Adena Friedman, president and chief executive of Nasdaq, said the partnership with cloud provider Amazon Web Services is “unique” as it involves expanding the company’s primary data center, which will lead to long-term revenue opportunities.

In November last year Nasdaq announced a multi-year partnership with AWS to migrate its North American markets to the cloud provider in a phased approach, starting with Nasdaq MRX, a US options market. Nasdaq will use a new edge computing solution that is co-designed with AWS specifically for market infrastructure.

Friedman said on Nasdaq’s results call for full-year 2021 that the firm wanted to review the experience of the MRX migration with clients before committing to a specific timeline for moving the rest of its US markets. Nasdaq has six US options exchanges and three US equity exchanges.

The partnership involves Nasdaq incorporating AWS Outposts directly into its core network to deliver ultra-low-latency edge compute capabilities from its primary data center in Carteret, New Jersey, to create the first private AWS Local Zone for the capital markets industry. AWS Outposts extend AWS infrastructure, services, APIs, and tools to virtually any data center, co-location space, or on-premises facility.

“The partnership with AWS will accelerate the migration of our North American markets to the cloud,” she added. “Specifically this year we plan to move our MRX options market to our next generation trading technology and as part of that migration, we also plan to move MRX into the AWS cloud environment within the Carteret data centre.”

Nasdaq has been using AWS technology since 2008, which Friedman said has proved beneficial as 2022 has started with increased volatility creating new records in trading volumes and message traffic. The firm has already moved many of the systems surrounding markets into the AWS cloud.

“We have hyper-scalability of our solutions today as otherwise we would have had to buy hardware to support the record volumes,” said Friedman. “That has been a real benefit in allowing us to scale for our clients and also moderating our expenses.”

In addition, over the last five years Nasdaq has been developing its trade lifecycle solution in the cloud, which was deployed in an options market in 2020 and will be deployed in MRX and the Nordic derivatives market this year.

“We are deploying cloud-based clearing and trading solutions out to our market tech,” Friedman added. “So we have already been making the investments needed to make sure that we are building out our solutions to support an AWS environment.”

Equinix and AWS will be doubling both the size and the power of the data center, which Friedman said will make it easier for Nasdaq’s clients to migrate to the cloud in the new AWS Local Zone. Market infrastructure operators and market participants will also be able to use new edge computing solution for the migration.

“We look forward to engaging with our market technology clients on this future oriented-approach to managing market infrastructure,” said Friedman. “In addition, the partnership will include opportunities to explore new ways to leverage AWS cloud capabilities across Nasdaq’s anti-financial crime data and investment analytics, as well as our market infrastructure software businesses.”

The new infrastructure will provide Nasdaq with low-latency access to its on-premises systems to deliver high-frequency trading capabilities, as well as give its clients access to cloud-based capabilities, including virtual connectivity services, market analytics and machine learning, at a lower cost. Nasdaq has more than 130 market infrastructure clients globally, ranging across exchanges, banks, clearing houses, central securities depositories and regulators.

Friedman said: “The partnership gives us expansion opportunities within Carteret which we can then deploy to other major markets around the world. We will become more of a managed service provider to our market technology clients, which builds a bigger relationship that accrues to our benefit, so there is a lot of revenue opportunity in the coming years.”

She emphasised that the AWS opportunity is over the long-term as it will take years to build out the data center and take some time to deploy cloud solutions to market tech clients.

“Once we get to scale and we have everything fully deployed, we have the opportunity to look at lower capex expenses and more scalability,” added Friedman. “The bigger opportunity for us is on the revenue side, because we will have a bigger footprint to support clients in the US and the ability to deploy this to our clients around the world.”

Results

Friedman said that although the markets have experienced increased level volatility this year, Nasdaq maintains a positive overall economic outlook as consumer demand for products and services remains high, the ongoing digital transformation of industry continues to drive long-term demand for technology and the employment environment is very strong. However, the tight labour market and supply chain challenges are driving inflation pressures and there is uncertainty around the pace and rate of monetary policy adjustments which will continue to drive volatility over the near-term.

“Within that context, we also remain confident in the strength and resilience of our business,” she added. “We’ve seen significantly higher trading volumes and within the last week, the industry and Nasdaq processed a new record number of messages on a single trading day.

