FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

Peter Jenkins, Managing Director, Institutional Equities at CODA Markets, has a broad range of institutional trading experience, spanning the buy side, to the exchange sector, to trading platforms.

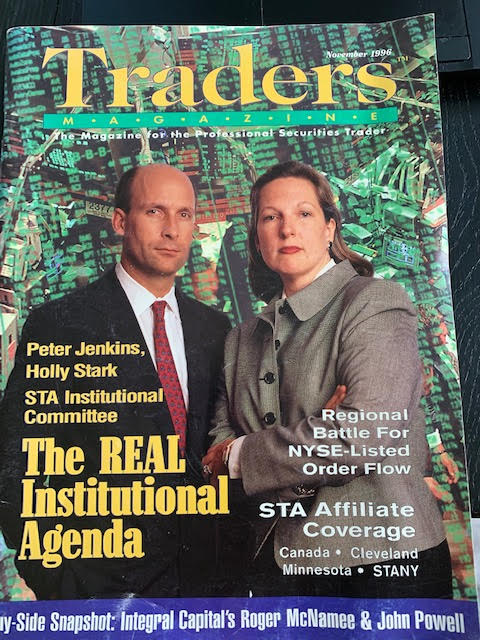

Jenkins appeared on the cover of the November 1996 issue of Traders Magazine, along with fellow STA Institutional Committee member Holly Stark. Jenkins was also quoted in a February 1999 Traders article about how the STA was primarily a sell-side organization. “We (the buy side) get some representation, and they voice our opinions. But we haven’t really shaped policy,” Jenkins said in the 1999 article.

Traders Magazine caught up with Jenkins to see what’s new in 25 years.

What do you recall about the STA and its role in the industry in the late 1990s?

The STA at the time was evolving. They allowed the buy side to expand their Institutional committee and have more time at the annual conference, but the policies and comment pieces did little to represent the buy side. The ICI market structure committee became the organization that played a big role in representing the buy side traders’ views in Washington. Subsequently, Ari Burstein ran the ICI committee expanding its membership and actions, while Jim Toes ushered in a new STA that helped transform the group, its representation, and their annual conference.

How has institutional trading changed since 1999?

After 1999, we saw a very quick move into automated markets, led by Credit Suisse building algos for the institutional trader. The VWAP benchmark became standard in those years as well, to assess execution quality. Manually operated dark pools (ITG, Instinet) arrived on the scene followed by more sophisticated ATSs, facilitating midpoint block trading.

What were the highlights of your time on the buy side, at Scudder and Deutsche Asset Management, from 1986 to 2004?

One of the highlights of my trading career was being invited as an Institutional Representative to sit on the NYSE Market Performance Committee when I was 29. Later I was asked to chair the NYSE Institutional Trading Committee and the Nasdaq Institutional Trading Committee. During this time, I also testified before Congressional subcommittees as a buy-side trader. Most meaningful to me though, was the excitement of leading a desk and working for a firm that allowed me to experiment with new technologies in order to achieve what was considered best execution at the time.

Why did you move on from the buy side?

I was offered the opportunity to lead the Institutional group at NYSE and sit on the Operating committee, as this historic exchange became a public company through its acquisition of Arca and began the move to be electronic.

How has your career evolved since then?

After the NYSE, Keith Ross asked me to come to CODA Markets. The exciting thing about CODA is its desire to create meaningful market structure change through auctions, using advanced computer technology and intelligent trading design. It’s completing my ‘wish list’ of places to be, in order to meaningfully impact market structure in a constructive way.

What has been most surprising/unexpected to you in the industry since the late 1990s?

The lack of innovation around the very basic problem of the continuous marketplace and the reliance on speed improvement as a work-around instead of true innovation. One-execution-at-a-time, while waiting in line at a series of fragmented continuous trading venues, is not an effective market structure for institutional trading needs.

How do you expect the trading business to evolve over the next 20 years?

My hope is that the business looks back to its roots for a logical solution to today’s market limitations. When NYSE trading first began in 1817, stocks were traded in auctions. It was the most logical and fair way for a stock to be traded. Buyers and sellers all came together in one place. Buyers competed with other buyers and sellers competed with other sellers in real time, and the result was a fair trade for all parties.

As the stock market grew, and more companies started listing, there was no longer enough time in the day to get through all the auctions for every stock. So, in 1871 the auction fell out of favor and NYSE resorted to a continuous market. And, 150 years later, that’s where we still are. A continuous, one-to-one market where every single order in a stock is still executed one trade at a time, one price point at a time. To make matters worse, there are now something like 16 exchanges and dozens of ATSs forcing investors to expose their order in multiple venues operating the same flawed model. This inefficient fragmentation only promotes further information leakage. It simply doesn’t have to be this way anymore because the technology and computing power now exist to once again have an on-demand, many-to-many, auction platform, not just for every symbol, but for every order. This promotes competition and true price discovery while minimizing market impact.

What’s in your future?

The equity markets are entering a new phase where there will be profound change brought on by further advances in technology and innovation. The cost and access to world news and data has allowed retail and smaller institutions the ability to compete with larger sophisticated players. Creativity and efficiency in building tools to enhance the investment process has allowed the US to increase liquidity and give access to almost anyone in the capital markets. I want to be a part of this change and CODA is the place to be.