The majority of traditional sell-side firms are expected to be replaced by new entrants in crypto derivatives according to research from Acuiti, a management intelligence platform.

Nearly two-thirds of respondents in the inaugural Acuiti Cryptocurrency Derivatives Management Insight Report thought traditional sell-side firms would be disintermediated and they also expect consolidation amongst the existing crypto derivatives exchanges.

The crypto derivatives market grew to a peak of $4.96 trillion in 2021 and the majority of crypto trading in February 2022, 62.7%, was in derivatives compared to spot markets according to the study.

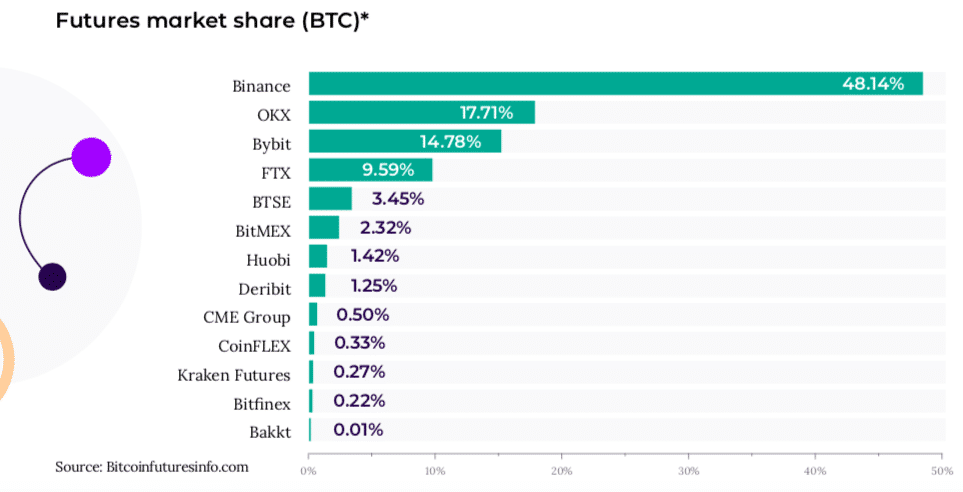

Binance, the largest crypto futures exchange, accounted for nearly half, 47.6%, of total volumes. In contrast, CME Group’s bitcoin futures and options had volumes of $36bn and $362.8m of volume respectively according to the report.

“The dominance of native crypto derivatives markets comes despite the uncertain regulatory regime they operate in,” said Acuiti. “This is resulting in the growth of a bifurcated market between traditional and native financial institutions.”

The report highlighted that a few sell-side firms, such as Goldman Sachs and TP ICAP, have executed crypto derivatives but most have been hesitant to enter the market apart from offering clearing for derivatives on CME. As a result, new crypto-native firms have emerged to offer access and services in derivatives.

For example, crypto exchange FTX has applied to the CFTC, the US regulator, to operate a regulated 24/7 derivatives markets offering a range of traditional products in addition to crypto with a market structure that would allow participants to clear directly, rather than through a futures commission merchant.

FTX currently operates a non-intermediated model and clears futures and options on futures contracts on a fully collateralized basis and has also proposed to clear margined products for retail participants while continuing with a non-intermediated model.

“The CFTC has launched a consultation on the proposals and, while it is not expected to approve the market to trade in traditional futures and options any time soon, it is likely to approve it for crypto derivatives as a test case,” said Acuiti. “This represents one of the most significant potential innovations in derivatives market structure since the advent of electronic trading.”

Crypto ETPs

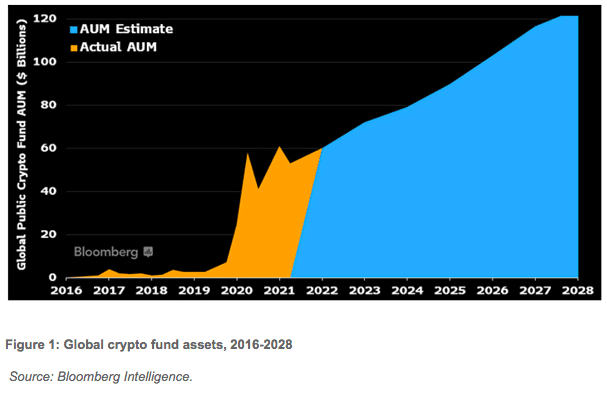

Increasing institutional demand and changes in US policy will push assets under management in crypto exchange-traded products above $120bn by 2028 according to a report by Bloomberg Intelligence.