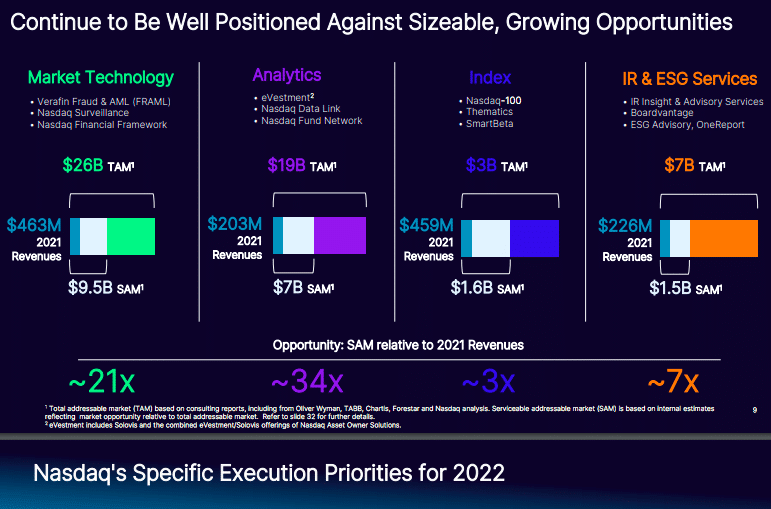

Net revenues for 2021 were $3.4bn, an increase of 18% over the previous year.

Friedman said: “Our record performance in 2021 is another important milestone in Nasdaq’s journey as a technology business serving the financial system. We grew across all segments of our business last year with a focus on competitive positioning, innovation in our trading and listing businesses, and the continued expansion of our software, analytics, data and cloud services.”

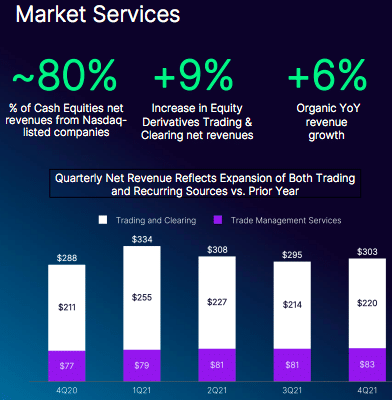

For the second consecutive year, Nasdaq led all exchanges in total traded U.S. options, inclusive of multiply-list equity options and index options products, while equity value traded on the Nasdaq Nordic markets reached their highest level since 2008. Nasdaq’s U.S. options market average daily number of contracts set a new annual record and totaled 12.8 million in 2021, an increase of 25% year -on-year. The average daily trading value of Nasdaq’s Nordic and Baltic main markets reached $4.7bn, an increase of 10% from 2020.

Nasdaq Stock Market led U.S. exchanges for IPOs during 2021 and featured nine of the ten largest U.S.-based IPOs by capital raised according to the firm. There were 1,000 new company listings in 2021, including 752 initial public offerings representing $181bn in capital raised, while Nasdaq’s European exchanges welcomed 207 new listings. Friedman said that, for the first time, Nasdaq Stockholm facilitated more capital raised than any other country in the European Union.

Friedman said: “We have more than double the number of IPO filings with the SEC compared to the prior year period, although market volatility could cause some delays in timing.”

In the index business in 2021, there were 61 launches of exchange-traded products tracking Nasdaq indexes, with nearly $3bn of assets under management accumulated during the year. Two thirds, 67%, of ETF launches in 2021 were outside the US.

Friedman highlighted last year’s launch of Data Fabric, a cloud-based managed data solution built from Nasdaq Data Link to help investment management firms scale their data infrastructure. Nasdaq’s investment management clients say their biggest challenge is managing their data – both traditional financial data and alternative data that might be relevant to making investment decisions or managing their portfolio risk.

She described Data Link as a container for all types of data which is cloud-based and easily accessible for clients.

“Data Fabric creates a management layer for our clients so they can put in their own data, their own research, into the same container so it is all available to investment professionals, to traders, to research analysts,” said Friedman. “It just creates a little bit of order out of the chaos that they are dealing with right now in terms of managing data.”