One of the most complex areas for sell-side execution desks today is dealing with client algorithms, according to the Acuiti’s Q3 Sell-Side Execution Management Insight Report.

According to the findinds, the challenges are primarily twofold: regulatory compliance and technology compatibility.

With clients ranging from highly sophisticated algo developers to those with minimal understanding of execution requirements, banks and brokers often serve as the de facto quality-control layer.

“While some operate at the coalface of algo building, with a keen understanding of both the technology and regulation affecting construction, others may be unaware of some of the finer details that they have to respect when creating algos,” the report said.

As a result, sell-side firms have had to invest in certification and testing frameworks to manage the growing complexity.

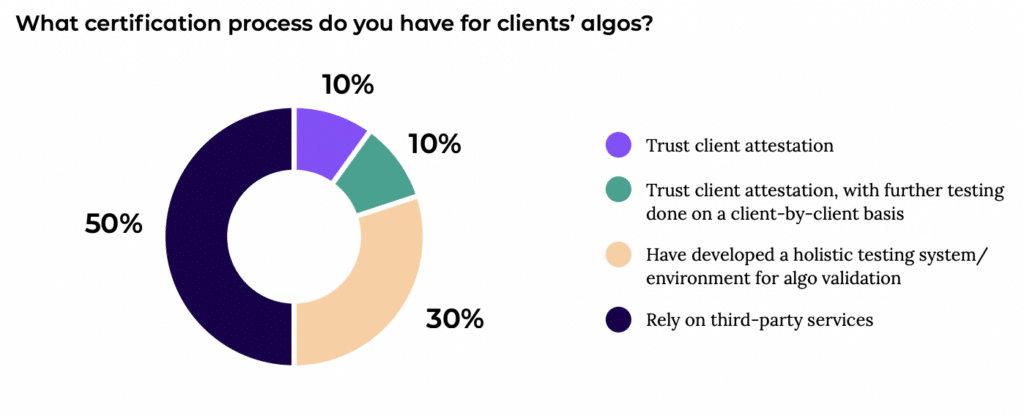

According to the report, 50% of the Acuiti network now rely on third-party services for algo certification, while just under a third have “developed a holistic testing system for algo validation.”

By contrast, only a small minority continue to depend on client attestation or case-by-case testing—approaches that offer limited assurance and are increasingly seen as insufficient.

Another significant area of difficulty is documentation and due diligence, especially given the lack of standardisation across firms.

Over time, the types of documentation requested by executing brokers and FCMs have diverged widely. Nevertheless, 95% of network members reported being satisfied with their current process, despite many acknowledging “some operational hiccups.”

“As with other administrative aspects of execution, this is an area where over the years firms have deviated substantially from each other in the documentation that they ask clients for,” the report said.

There is a strong appetite across the network to bring greater consistency to the process with 94% of respondents agreed that a refresh of FIA’s industry templates would help improve standardisation and reduce administrative burden.

While a quarter of firms cited “FCMs’ divergence from FIA templates” as a complicating factor, even more pointed to the diversity in client needs. This includes not only different levels of sophistication, but also a wide range of asset classes and strategies in which algos are now deployed.

“This variance not only applies to clients’ levels of sophistication, but also the breadth of asset classes and strategies that algorithmic execution is now applied to,” Acuiti noted.

Internal inefficiencies further compound the problem. Nearly a third of firms said their challenges stem from organizational fragmentation, such as compliance and execution teams operating in different time zones or under differing mandates.

“Even for firms with less geographical reach, culture clashes between compliance desks and the front-office can slow down processing,” the report said.

In parallel with the challenges around algorithmic trading, the report identified shifting trends in execution models that reflect broader changes in client demand and competitive dynamics.

One of the clearest changes is the increasing client interest in agency execution. Most network members reported that buy-side firms are migrating away from traditional principal models in favour of more transparent, agency-based approaches.

Alongside this shift, specialist liquidity providers—traditionally focused on market-making—are now stepping into execution, intensifying competition for established providers.

In addition, the report highlighted signs of a resurgence in voice execution, particularly in markets where complexity and volatility remain high.

While electronification continues to dominate, members noted increased use of voice trading in commodity derivatives, and also observed a comeback in rates and equity derivatives.

“While the dominant theme of recent years in execution has been the inexorable electronification of most asset classes, network members have reported signs of a resurgence in voice execution in some markets,” the report said.