were still fresh in my mind.

Q: You said “I’ll miss the trading floors”. What was it about them in particular you’ll miss?

A: I know this sounds strange, given Wall Street can be viper’s nest at times, but first off I’ll miss the honesty. What do I mean by that? Basically, in trading, there is really only one measure of success: your P&L. Nothing else matters. You can be a Harvard Law graduate or a high school dropout tennis pro—like the two traders I stood next to on the floor of the Chicago Merc—and all that matters is how much money you make. No one cared really about degree, or pedigree, or any other achievement outside the trading arena. If you were a good trader you made money. If not, you lost money. Period. No politics, no corporate maneuvering.

Also, I’ll miss the characters. The floor was where some of the most interesting people I’ve ever met could be found. We had former Major League Baseball pitchers, art historians, former farmers and meatpackers, people from all over. But most you saw on the that floor got there by being scrappers, and often iconoclasts. Some of the sharpest people I’ve ever known come from the pits. And some of the most successful today. It was a great incubator of talent.

Q: You write in your book that you feel like something was lost when the floors closed. What was lost?

A: Two things, really. First was that the exchange floor was a great avenue for those who lacked the esteemed pedigree like a Wharton MBA or MIT PhD to get a foothold in Wall Street and the trading world. Now, unfortunately, this backdoor pathway for those who may lack the finance bona fides is closed.

Which brings me to the second thing lost. The floor produced traders who understand that markets are human constructs. We literally watched how emotion affected decision-making. Put another way, we came to see that markets will not always behave rationally, or in concert with how one’s complex financial modeling predicts. We saw that happen with Long Term Capital Management…a group of well-heeled MBAs and even Nobel Laureates, who nevertheless went bust when the price action deviated from their carefully constructive predictive models, and they seemed baffled as to why. It was because they forgot the human factor. A factor that we understood from being a part of that factor itself.

Q: How much of the book is based on fact?

A: Actually all of it. As well as I remember after three decades have passed that is. I’ve changed the names just to give the people a modicum of privacy. And when the stories are second-hand I make sure to relay them as such. But most of what you read about I witnessed with my own eyes.

Q: Was it really as crazy and chaotic as you make it sound?

A: If anything, I think I actually toned it down a bit. There were times when you really felt like you were in a mosh pit.

Q: Are there any Wall Street books out there that you modeled this after?

A: I think my biggest influences are Reminiscences of a Stock Operator, by Edwin LeFevre and Liar’s Poker by Michael Lewis. The first book is what many in trading consider the best book on trading. It’s not only a fun read and historically significant, but it offers invaluable advice on trading. And Michael Lewis’ book is a such a fun read. Like me, he encountered great characters that he brings to life—my personal favorite is “The Human Piranha.” His was the first such fly-on-the-wall type book about Wall Street. I see LIFE IN THE PITS as the trading floor’s amalgamation of these two classics.

Q: So, would you say another reason beyond just telling the story of the trading floor is to impart lessons?

A: Absolutely. I’m 56 now. I first stepped onto the CME at age 21. I’ve both watched others make mistakes and made plenty myself just trading my own money now. I’ve learned a few things over the years. And if someone reading this comes away with not just a few laughs and some knowledge of a time that is now gone, but also takes away a few nuggets of hard-earned, and sometimes very expensive, wisdom to help them in their own speculative efforts, then even better.