Bloomberg Intelligence’s 2022 Crypto Outlook said the majority of institutions, 52%, took crypto positions in 2021, up from 33% in 2019. In addition, there was an increase in the number of US broker-dealers offering crypto products which supports retail involvement by offering convenient and simple access to products.

Julie Chariell, senior fintech industry analyst at Bloomberg Intelligence, said in a statement: “With some discipline, through regulation, crypto has the potential to achieve acceptance by peers in the shape of mainstream adoption.”

Bloomberg Intelligence estimated there are at least 107 cryptocurrency funds with 119 share classes listed on public exchanges globally, including exchange-traded funds, mutual funds and trusts.

“With the industry moving from a niche offering to a more established investment product, BI forecasts that exchanges such as Coinbase and FTX will see strong volume and revenue grow, while the potential for the U.S. to launch a central bank digital currency in the coming years remains a distinct possibility,” added Bloomberg Intelligence.

Spot bitcoin ETF approval

There are 15 blockchain or crypto-related equity ETFs currently trading on U.S. exchanges, compared to four in March 2021 according to BIoomberg Intelligence.

James Seyffart, ETF strategist at Bloomberg Intelligence, said in the report: “The number of publicly listed cryptocurrency funds – mostly tracking Bitcoin and Ethereum – should sustain the rapid growth of the past two years through 2022 and into 2023 as more countries allow the launch of spot products and regulators get more comfortable with digital assets.”

The US Securities and Exchange Commission started approving futures-based Bitcoin ETFs in October 2021 but has not authorised a spot Bitcoin ETF, unlike other jurisdictions. Bloomberg Intelligence predicted that regulatory approval will be a key catalyst for a spot Bitcoin ETF and would attract tens of billions in assets to crypto funds.

Consultancy Coalition Greenwich agreed that a spot Bitcoin ETF will help overcome hesitation among traditional financial advisors about recommending cryptocurrencies and could potentially attract billions of dollars in assets into crypto.

Financial advisors

US.advisors control about $26 trillion in assets, with only a small minority of those advisors having exposure to crypto according to Bloomberg Intelligence.

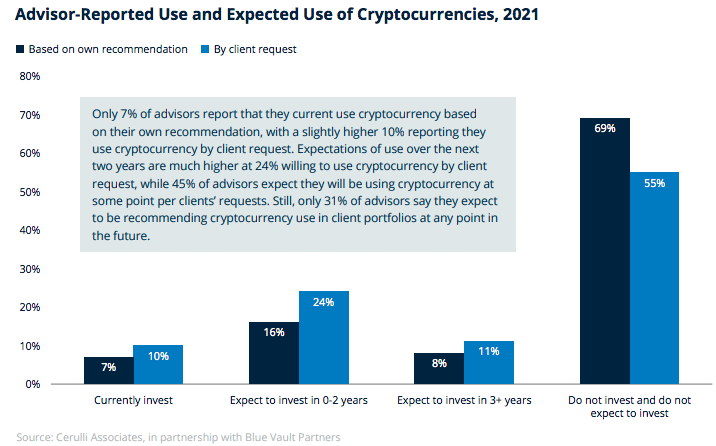

It is increasingly important for market participants, including asset managers and advisors, to engage and take a view on crypto according to Cerulli Associates. The research provider said in a white paper, Cryptocurrency: Navigating a Frontier Asset Class for Advisors and Asset Managers, that nearly half, 45%, of advisors expect to use cryptocurrencies by client request at some point in the future.

The majority, 80% of financial advisors, said in the report that they are being asked about cryptocurrencies, but only 14% are using or recommending cryptocurrencies.

Matt Apkarian, senior analyst at Cerulli, said in the report: “Many simply don’t understand or believe in cryptocurrency as an investment.”

As a result, crypto-focused organizations are developing standards that aid in understanding for investors.

“There will be payoff for cryptocurrency providers that devote time and resources toward advisor education,” added Apkarian.

The majority, 80%, of financial advisors in the Coalition Greenwich study, Retail Investors Want Crypto, but Advisors Face Roadblocks, support the creation of a spot Bitcoin ETF.

Kevin McPartland, head of research in the Coalition Greenwich market structure and technology group, said in a statement: “Despite the fact that buying Bitcoin is now quite easy for retail investors through a number of trading apps, the ability to gain that exposure through a traditional investment vehicle, traded and held by a traditional broker-dealer or investment firm, would provide tremendous comfort to many.”

President Biden issued an Executive Order on March 9 on the responsible development of digital assets which instructed regulatory bodies to put a framework in place for the new asset class.